Synthetix Makes Its Comeback on Ethereum's Mainnet After Three Years

Synthetix aims to lead a resurgence of decentralized perpetual exchanges on Ethereum as conditions improve.

The perpetual trading platform Synthetix is making a return to Ethereum’s mainnet, with its founder asserting that the network is now fully equipped to handle high-frequency trading applications following years of congestion that diverted such activities elsewhere.

“By the time perp DEXs became a thing, the mainnet was too congested, but now we can run it back,” said Kain Warwick in a recent interview with Cointelegraph.

Warwick remarked that the absence of a Perp DEX on the mainnet was noteworthy, explaining how reduced demand stemming from earlier migrations and continued network improvements have revitalized Ethereum’s layer 1 for these purposes.

“It’s definitely the best place to run a perp DEX,” he affirmed.

He highlighted that high gas fees and network congestion had previously discouraged complex trading activities on the platform. Over recent years, many perpetual exchanges shifted to layer-2 solutions or different blockchains. Notably, Synthetix migrated to the Ethereum layer-2 network Optimism in 2022, with further expansions later to Arbitrum and Base.

Around the same period, decentralized derivatives exchange dYdX transitioned from the mainnet to StarkEx, a StarkWare layer-2 solution.

Warwick cites high fees as an impediment

Warwick states that excessive transaction costs had made it impractical to maintain essential trading infrastructure.

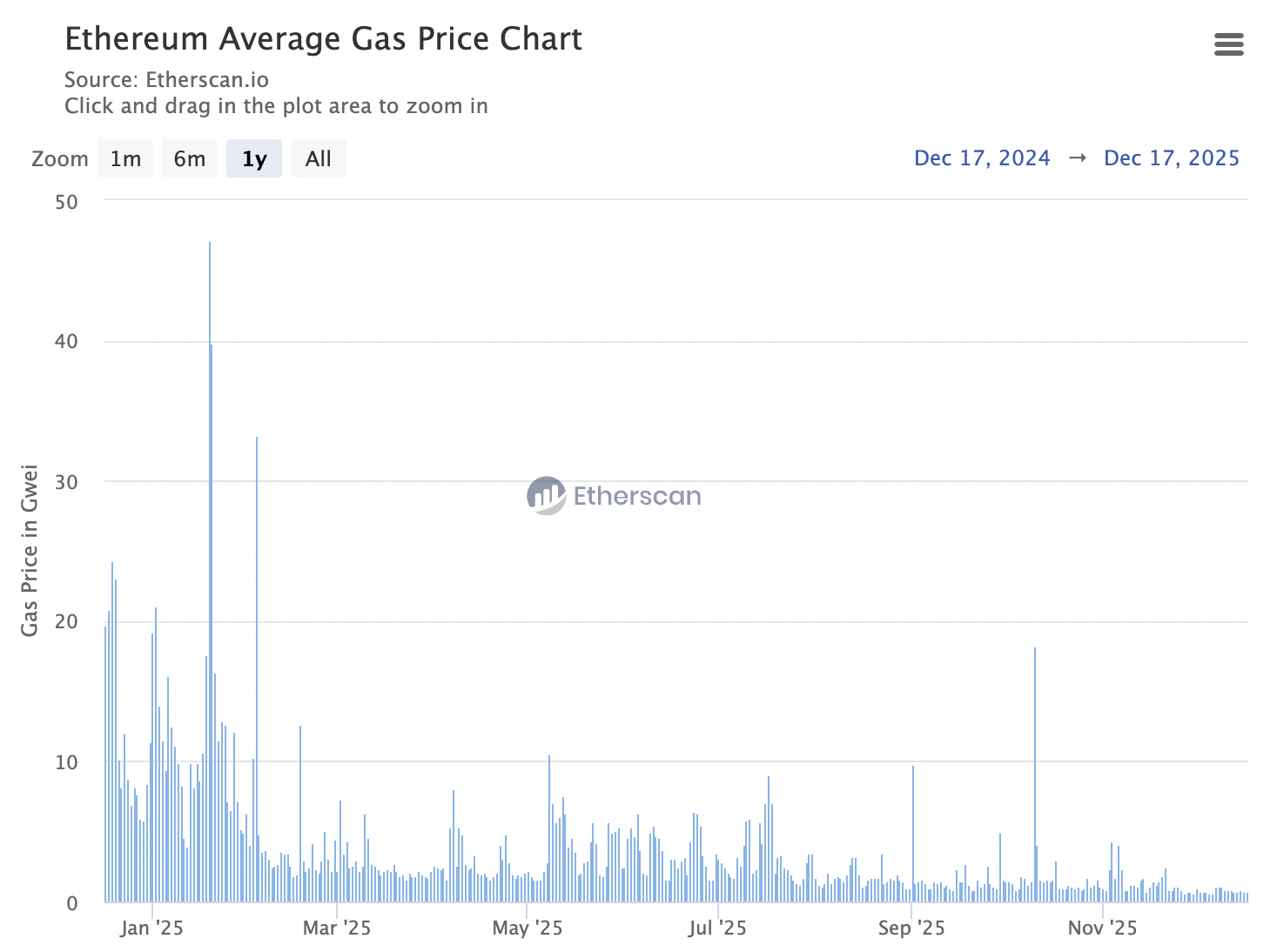

“The cost per transaction and therefore the efficiency of the markets on the chain really degraded,” Warwick noted, pointing out that Ethereum’s average gas fee, currently about 0.71 gwei, has dropped nearly 26-fold from an average of 18.85 gwei a year ago.

Gas Fees Comparison

Gas Fees Comparison

Warwick suggested that improving both layer-1 and layer-2 solutions means that “you can actually run critical infrastructure on mainnet again.”

As some within the Ethereum community foresee additional enhancements in network capacity by 2026, Ethereum advocate Anthony Sassano remarked that aiming to raise the gas limit to 180 million next year serves as a baseline aspiration rather than a best-case expectation.

Expectation to see more exchanges follow

Warwick predicts that other perpetual DEXs are likely to emulate Synthetix’s return to the mainnet, reinforcing his belief that Ethereum can now accommodate multiple DEXs at once.

“It wouldn’t be a Synthetix launch if someone didn’t try and, you know, follow us within 20 minutes,” he quipped.

He also pointed out that the majority of liquidity in the cryptocurrency market resides on the Ethereum mainnet, making it the premier platform for liquidity and trading efficacy.

Warwick concluded by stating that Ethereum’s developmental progress has significantly improved in 2025, marking it as potentially the most fruitful year for the network since the Merge in September 2022.

“There’s been a renewed kind of focus on, like, the needs of builders, in a way that I think in the past, maybe it was much more focused on the network itself,” he remarked.

Related: Ripple pilots RLUSD on Ethereum L2s in multichain push

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?