Bitcoin Demonstrates Significant Inverse Relationship with USDt Activity: Insights from Glassnode

An exploration into the correlation between Bitcoin's price fluctuations and stablecoin activities, revealing a strong negative correlation.

Blockchain analytics firm Glassnode has identified a “strong negative correlation” between Bitcoin and USDt activities over a span of two years.

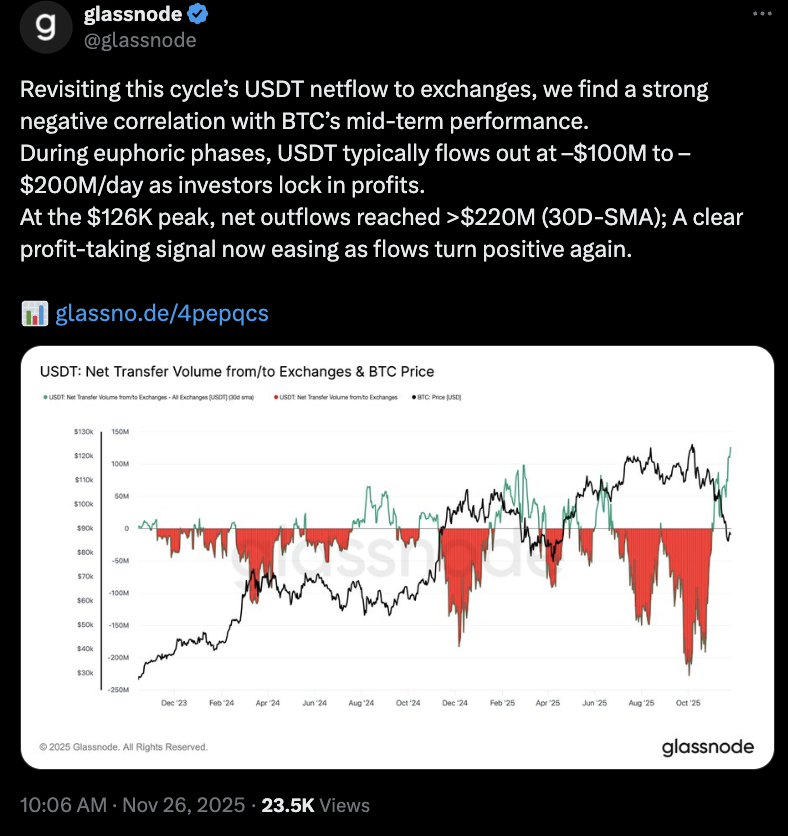

In a recent post on X, Glassnode presented a detailed comparison of Bitcoin’s (BTC) price movements alongside the net flows of USDt (USDT) towards exchanges, starting from December 2023. The findings indicate that net outflows of USDT from these exchanges typically coincide with price increases of BTC.

“During euphoric phases, USDT usually flows out at a rate between -$100M to -$200M per day as investors realize profits,” Glassnode mentions. “At the peak of $126K in October, net outflows exceeded $220M (30D-SMA); this indicates a clear profit-taking trend now subsiding as flows return to positive.”

Bitcoin and USDt Activity

Source: Glassnode

Bitcoin and USDt Activity

Source: Glassnode

Moreover, a previous analysis conducted by Whale Alert in April disclosed a notable correlation between Bitcoin and USDt, showing that the stablecoin manufacturer typically mints during Bitcoin’s bullish phases and burns during downturns. Both Bitcoin and USDt rank first and third respectively in terms of market capitalization, with total values around $1.8 trillion and $184 billion.

Regulatory Developments for Stablecoins Amid Bitcoin’s Growing Presence

In July, the US administration enacted the GENIUS Act, which lays down a regulatory framework intended for payment stablecoins. Tether CEO, Paolo Ardoino, stated that USDt will adhere to the new regulation. However, he also revealed in September plans for launching a new compliant dollar-pegged stablecoin, USAT.

The federal and several state governments have started initiatives to accumulate Bitcoin as part of their strategic reserves. In March, President Donald Trump authorized an executive order for the establishment of a digital asset reserve.

Despite such efforts, reports indicate that the implementation of this strategy, which heavily relies on amassing confiscated cryptocurrency, has yet to be fully realized.