MarketVector Indexes has introduced two innovative benchmarks designed to target stablecoin and real-world asset tokenization infrastructure, with Amplify ETFs joining in to create exchange-traded funds that will track these benchmarks.

As stated in a Tuesday announcement, the MarketVector Stablecoin Technology Index and the MarketVector Tokenization Technology Index will offer investors a regulated avenue to companies and digital asset initiatives linked to stablecoin issuance and payment systems, alongside platforms that facilitate tokenized real-world assets (RWAs).

New ETFs Launched

The launch also includes two funds from Amplify ETFs associated with these indexes. The Amplify Tokenization Technology ETF (TKNQ) will follow the tokenization-focused index, and the Amplify Stablecoin Technology ETF (STBQ) will align with the stablecoin benchmark.

These ETFs are intended to reflect MarketVector’s benchmarks instead of holding stablecoins or tokenized assets directly, and they will be available on the NYSE Arca exchange in the United States.

MarketVector, located in Germany, serves as an index provider and regulated benchmark administrator overseen by BaFin, supporting diverse exchange-traded products globally. Specific details regarding the companies involved in these indexes have yet to be disclosed.

Insights on Market Growth

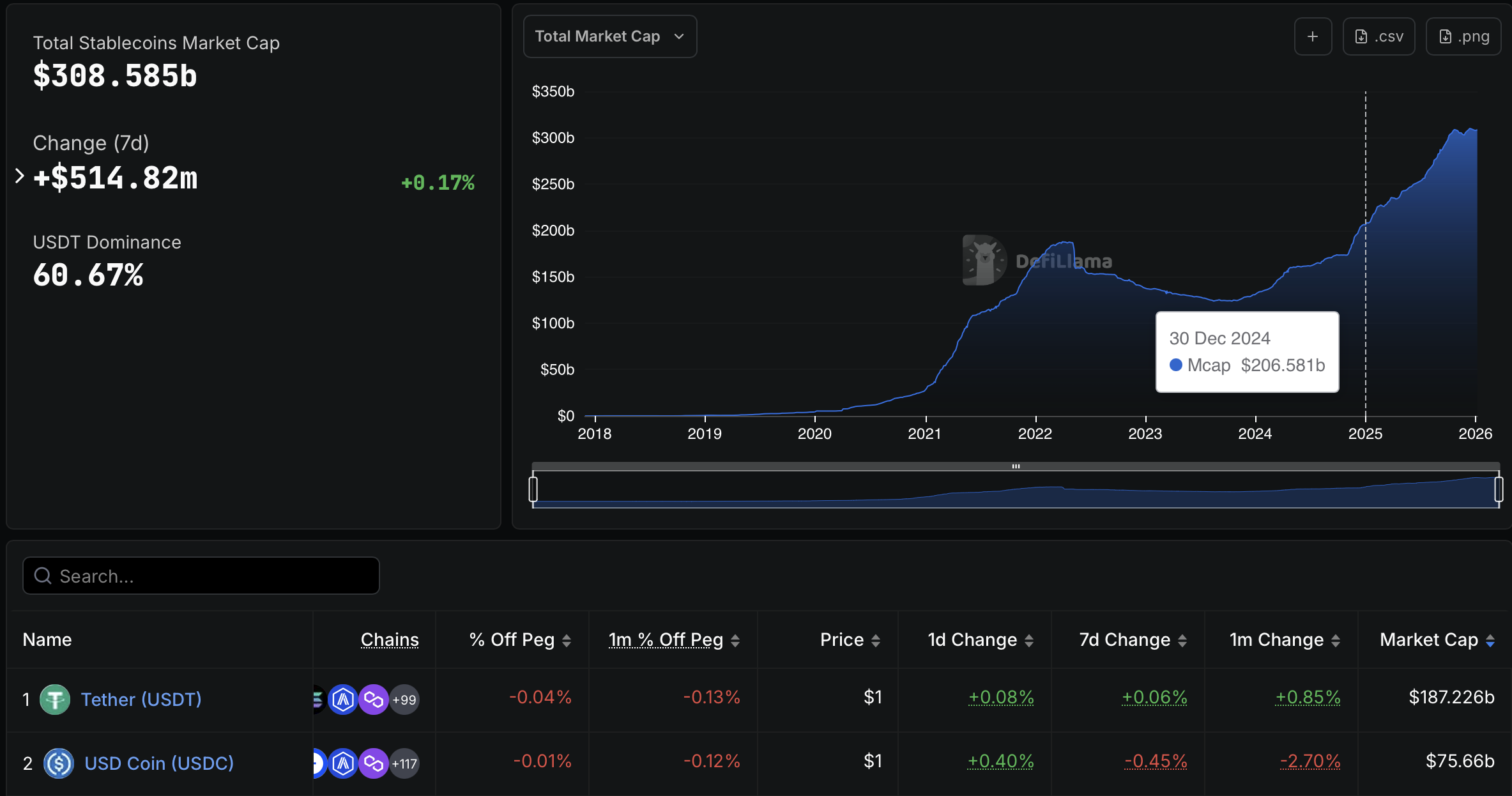

This year, the stablecoin market saw a cap of $308.6 billion, marking an increase of over 50% since the end of 2024, according to data from DeFiLlama. The expansion of the market has included multiple new stablecoin launches in the previous year; however, it remains heavily dominated by Tether’s USDt (around 60% of total market cap) and Circle’s USDC (about 24%).

Moreover, the tokenization of real-world assets has experienced remarkable growth in 2025, with values estimated at $19.6 billion, up from approximately $5.55 billion at the end of 2024. This sector’s rise is largely attributed to financial products that tokenize government securities.

Executives in the crypto sector expect the trends of stablecoin and tokenized assets to continue into 2026.

Related: China’s financial associations reclassify RWAs as ‘risky’

Market Cap Data

Stablecoin market cap. Source: DefiLlama

Market Cap Data

Stablecoin market cap. Source: DefiLlama