Bitcoin's Downward Spiral Continues as Corporate Crypto Treasuries Face Challenges

Corporate crypto treasuries are grappling with increased unrealized losses and diminishing asset values, complicating efforts to secure investment capital for future digital asset endeavors.

Ongoing Decline in Cryptocurrency Markets

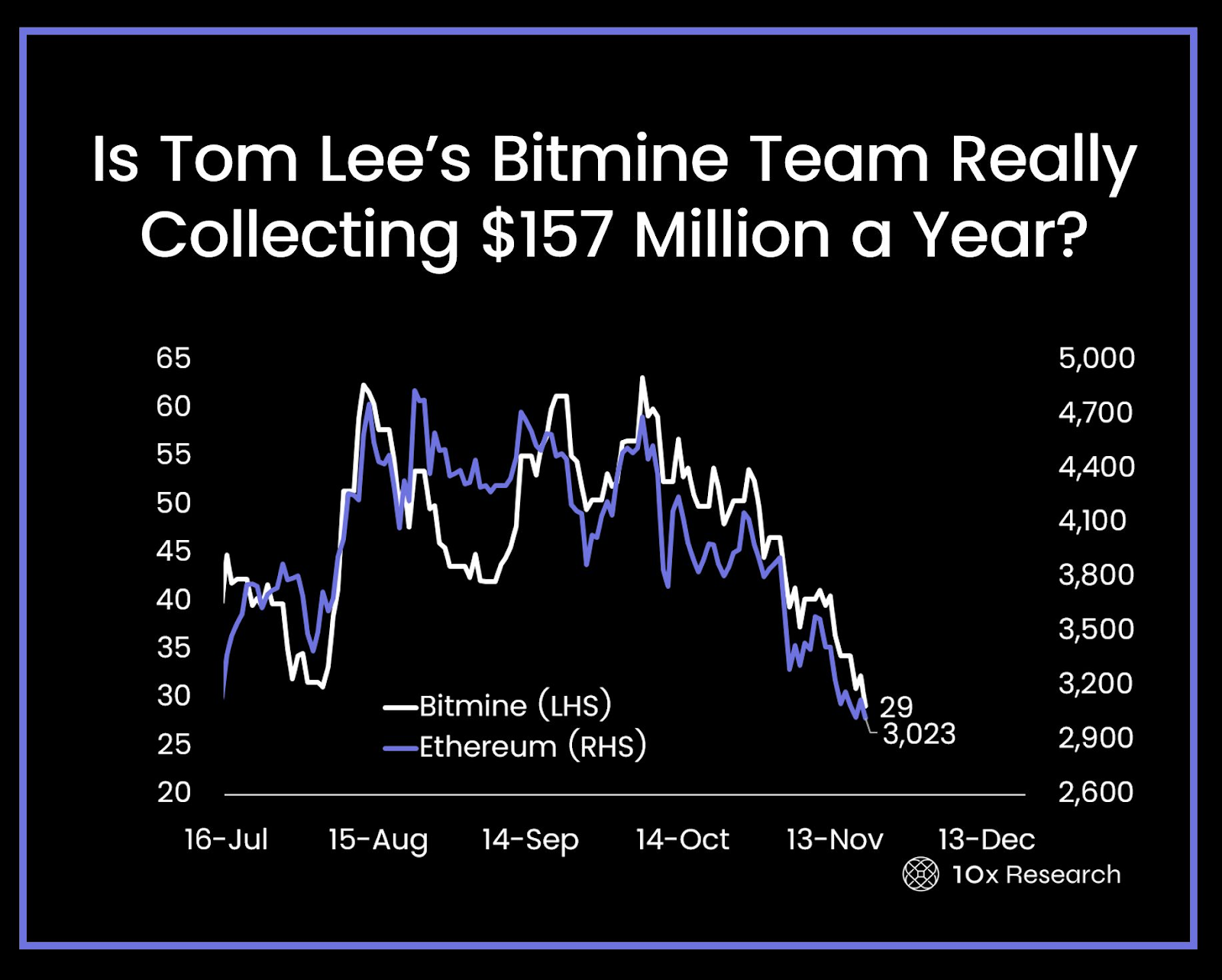

Cryptocurrency markets have experienced a decline for four weeks in a row, raising alarms about the current bull market cycle. On Thursday, investor anxieties spiked following a report from 10X Research highlighting that BitMine Immersion Technologies, which holds the largest amount of Ether (ETH) globally, is facing an unrealized loss of $3.7 billion across its assets.

Many digital asset treasuries (DATs) are witnessing a downward trend in their net asset values (NAV), complicating their ability to attract funding for new investments or engage new retail investors, which leaves current stakeholders in a tough spot with significant paper losses, according to Markus Thiele, the founder of 10x Research.

