Bitcoin’s perpetual open interest has reached 310,000 BTC as funding rates have doubled, indicating a bullish market sentiment toward the end of the year.

Crypto derivatives markets are experiencing heightened activity, with a recent report from Glassnode noting that perpetual open interest grew from 304,000 to 310,000 BTC. This rise coincided with Bitcoin’s price momentarily hitting $90,000 on Monday.

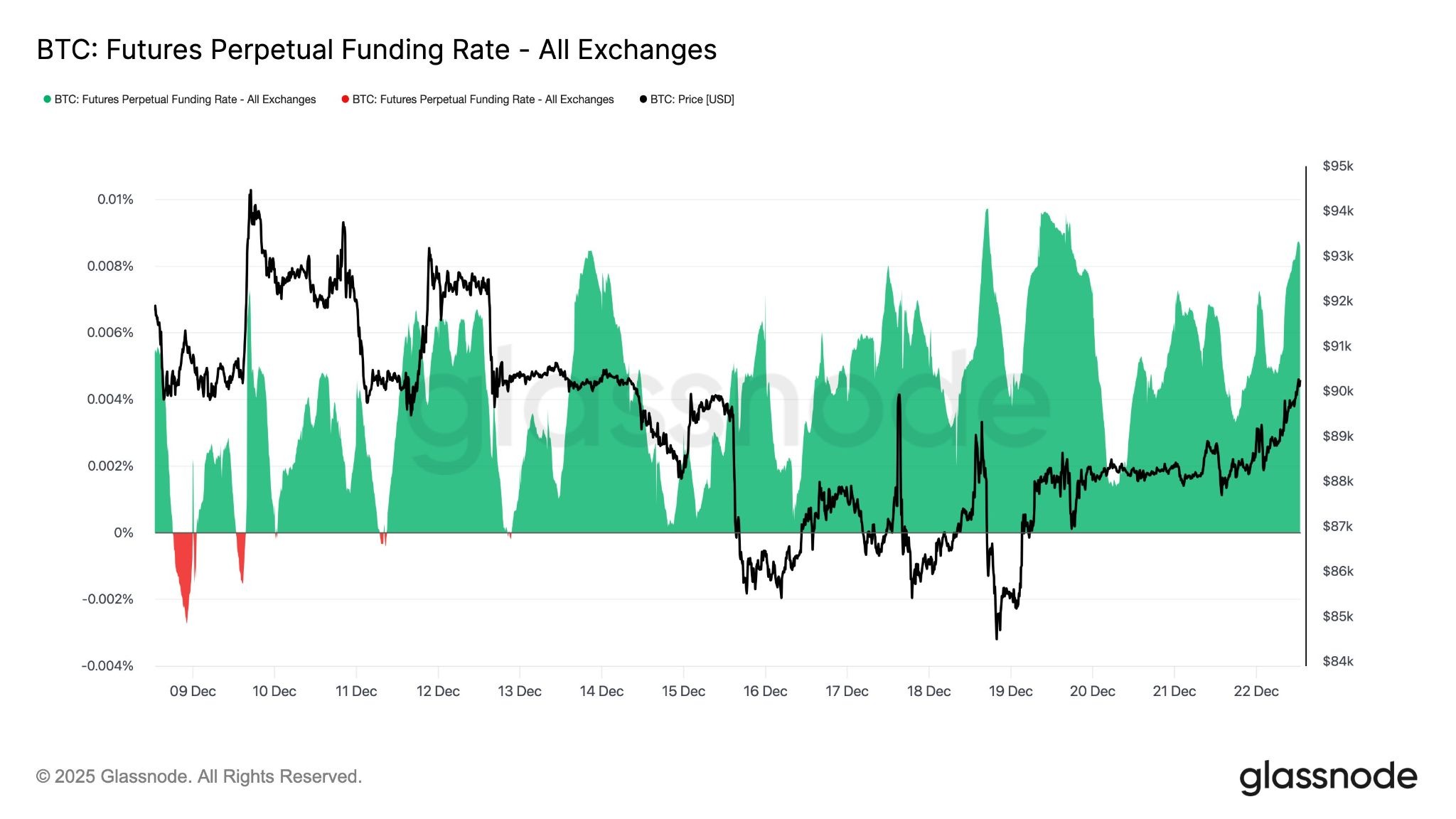

The funding rate has also climbed from 0.04% to 0.09%, suggesting that traders are positioning themselves for potential movements in the market as the year concludes. Glassnode commented, “This combination signals a renewed buildup in leveraged long positioning, as perpetual traders position for a potential year-end move.”

Increased Funding Rate Reflects Bullish Sentiment

Elevated funding rates generally suggest that the perpetual price is exceeding the spot price, with more traders showing bullish tendencies by paying premiums for long-held positions. However, excessively high rates might indicate potential market overheating, posing risks of correction.

As of the current reporting, Bitcoin price has retracted to $88,200 after failing to sustain levels above $90,000.

Bitcoin perp funding rates have increased recently. Source: Glassnode

Bitcoin perp funding rates have increased recently. Source: Glassnode

Enormous End-of-Year Options Expiry

A substantial end-of-year Bitcoin options expiry event is anticipated on December 26, which could increase market volatility. More than $23 billion in notional value contracts are set to expire, marking one of the largest options expiry occurrences in history.

Long positions are clustered around the $100,000 and $120,000 strike prices, while shorts are primarily positioned around $85,000, according to data from Deribit. The current put/call ratio stands at 0.37, indicating that long contracts significantly outnumber short ones. The current ‘max pain’ point, where losses will peak, is at $96,000, as noted by Coinglass.

If the spot price does not rally, many of these contracts may expire worthless, indicating that the bullish outlook surrounding higher strikes could have been overly optimistic.

There is a lot of OI at higher strike prices. Source: Deribit

There is a lot of OI at higher strike prices. Source: Deribit

Related topics: Crypto has everything necessary for a bull market, why is the market declining?