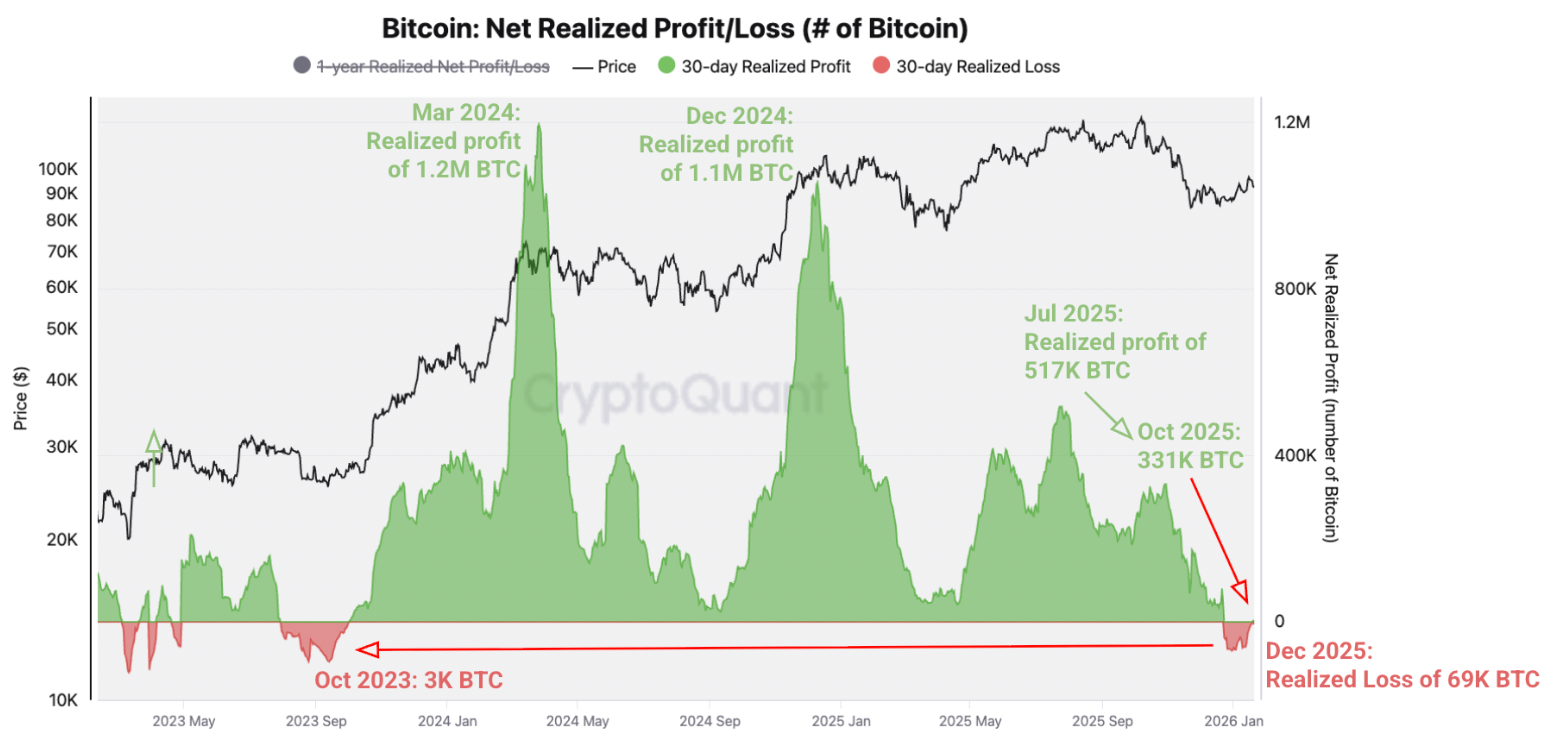

Bitcoin’s recent price drop below $90,000 has pushed on-chain profit indicators into negative territory, signaling a bear market transition as per recent analysis. A key finding from data provider CryptoQuant indicates that Bitcoin holders are shifting from gaining profits to recording losses for the first time in over two years.

Key Insights:

- Bitcoin’s net realized profit/loss indicates a potential macro downtrend.

- The primary support zone for Bitcoin is currently between $80,000 and $84,000.

Market Analysis

Market Analysis

According to CryptoQuant’s Thursday newsletter, the drop in net realized profit/loss has fallen to 69,000 BTC over the past month, indicating a decline in market strength.

“Bitcoin holders began realizing net losses for the first time since October 2023.”

Profit and Loss Overview

Profit and Loss Overview

The steady decline in annual net realized profits, from 4.4 million BTC in October to 2.5 million BTC, reinforces the notion that on-chain profit dynamics are aligning with conditions typical of an initial bear market phase.

Looking Ahead

Analysts are amid predictions that 2026 will be characterized as a bear market year, awaiting the potential for Bitcoin prices to return to levels around $58,000.

Key trading levels to monitor include:

- Loss of 75% supply cost basis which is currently situated at $92,940.

- Major support established around $84,000, where many investors acquired around 941,651 BTC over the last six months.

With the current dynamics resembling the transition phases of previous bear markets, careful observation of these support levels is crucial for traders and investors.