Pressure from MSCI Exclusions

DATs are already under pressure from the MSCI stock market index, which is contemplating excluding firms that have more than half of their balance sheets in crypto. The consultation remains open until December 31, while results are expected to be released on January 15, 2026, with any changes implemented in February.

Meanwhile, Bitcoin dipped to a six-month low of $82,000 on Friday, a level not seen since April when markets were recovering from a tariff announcement by US President Donald Trump. TradingView data supports this data.

BTC/USD, 1-day chart, year-to-date. Source: Cointelegraph/TradingView

BTC/USD, 1-day chart, year-to-date. Source: Cointelegraph/TradingView

BitMine Facing Significant Losses

The situation for BitMine Immersion Technologies continues to worsen as it grapples with a staked Ether fund initiated by BlackRock, which analysts suggest might directly compete with existing DATs. This leads to worries about the viability of corporate crypto treasury firms.

As reported, BitMine’s losses stand at $1,000 per purchased ETH, calculates a total unrealized loss of $3.7 billion on its entire holdings, as revealed in a recent analysis by 10x Research.

The diminishing NAV amongst these firms also makes it challenging to attract fresh retail investments, leaving existing investors effectively “trapped” unless they sell at a major loss, according to Markus Thiele’s LinkedIn post.

“When the premium inevitably shrinks to zero, as it is doing now, investors find themselves trapped in the structure, unable to get out without significant damage, a true Hotel California scenario,” he articulated.

Translation: “When the premium inevitably decreases to zero, which is currently happening, investors find themselves confined within the structure, unable to exit without considerable harm, akin to a Hotel California situation.”

Unlike exchange-traded funds (ETFs), DATs burden themselves with complex and often opaque fee structures that can quietly diminish returns.

BitMine, Ethereum price trend. Source: 10X Research

BitMine, Ethereum price trend. Source: 10X Research

In addition, the basic mNAV for BitMine is recorded at 0.77, and the diluted mNAV at 0.92, according to findings from Bitminetracker.

