Introduction

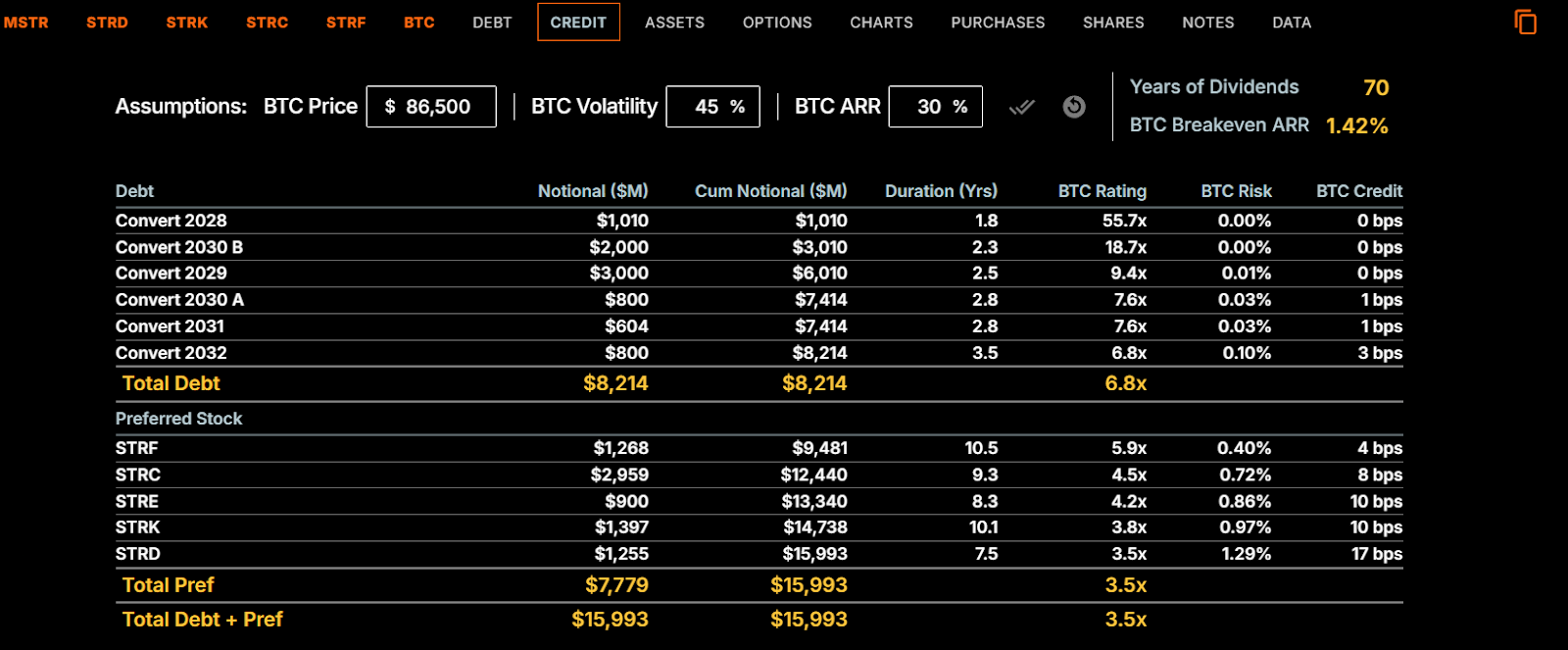

Strategy has announced a new credit rating dashboard aimed at alleviating investor fears concerning their balance sheet after the recent drop in Bitcoin prices. The company, noted for having a 70-year dividend runway, introduced this metric to address potential concerns over Digital Asset Treasury (DAT) liquidation risks during market downturns.

The New Credit Rating Metric

According to Strategy, the world’s largest corporate holder of Bitcoin (BTC), this new dashboard is based on their preferred stock’s notional value. They assert that they can sustain dividend payments for another 70 years, even if Bitcoin prices remain stagnant.

“If $BTC drops to our $74K average cost basis, we still have 5.9x assets to convertible debt, which we refer to as the BTC Rating of our debt. At $25K BTC, it would be 2.0x,” the company noted in a recent post.

Investor Concerns

This initiative comes amid increasing apprehensions that the plummeting prices of cryptocurrencies might lead substantial DAT companies to face liquidation, further amplifying pressures on an already fragile market.

