Key Highlights:

- Ethereum (ETH) has dropped to a four-month low below $3,000, despite growth in Layer-2 solutions that has reduced fees and increased its use for tokenization and stablecoins.

- There is potential for a rebound if global risks subside and new liquidity flows into the market, aiming to push the price back towards $3,900.

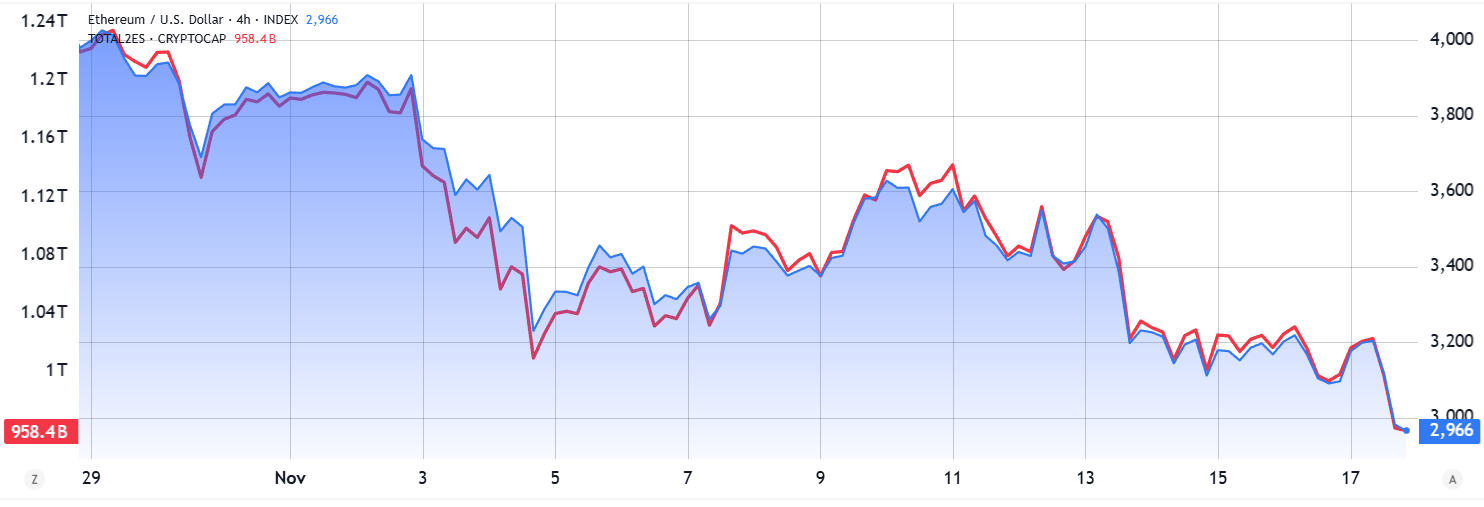

On Monday, Ether’s value dipped under $3,000, a clear indicator of anxiety in the market as the bullish trend appears to have stalled after a significant correction from its all-time high of $4,956 in August.

ETH/USD vs. Altcoin Market Cap

Source: TradingView / Cointelegraph

ETH/USD vs. Altcoin Market Cap

Source: TradingView / Cointelegraph

Ether’s recent movements have closely mirrored those of the altcoin market, suggesting a shift in focus for traders towards broader macroeconomic conditions rather than specific asset performance. If competitive pressures or weakening fundamentals were apparent, Ether would underperform against altcoins, which hasn’t yet been the case.

Analysts suggest that the current crypto slump is tied to growing concerns about worldwide economic growth. Factors such as a potential US government shutdown and new tariffs are being highlighted, compounded by disappointing earnings reports in the consumer sector and concerns about the artificial intelligence industry.

ETH Futures Premium

Source: laevitas.ch

The demand for bullish Ethereum leverage has been stagnant for the past month, as futures premiums have remained below the neutral level of 5%. Market anxieties may influence companies holding ETH reserves, like Bitmine Immersion, SharpLink Gaming, and The Ether Machine, that currently reflect unrealized losses as their stocks trade under their net asset value.

Declining Ethereum Onchain Activity

The falling activity on Ethereum’s blockchain has also negatively affected investor sentiment. Diminished network traffic leads to lower ETH demand and increased supply, complicating the effects of Ethereum’s burn mechanism which becomes significant only when base layer demand escalates.

