Bitcoin is showing signs of recovery after falling close to $82,000 on Friday, with analysts reporting that the selling pressure has lessened and expectations for a Federal Reserve rate cut are on the rise.

Following a tumultuous two weeks where tech stocks and crypto markets faced backlash due to fluctuating expectations regarding rate cuts, Capriole Fund founder Charles Edwards noted on X, “As the market reverts, expect it will carry Bitcoin somewhat higher.”

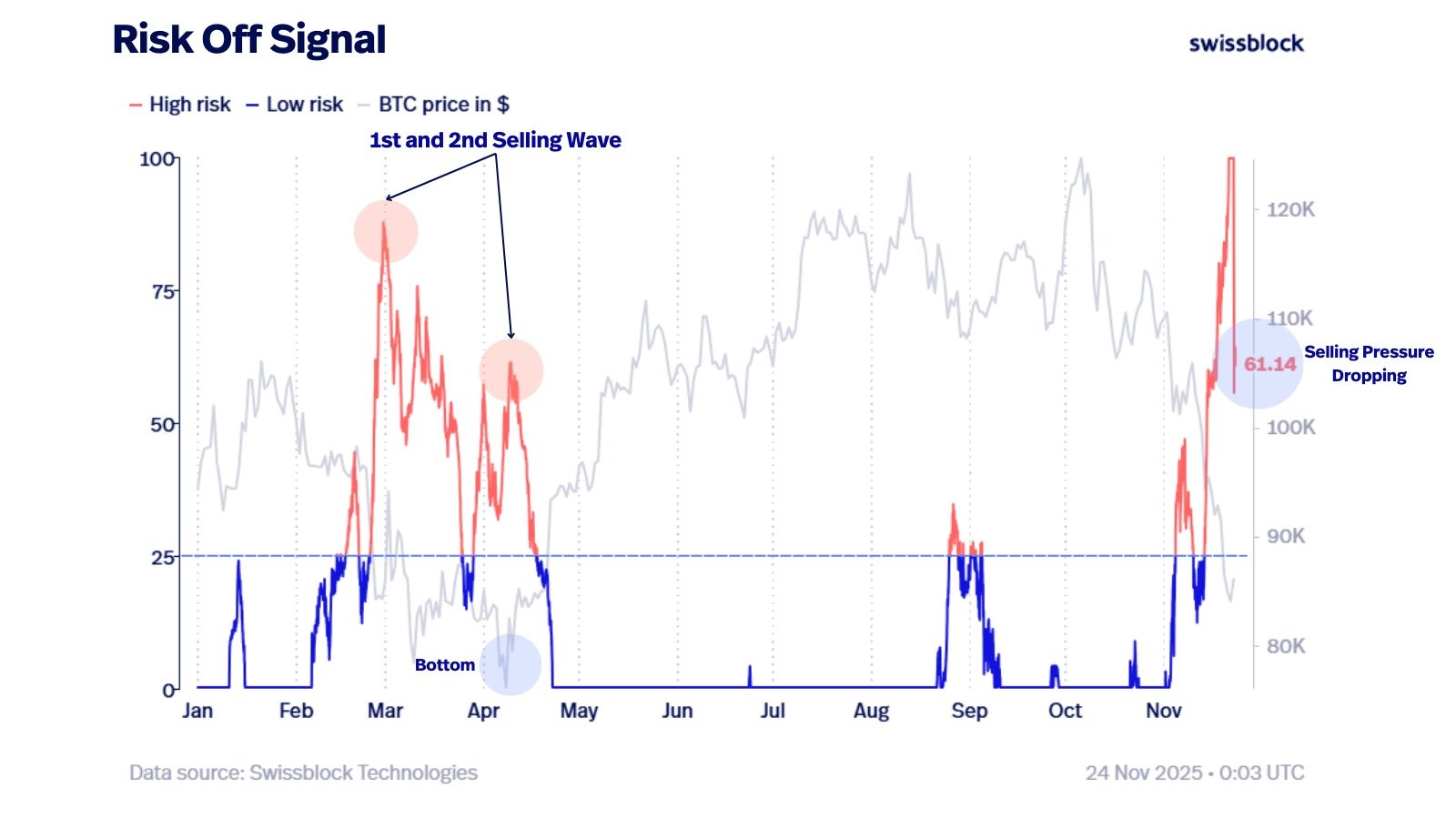

Analysts at wealth manager Swissblock stated that Bitcoin (BTC) has taken its initial steps toward establishing a bottom. They reported:

“The Risk-Off Signal is dropping sharply, which tells us two things: selling pressure has eased, and the worst of the capitulation is likely behind us, for now.”

They highlighted that this week is critical for Bitcoin as ongoing reductions in selling pressure are pivotal. However, they cautioned against a possible second selling wave, which, while weaker than the first, often indicates a shift back toward bullish control.