Strategy’s BTC Credit Dashboard

Source: Strategy.com

Strategy’s BTC Credit Dashboard

Source: Strategy.com

Related: Strategy rides out Bitcoin crash, still on track for S&P 500 spot: Matrixport

Analyst Insights

Lacie Zhang from Bitget Wallet mentioned that Strategy’s dividend runway and robust software cash flow significantly mitigate liquidation risks for the company. “We view MicroStrategy’s 71-year dividend runway claim as realistic under a flat Bitcoin price scenario,” Zhang observed, adding that various uncertainties could affect long-term forecasts.

“I’m not particularly concerned about near-term liquidations for the largest corporate BTC holder, as their diversified funding and hodl strategy positions them well for sustained growth.”

Zhang highlighted that ongoing accumulations by Strategy have also contributed to greater industry stability and fostered deeper institutional adoption.

Future Market Predictions

Furthermore, Ki Young Ju, the CEO of CryptoQuant, expressed optimism regarding Strategy’s financials, suggesting that their strategy could help Bitcoin dodge major declines in future markets.

As Bitcoin’s largest corporate holder is suspected to avoid forced selling, this may help prevent the cryptocurrency from dipping below significant psychological levels in the upcoming downturns.

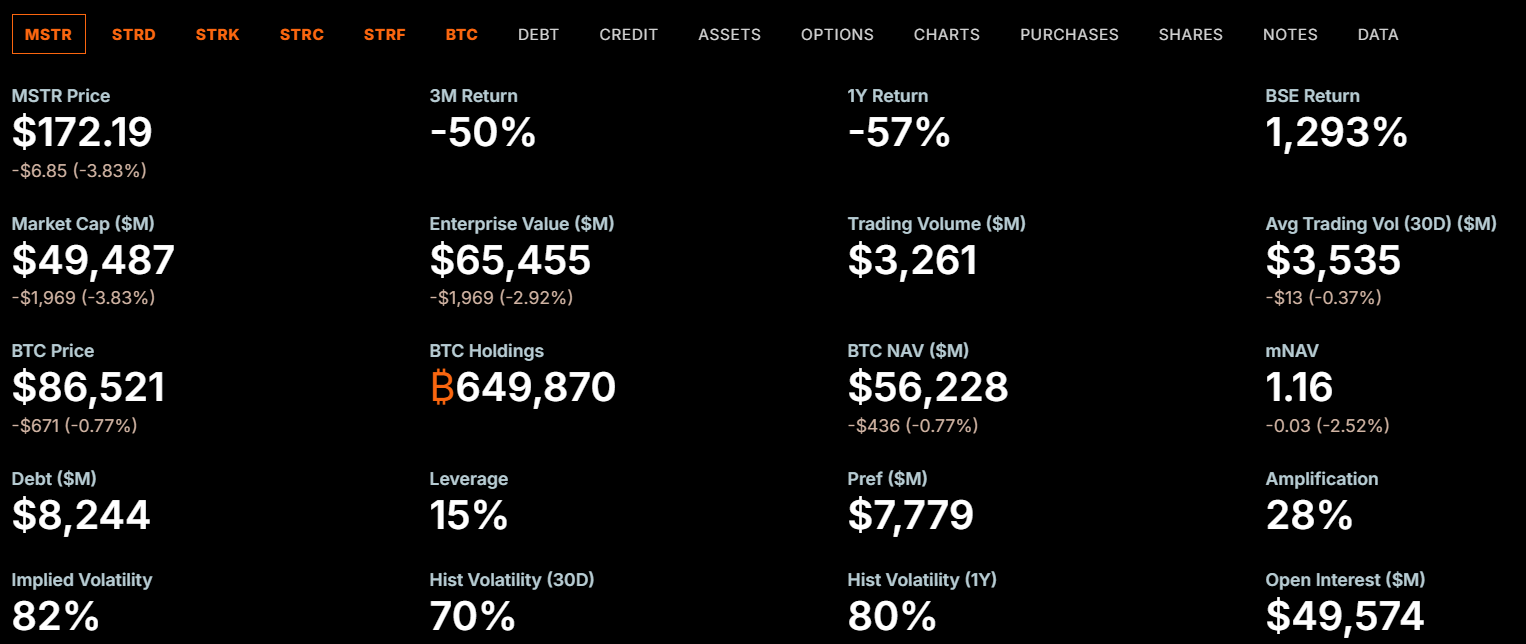

Strategy Key Metrics

Source: Strategy.com

Strategy Key Metrics

Source: Strategy.com

Strategy’s mNAV was recorded at 1.16, indicating that the company could still theoretically issue new shares to increase capital.

Conclusion

Given these insights and developments, the market is poised to observe how Strategy’s actions and metrics will influence Bitcoin’s stability amidst ongoing challenges.