Upcoming SEC Discussion on Privacy Issues

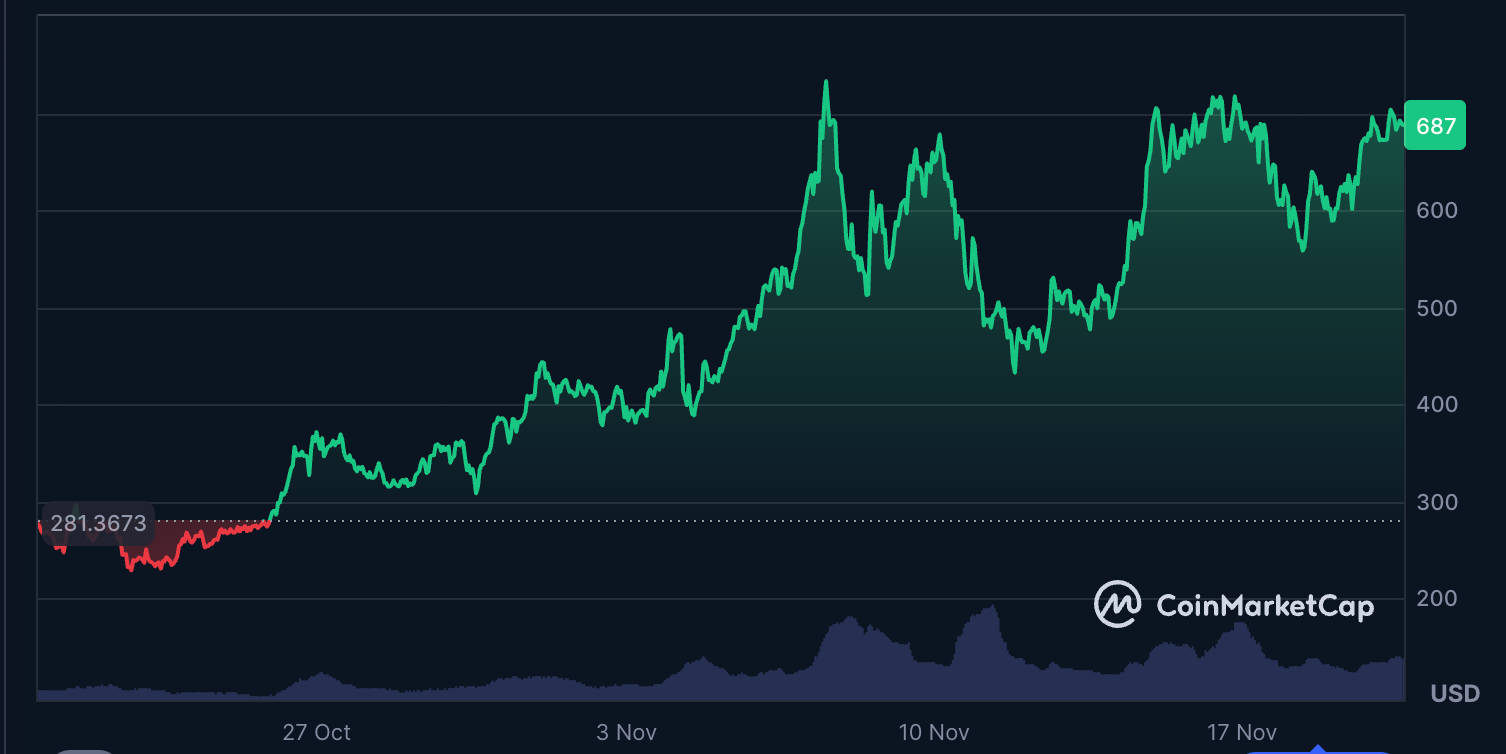

The US Securities and Exchange Commission (SEC) is to hold a roundtable meeting on privacy and financial surveillance on December 15, in response to the growing significance of privacy within the cryptocurrency sector.

The discussion will allow crypto industry executives and SEC officials to deliberate on collective challenges and possible solutions without presenting any formal policy proposals. Privacy has ascended to a critical topic due to several recent events, including the partial guilty verdict in the trial of Roman Storm, the Tornado Cash developer, and the sentencing of the Samourai Wallet developer this November.

Privacy tokens like Zcash have seen a price increase starting in October. Source: CoinMarketCap

Privacy tokens like Zcash have seen a price increase starting in October. Source: CoinMarketCap

“Authoritarians thrive when people have no privacy. When those in control demonstrate hostility towards privacy concerns, it becomes a significant warning sign,” stated Naomi Brockwell, founder of the Ludlow Institute, an organization advocating for technological liberty.

Translation: “Dictators flourish when individuals lack privacy. When authority figures become antagonistic towards privacy protections, it indicates a serious alarm.”

This renewed focus on privacy recalls crypto’s cypherpunk origins, underscoring the purpose of the cryptographic systems that enable cryptocurrency: to secure communication channels in unfriendly settings.

Coinbase Introduces ETH-Backed Loans

In a new initiative, Coinbase has rolled out Ether-backed loans for its US clientele, granting customers the ability to borrow USDC against their ETH holdings without the need to sell. This new offer, supported by Morpho, is accessible across the majority of US states, excluding New York, with variable rates linked to market dynamics.

Users are permitted to borrow up to $1 million in USDC stablecoin.

Source: Coinbase

Source: Coinbase

Plans for expansion to other assets, including loans backed by Coinbase’s staked Ether token, cbETH, are in progress.

According to data from Dune, Coinbase’s on-chain lending markets have facilitated over $1.25 billion in loan origination, secured by approximately $1.37 billion in collateral deposits.

DeFi Education Fund Proposes Solutions for Global Poverty

The DeFi Education Fund, a group advocating for decentralized finance, has suggested leveraging DeFi infrastructure to diminish costs and confront global poverty.

The organization asserted that employing DeFi could save unbanked individuals worldwide around $30 billion each year by lowering remittance costs, highlighting that sending funds home could incur fees reduced by up to 80% through DeFi.

“The ongoing expenses faced by low-income households that wealthier individuals frequently access at reduced costs remain prevalent because the current layered financial infrastructure is prohibitively expensive to navigate,” indicated the DeFi Education Fund, elaborating:

Translation: “The continuing costs that low-income families face—costs that wealthier individuals often manage to lower—are primarily due to a convoluted, outdated financial system that makes serving lower-income clients challenging.”

Some advocates are actively proposing the use of various blockchain technologies to tackle the issues contributing to poverty, including reducing transaction times and fees, while boosting access to financial services.

Mastercard Partners with Polygon for Easier Crypto Transfers

In a new venture, Mastercard is enhancing its Crypto Credential initiative to include self-custody wallets, enabling users to transfer cryptocurrencies using simple, username-style identifiers instead of cumbersome wallet addresses. Polygon has been chosen as the first blockchain to facilitate this upgrade, while Mercuryo will oversee identity verification and provide aliases to users.

“By simplifying wallet addresses and bolstering verification, the Mastercard Crypto Credential aims to establish trust in digital token transfers,” remarked Raj Dhamodharan, Mastercard’s executive vice president of blockchain and digital assets.

Mastercard selected Polygon for username-based cryptocurrency transfers. Source: Polygon

Mastercard selected Polygon for username-based cryptocurrency transfers. Source: Polygon

Join us next week for more updates on pivotal DeFi developments.