Ethereum Price Insights: Is a Stabilization Possible Following Market Fluctuations?

Ethereum faces significant pressure as market corrections raise questions about its stability and future price movements.

Ethereum is currently experiencing substantial pressure as it navigates a broader correction in the cryptocurrency market. The asset has lost crucial support levels, causing investors to grow wary. The ongoing question is whether Ethereum can stabilize over significant levels or if another downturn is imminent.

Technical Overview

Daily Chart

In recent trading, Ethereum has dipped beneath its 100-day and 200-day moving averages, lingering around the $2,800 mark after briefly consolidating near the $3,000 threshold—previously a feeble point of support.

- The RSI is currently hovering around 30, indicating a deeply oversold condition and signaling robust bearish pressure. Should Ethereum fail to reclaim the $3,000-$3,100 range shortly, the next significant barrier will likely be around $2,500—a previously established demand zone.

Ethereum Daily Chart

Ethereum Daily Chart

4-Hour Chart

Analyzing the 4-hour chart reveals that Ethereum has established a bearish rising wedge pattern during its recent uptrend—often a continuation indicator during downward trends. The price is nearing a potential breakout below this wedge, suggesting that bearish sentiment persists.

If confirmed, a revisit to the $2,500 support zone is highly probable, with the RSI on this timeframe also trending downward and struggling to breach the 50 mark, reinforcing the sellers’ advantage. Consequently, the $2,500 level emerges as critical: it must either hold or face breakdown, leading to deeper retracement.

Ethereum 4-Hour Chart

Ethereum 4-Hour Chart

On-Chain Insights

Exchange Netflows

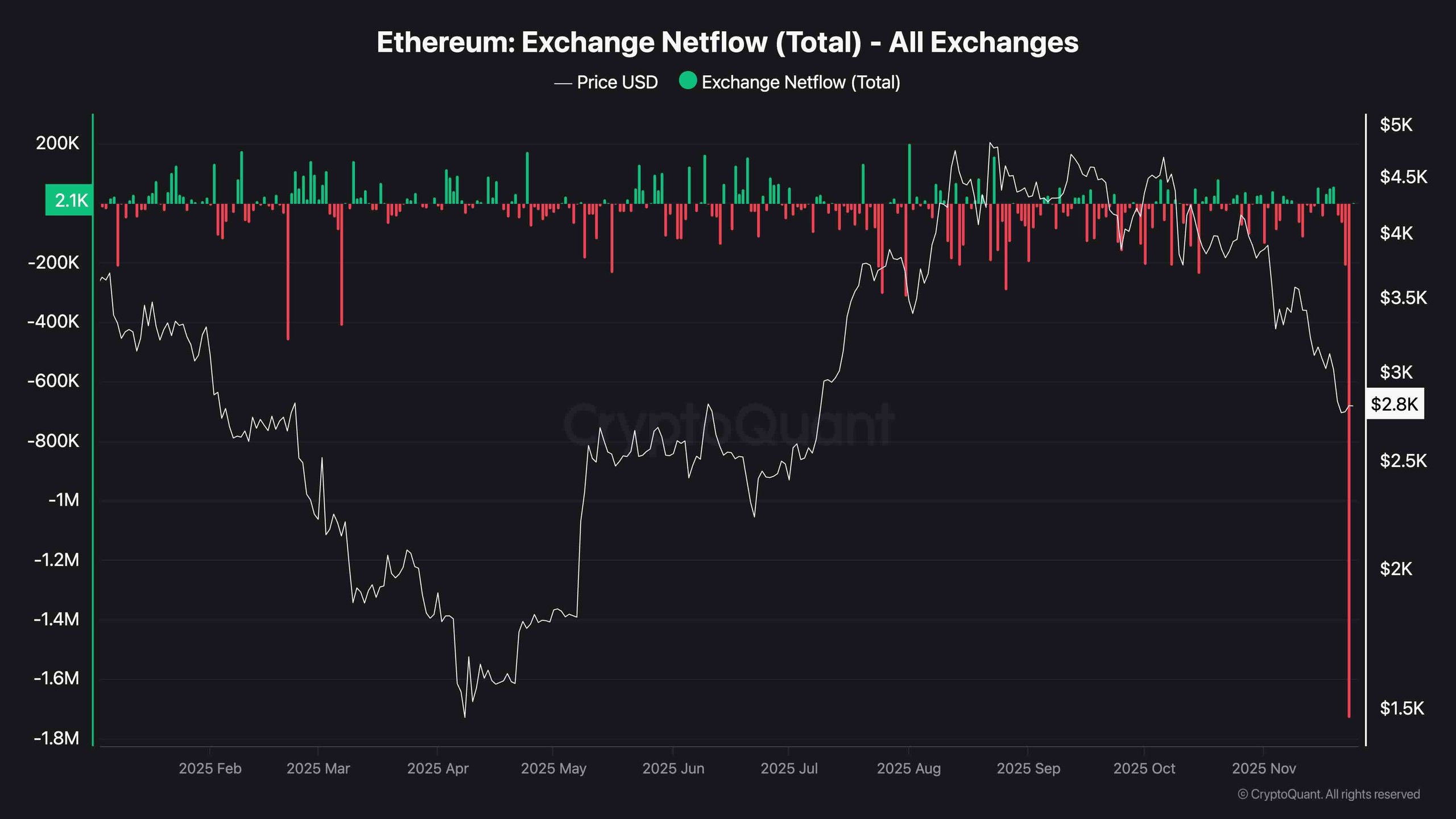

On November 23rd, Ethereum witnessed a notable uptick in outflows from exchanges, marking one of the largest negative netflows in years. A substantial volume of ETH was drawn from centralized platforms, which may indicate that large holders (whales) or institutions are transferring assets to cold storage amid market weakness, seeking accumulation opportunities or long-term retention. Alternatively, this behavior might reflect users seeking to mitigate custodial risks amid fears of further downturns.

Regardless, such trends generally alleviate immediate selling pressure on exchanges but do not guarantee a market bottom unless supported by bullish price movements or strong inflows into DeFi and staking platforms. Currently, the netflow metrics suggest signs of cautious accumulation without full-blown reversal confidence.

Ethereum Exchange Netflow

Ethereum Exchange Netflow

Disclaimer: The analysis presented reflects the author’s views and does not constitute investment advice. Always conduct thorough research before making any investment decisions.