New research emphasizes that reaching all-time highs in stablecoin supply serves as a classic bullish factor for cryptocurrency prices, even amid market pullbacks.

Key Highlights:

- Stablecoin supply metrics remain favorable for growth in the cryptocurrency market.

- The ERC-20 stablecoin total is now $185 billion.

- Users on Binance are maintaining stablecoins as liquidity for future market entries.

Research Insights: The Importance of Stablecoins Over M2 Supply

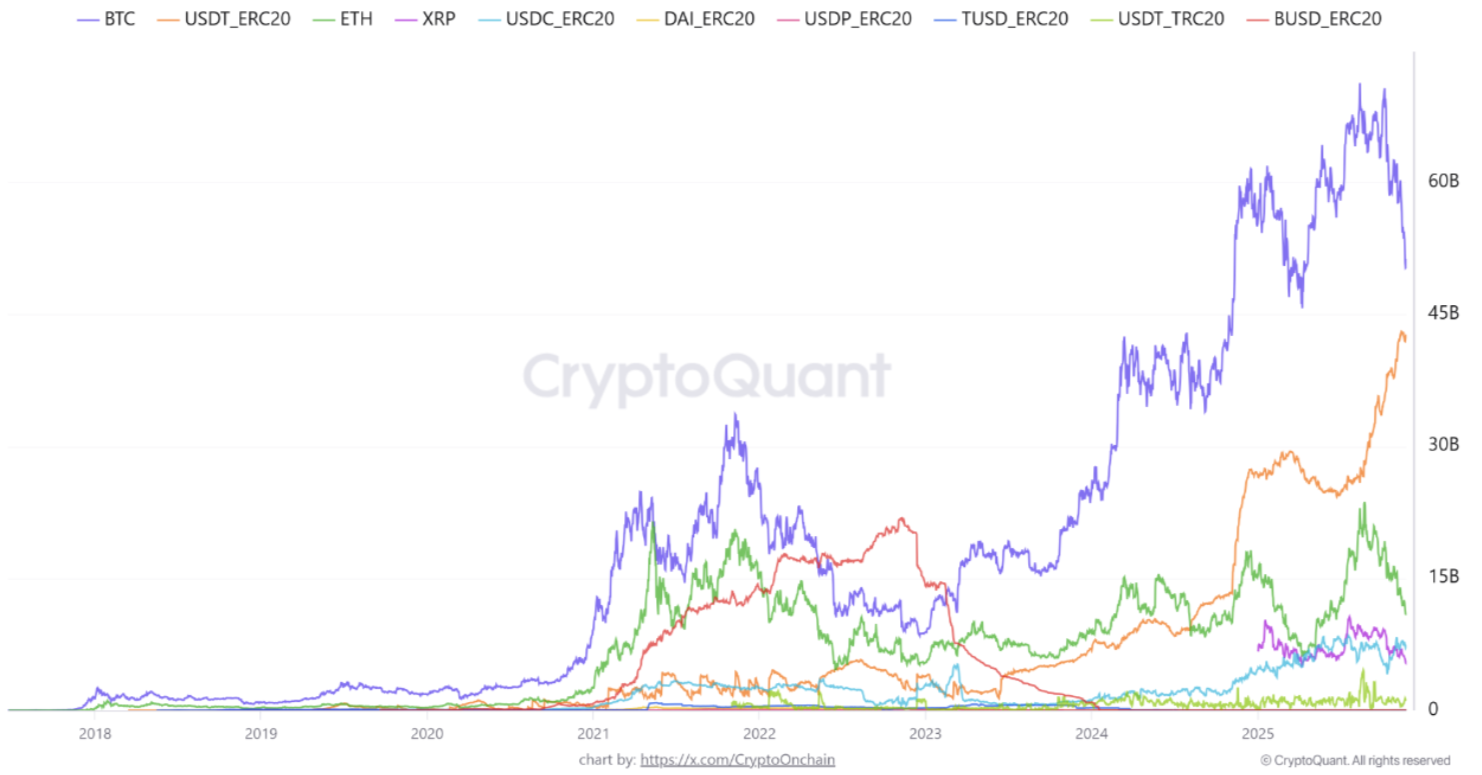

According to recent data from the on-chain analytics platform CryptoQuant, the supply of stablecoins has continued to achieve all-time highs as we enter November 2025. This internal liquidity indicates prospects for renewed growth, even with short-term market challenges.

In 2025, the total supply of ERC-20 stablecoins on the Ethereum network has reached $185 billion—the highest on record and consistently maintained this month.

“This growth is more consistent than Bitcoin’s price and directly reflects capital entering the crypto ecosystem,” stated XWIN Research Japan in CryptoQuant’s blog.

