More than half of traditional hedge funds now have exposure to digital assets, showcasing a steady institutional shift toward the cryptocurrency market despite recent fluctuations, based on a new survey.

A survey released on Thursday by the Alternative Investment Management Association (AIMA) indicates that 55% of hedge funds currently allocate funds towards digital assets as of 2025, marking an 8% increase from 47% in the 2024 survey.

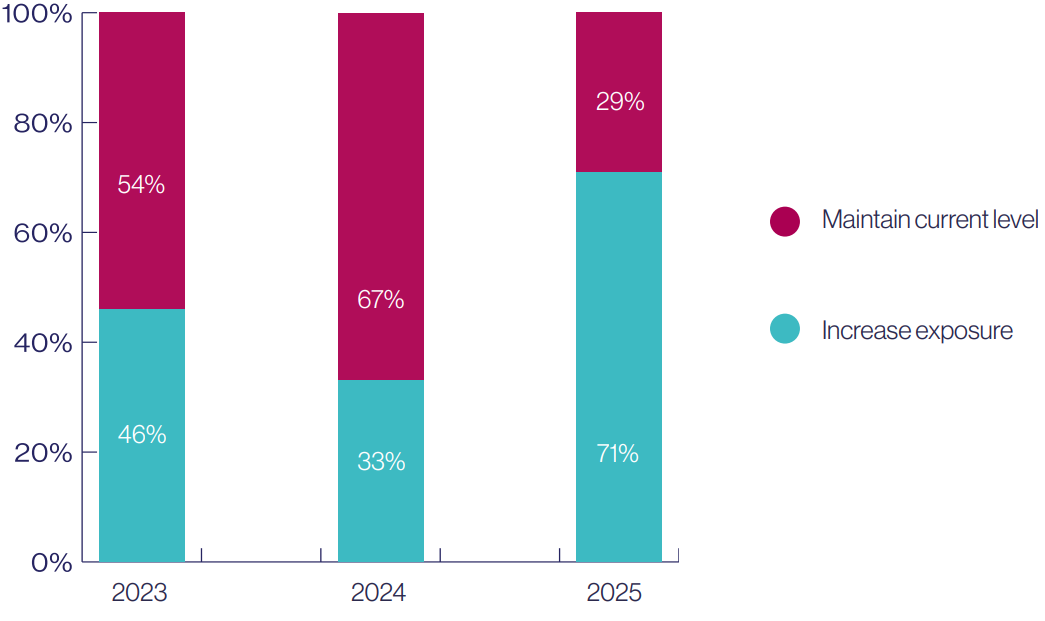

Traditional hedge funds that have invested and with future plans for increasing exposure to crypto. Source: AIMA

Traditional hedge funds that have invested and with future plans for increasing exposure to crypto. Source: AIMA

The survey included responses from 122 hedge fund managers, collectively managing $982 billion in assets. On average, these funds dedicate 7% of their portfolios to crypto-related assets, although most hedge funds remain cautious, investing less than 2% in cryptocurrencies. Nonetheless, 71% plan to enhance their allocations in the coming year.

Related: US, UK joint task force to explore crypto regulatory collaboration

Nearly two-thirds (67%) of participants invest in cryptocurrencies mainly through derivatives without directly engaging with digital assets. However, the report warns that the recent flash crash exposed vulnerabilities related to excessive leverage and inadequate institutional-grade infrastructure affecting derivatives.

US Regulators Spark Increased Interest

Almost half (47%) of the respondents attribute their expanded allocation to digital assets due to the changing regulatory landscape in the US. This follows significant shifts in Washington, including the Trump administration’s revision of US digital asset regulations and ongoing Senate discussions regarding a crypto market structure bill championed by bipartisan lawmakers.

Related: US regulators clarify rules for spot crypto trading

Recent reports from late October also suggest that several senators are working to advance the bill despite the ongoing US government shutdown.

The news comes after a warning from North Carolina Republican Senator Thom Tillis, who stressed that Congress has only a few months left to advance crypto legislation before election politics hinder progress. The framework for stablecoin payments, as detailed in the GENIUS Act, recently entered a second period of public comment in late September as it moves toward realization.

Magazine: How crypto laws are changing across the world in 2025