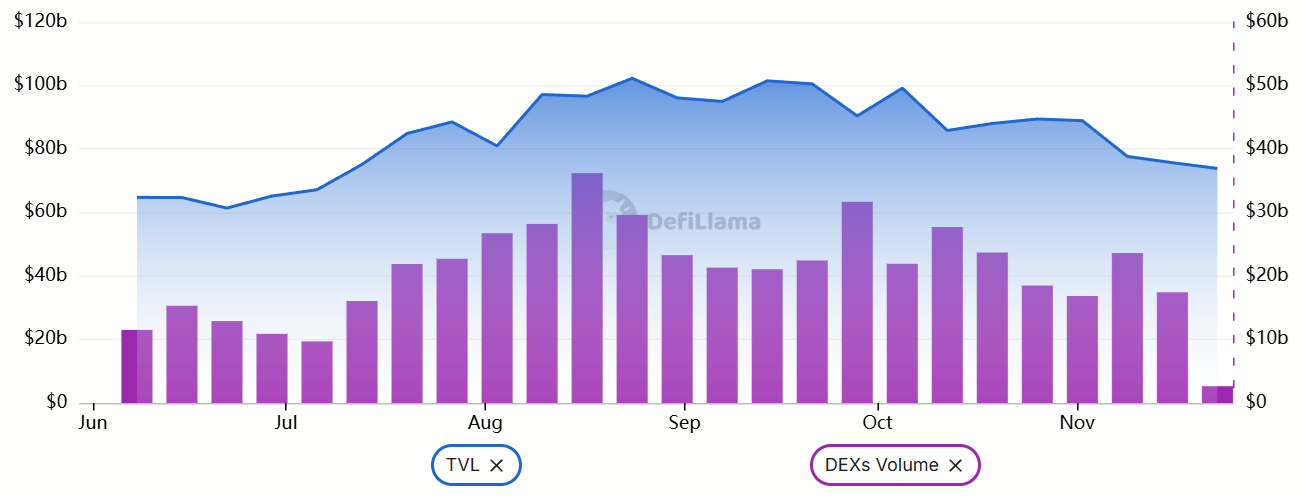

Ethereum TVL vs. DEX Volumes

Source: DefiLlama

Ethereum TVL vs. DEX Volumes

Source: DefiLlama

As Total Value Locked (TVL) on the Ethereum network reaches a four-month low of $74 billion, activity on decentralized exchanges (DEX) has sharply declined by 27% to $17.4 billion over the last week. Although Ethereum remains dominant in deposits, it is facing increasing competition for trading volume.

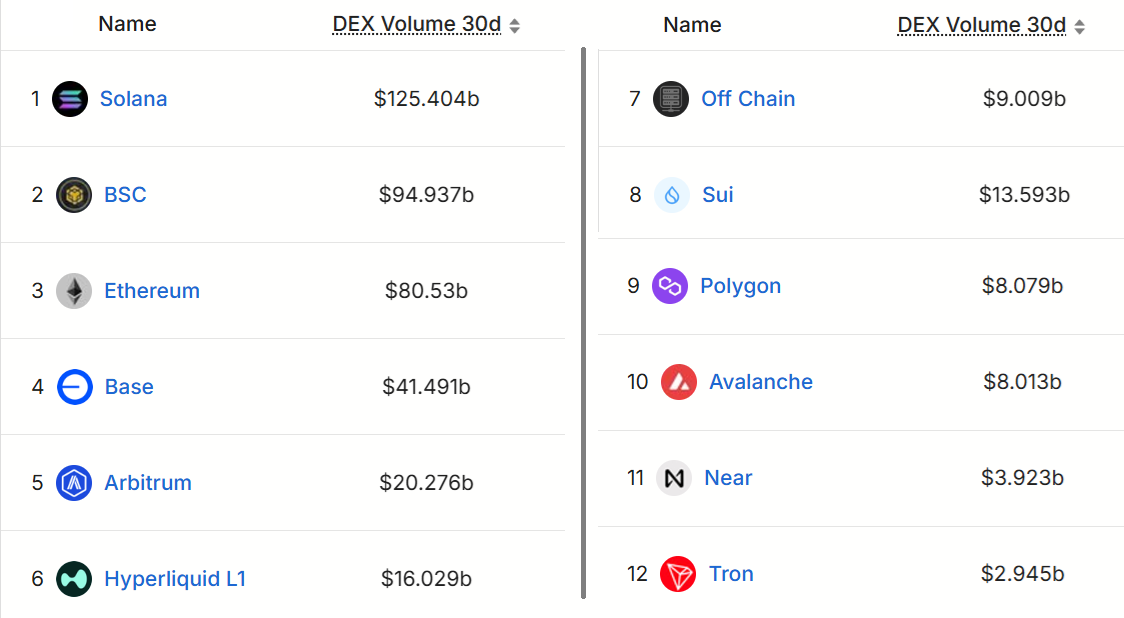

Blockchains by DEX Volume

Source: DefiLlama

Blockchains by DEX Volume

Source: DefiLlama

The migration of activities to Layer-2 solutions is not necessarily a threat. In fact, it may bolster Ethereum’s advantage in tokenization of real-world assets and decentralized stablecoin projects like Sky. Solutions such as Base, Arbitrum, and Polygon have improved Ethereum’s capacity, although they also raise concerns regarding transaction fees.

Ether’s future largely hinges on the alleviation of global socio-political uncertainty since the US government is under strain with increasing national debt. Eventually, central banks may need to inject more liquidity to stabilize their economies, which could ideally position ETH to leverage such inflows, potentially allowing it to revisit the $3,900 threshold.