ERC-20 stablecoin supply screenshot

ERC-20 stablecoin supply screenshot

ERC-20 stablecoin supply (source: CryptoQuant)

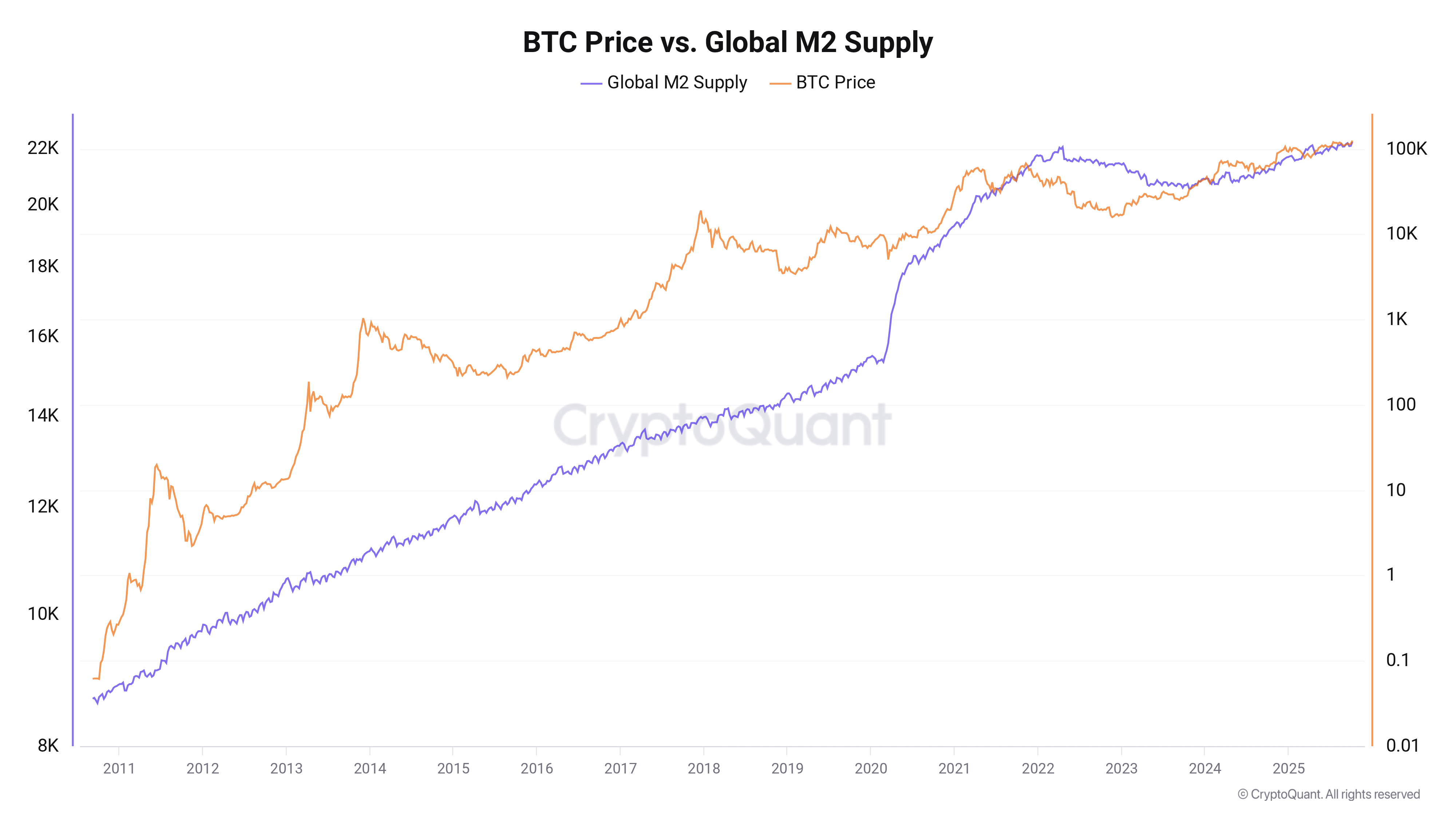

As noted in previous reports by Cointelegraph, the performance of cryptocurrency prices has historically been linked with variations in the global M2 money supply. Following a peak in M2 earlier in 2025, its growth has since decelerated, leading to uncertainty in risk assets.

BTC/USD vs. global M2 supply

BTC/USD vs. global M2 supply

BTC/USD relative to global M2 supply (source: CryptoQuant)

However, XWIN suggests that stablecoins serve as a more critical metric for gauging industry performance.

“Stablecoin supply is significant because: 1 It’s a principal source of liquidity for trading, DEXs, lending, and derivatives. 2. It adjusts rapidly, capturing investor flows quicker than monthly or quarterly M2 reports. 3. It tracks institutional and ETF-related inflows into crypto.”

“In both the 2021 bull market and the recovery from 2024–2025, an increase in stablecoin supply clearly preceded Bitcoin’s price upswings.”

Focus on Stablecoin Liquidity

This trend is evident in the liquidity changes on Binance, the world’s largest cryptocurrency exchange.

Related: Bitcoin sees ‘significant step forward’ as $97K BTC price targets return

CryptoQuant pointed out that the soaring stablecoin reserves on Binance starkly contrast with the declining reserves of Bitcoin and Ether (ETH).

“This distinct scenario (declining coin supplies and soaring stablecoin reserves) indicates that traders have been realizing profits and are now waiting with significant liquidity,” wrote contributor CryptoOnChain at the time.

Binance stablecoin reserves screenshot

Binance stablecoin reserves screenshot

Binance stablecoin reserves (source: CryptoQuant)

This amount of stablecoins held on the exchange acts like a coiled spring; on a price dip or economic recovery, it could fuel a new surge in market activity. The current phase is characterized by a readiness to buy following patience.

This article does not serve as investment advice or recommendations. Each investment involves risks, and readers are encouraged to do their own research before deciding.