Four Factors Keeping Ethereum's Price Strong Above $2,800

Despite dropping below $3,000, Ethereum's price is showing signs of recovery, with key support at $2,800.

Despite Ethereum’s recent drop below the $3,000 mark, data indicates a potential recovery, as long as the support level at $2,800 remains intact. Here are the key insights:

- ETH’s price has risen 11% since the precipitous drop, suggesting strong institutional interest and the anticipated end of the Federal Reserve’s quantitative tightening (QT) might help push prices towards $3,600.

ETH Demand Surges

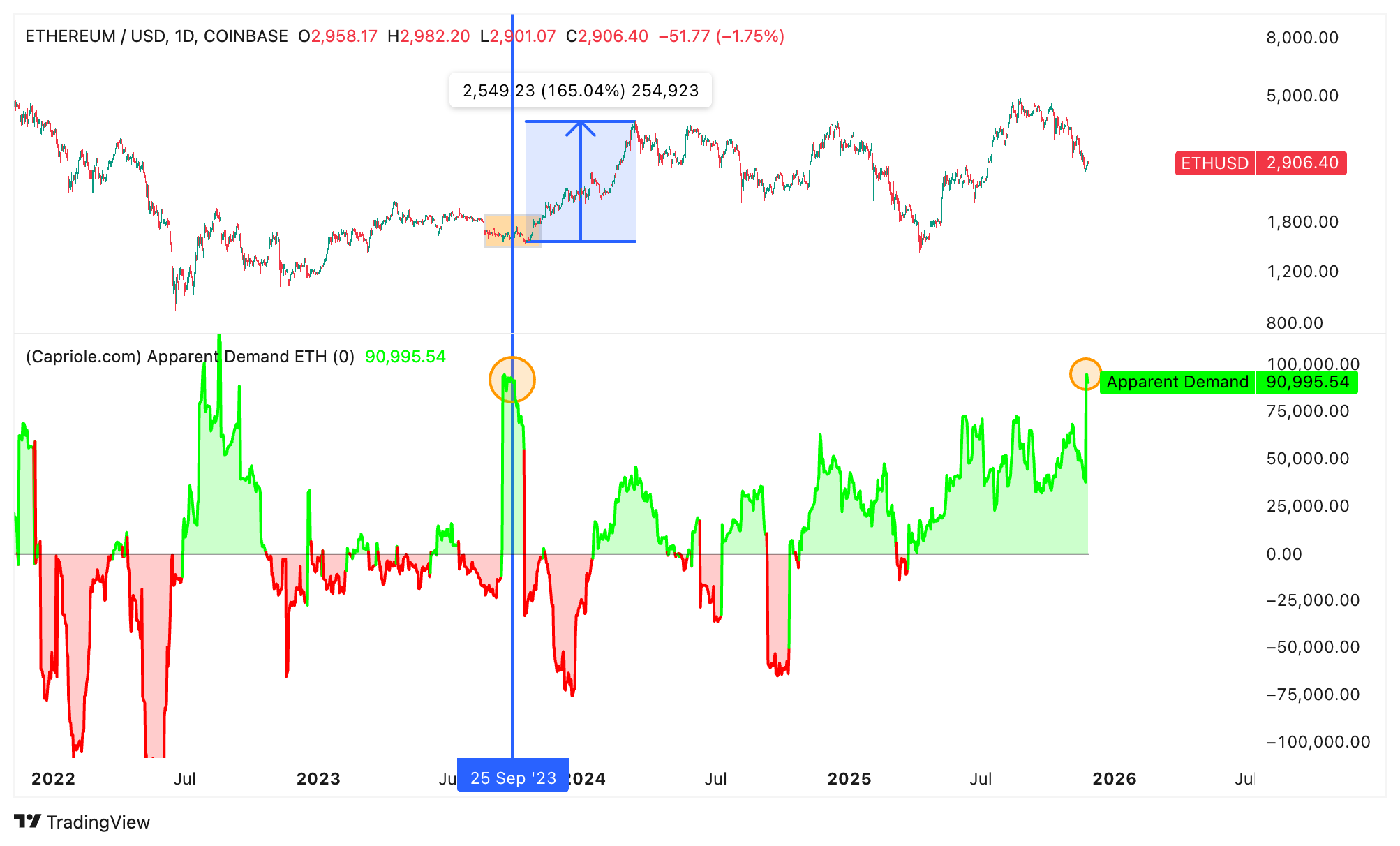

Ethereum demand is reportedly recovering alongside increased ETF inflows. On November 26, the apparent demand for ETH surged to 90,995 from 37,990 on November 22. This indicates aggressive accumulation during price dips, hinting at an imminent price rebound.

Ethereum apparent demand

Source: Capriole Investments

Ethereum apparent demand

Source: Capriole Investments

Rebounding Expectations

The end of QT on December 1 could echo past market behavior where a return to liquidity propelled altcoins, including ETH, beyond Bitcoin in value. Analysts state that maintaining support at around $2,800 is critical for future bullish movements.

- “It is essential for the bulls to defend this area,” said Daan Crypto Trades, emphasizing the significance of this support zone.

ETH/USD chart

Source: Daan Crypto Trades

ETH/USD chart

Source: Daan Crypto Trades

Concluding Insights

Ethereum’s technical outlook shows a V-shaped chart pattern, suggesting potential upward movement towards $3,600 if bullish momentum is sustained. As the market anticipates a strong recovery, all eyes will be on how ETH responds to these critical price levels.