Record Withdrawals from Spot Bitcoin ETFs Amid Weaker Demand Indicators

Spot Bitcoin ETFs faced historic outflows as demand indicators signal a potential downturn.

Key Highlights

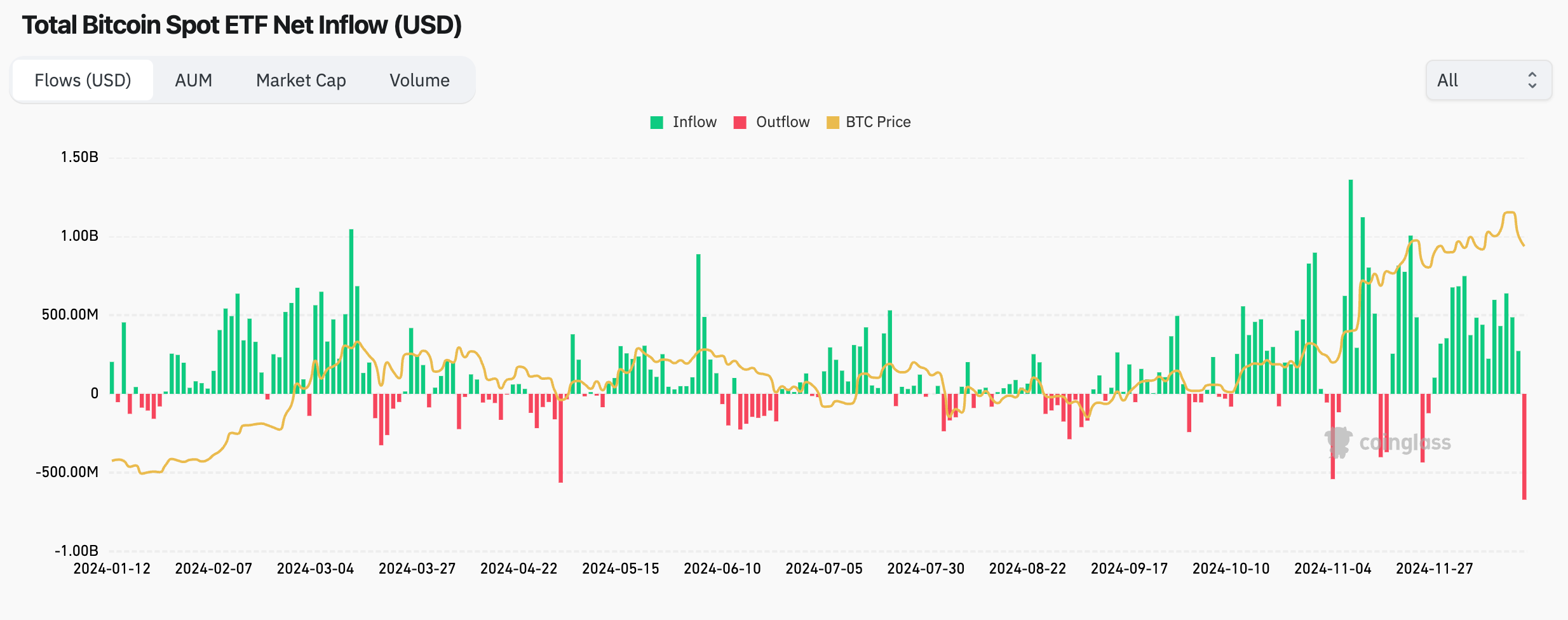

- On Thursday, investors withdrew $671.9 million from 11 spot Bitcoin ETFs, ending a 15-day inflow trend.

- The annualized premium on one-month CME futures dropped to below 10%, suggesting diminishing short-term demand.

Market Overview

The U.S.-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) experienced significant outflows on Thursday. Data from Coinglass and Farside Investors confirmed a record withdrawal amounting to $671.9 million, marking the largest single-day exit since these ETFs were launched on January 11.

Fidelity’s FBTC and Grayscale’s GBTC led these outflows with losses of $208.5 million and $188.6 million, respectively. Bitcoin further declined to $96,000, representing a nearly 10% drop from its peak of $108,268 observed earlier in the week, as it extended its post-Fed losses.

Derivative Market Insights

In a continuing bearish trend, the CME’s one-month bitcoin futures premium fell to 9.83%, the lowest level in over a month, illustrating declining cash-and-carry arbitrage opportunities between the ETFs and futures market. This trend points to potentially ongoing weak demand for the ETFs in the foreseeable future.

Ether ETFs

Additionally, Ether ETFs recorded net outflows totaling $60.5 million, the first outflow since November 21, indicative of market adjustments following significant changes in the crypto landscape.