A recent policy document from the Coinbase Institute suggests that the key factor in global finance isn’t the wealth gap between rich and poor, but rather the disparity between those with direct access to capital markets and those without. This division is referred to as the ‘brokered’ versus the ‘unbrokered’.

The report estimates that conventional financial structures exclude around four billion individuals who lack the ability to own productive assets or raise capital effectively. The authors advocate for substantial changes to market infrastructures to allow smaller investors and issuers to engage directly, eliminating reliance on various intermediaries.

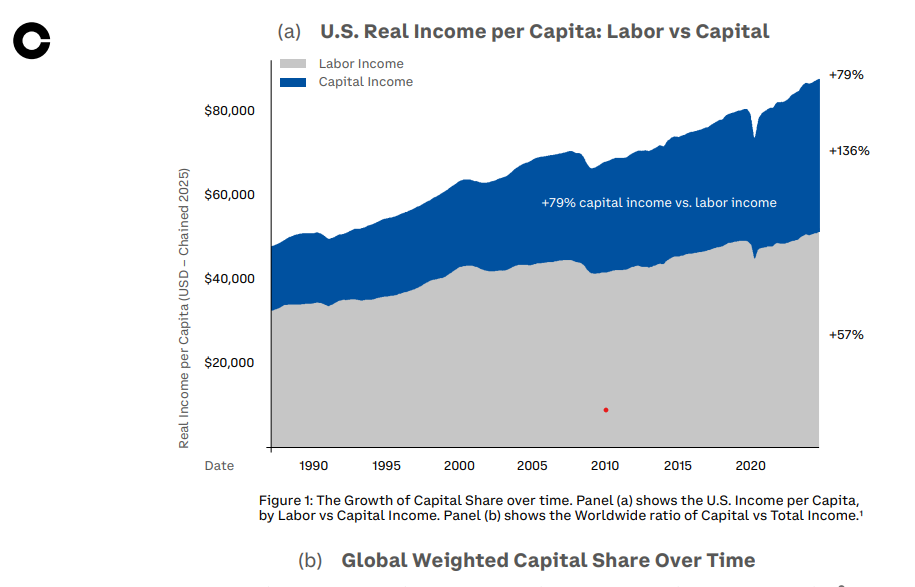

In the past four decades in the U.S., capital income has surged by 136% while labor income has only increased by 57%. This underlines a vital argument: it is access to capital markets, rather than merely basic banking, that plays a pivotal role in wealth creation.

Capital income vs labor income. Source: Coinbase Institute

Capital income vs labor income. Source: Coinbase Institute

Traditional financial models depend heavily on a network of brokers and custodians, making it impractical to serve smaller clients and creating a divide or ‘capital chasm’ between the brokered elite and everyone else.

Moreover, ownership of financial assets like stocks and bonds is highly concentrated within developed nations among already brokered families.

Why Coinbase Advocates for Open Systems

Coinbase envisions a future where permissionless tokenization is essential for the unbrokered to gain advantages. The report highlights that closed, permissioned blockchain efforts merely reinforce existing hierarchies, as a few gatekeepers dictate who can create or access tokenized assets. In contrast, an open system, much like the TCP/IP protocols of the internet, allows anyone to build upon the same framework without the risk of losing interoperability over time.

Progress in Tokenization

The report arrives at a time when tokenization advancements are moving from conceptual phases to implementation across both cryptocurrency and traditional financial sectors. Notable developments include Franklin Templeton’s issuance of tokenized U.S. money market fund shares on public blockchains, aiming for faster settlements within regulatory frameworks.

JPMorgan is also incorporating tokenization via its live platform, enhancing efficiency in collateral movement among institutional clients. Furthermore, the New York Stock Exchange has revealed its plans for a 24/7 trading environment for tokenized stocks and ETFs, complete with blockchain-supported post-trade structures.

Coinbase’s release of this report coincides with the World Economic Forum gathering in Davos, where CEO Brian Armstrong expressed intentions to engage in discussions about market structure reforms, tokenization, and pursuing economic freedom through updated financial systems.