Overview

MicroStrategy has leveraged convertible notes uniquely to fund its bitcoin acquisitions, raising $6 billion to date with plans for an additional $18 billion. This approach has piqued interest within the investment community due to the potential for trading based on bitcoin’s volatility.

Key Points

- MicroStrategy is raising funds through convertible bonds, gaining popularity among investors for their innovative approach.

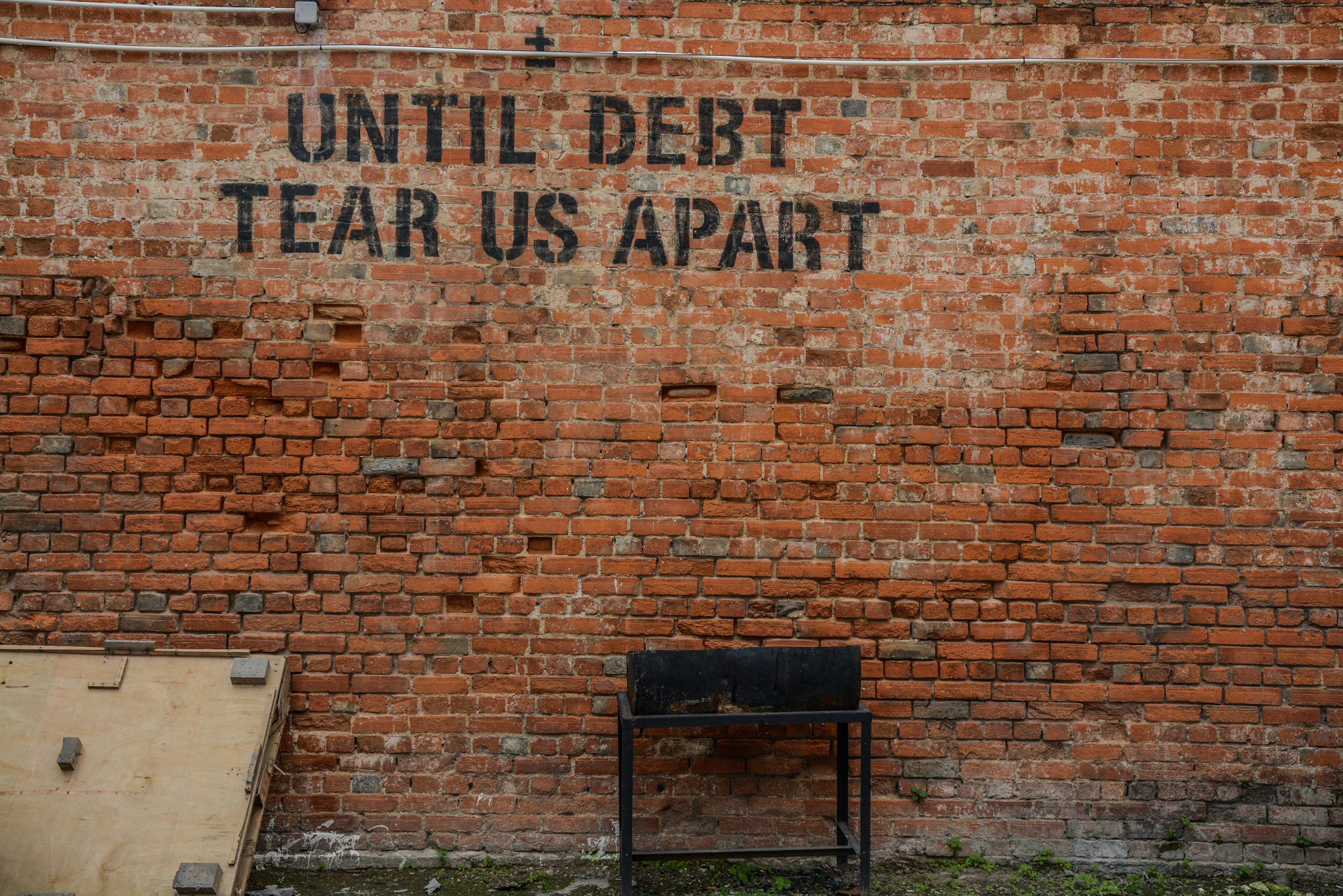

- The potential for future bitcoin price declines raises concerns about the sustainability of this strategy.

- Other companies like MARA Holdings are mirroring this strategy, leading to questions about the long-term impact on both their health and the broader crypto market.

Convertible Notes Explained

Convertible notes allow companies to gather funds without diluting shares immediately and without providing collateral. They generally offer downside protection and a potentially profitable pathway during stock surges, making them attractive to many investors.

Market Impact

Sophisticated traders are capitalizing on the volatility associated with bitcoin, driving demand for MicroStrategy’s convertible notes. The success of these bonds also suggests a rising trend among other firms to follow suit, which could impact the overall crypto market dynamics.