Bitcoin selling pressure is falling. Source: Swissblock

Bitcoin selling pressure is falling. Source: Swissblock

On Friday, TradingView indicated that Bitcoin had dipped to $80,600, its lowest level since mid-April, marking a 36% correction from its all-time high of over $126,000 earlier in October.

Increased Odds for Fed Rate Cut

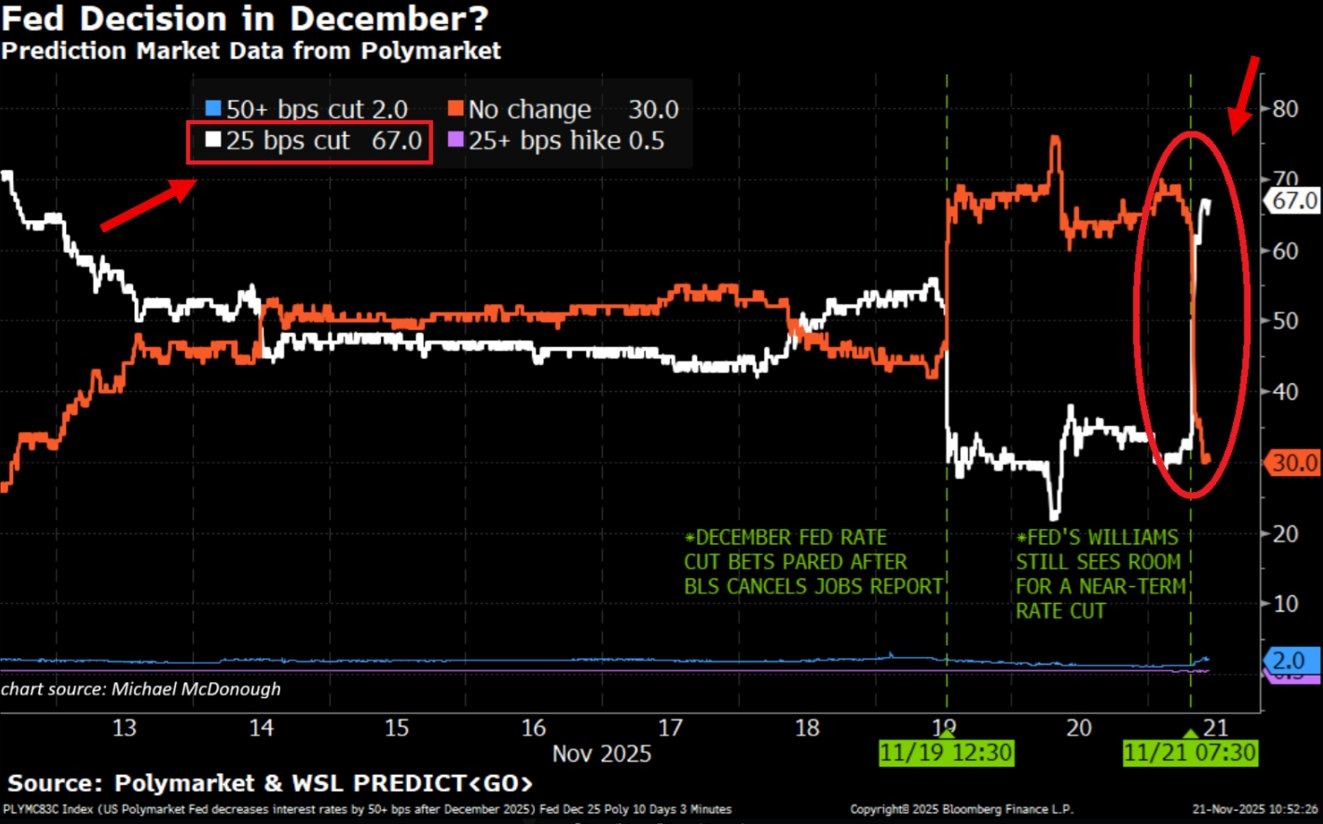

The likelihood of a Federal Reserve rate cut in December has fluctuated around 30% last week before climbing back to 70%, according to Edwards.

The CME Fed Watch Tool, which tracks target rate probabilities, currently displays a 69.3% chance of a 0.25 basis point cut at the upcoming December 10 meeting.

“What a difference two days make in market expectations,” stated the market research account Global Markets Investor on X.

Fed rate cut predictions flip back toward 70%. Source: Global Markets Investor

Fed rate cut predictions flip back toward 70%. Source: Global Markets Investor

Imminent Liquidity Injection

Market analyst Sykodelic expressed on Sunday, “I really would not be surprised to see the Fed announce something at the next meeting regarding ‘reserves management’… essentially, liquidity expansion.”

They emphasized that without liquidity injection, the central bank could face bankruptcy, adding,

“If you are betting on a year-long bear market, you are essentially betting that the USA will allow itself to go broke.”

Interest rate cuts alongside injected liquidity typically signal positive prospects for high-risk assets like cryptocurrencies, and historical quantitative easing phases have preceded significant rallies.