Paradex Returns $650K to Users After Database Upgrade Error Leads to Liquidations

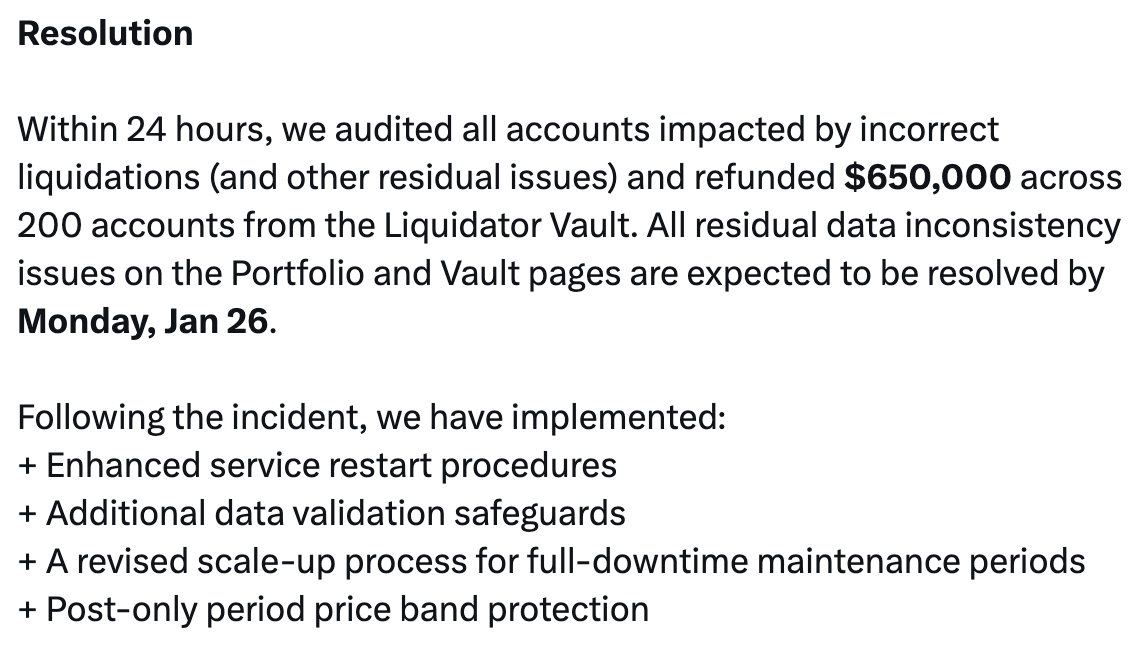

Paradex issued refunds of $650,000 to nearly 200 users following a maintenance-related software issue that resulted in unexpected liquidations.

Onchain derivatives platform Paradex has refunded $650,000 to approximately 200 users after a software error tied to maintenance triggered unintended liquidations in multiple markets.

A post-mortem shared on X by Paradex revealed that during a planned 30-minute database upgrade on Monday, a “race condition” led to corrupted data being written onchain. The company clarified that this issue was operational and not due to a hack or security breach.

In reaction, Paradex disabled platform access temporarily, canceled all open orders (excluding take-profit and stop-loss orders), and rolled back the blockchain to a snapshot prior to maintenance.

News

Source: Paradex

News

Source: Paradex

Paradex allows traders to engage in leveraged perpetual positions while retaining control over their funds, avoiding the need to deposit assets with centralized exchanges.

The incident represented the first rollback of the Paradex Chain, characterized by the exchange as an “undesired but necessary action to protect users and restore network integrity.”

To prevent future occurrences, Paradex has instituted several changes, such as updated restart procedures for services, enhanced data validation checks, a modified scaling process during full maintenance periods, and protections for price bands during post-only trading intervals.

Trading Disruptions Caused by Technical Failures

Recent events underscore how operational failures, instead of hacks, can impact derivatives trading and crypto market access.

In October, decentralized exchange dYdX halted trading for around eight hours due to a code-ordering error, which resulted in mispriced trades and liquidations. A governance vote was initiated to compensate affected traders up to $462,000 from the protocol’s insurance fund.

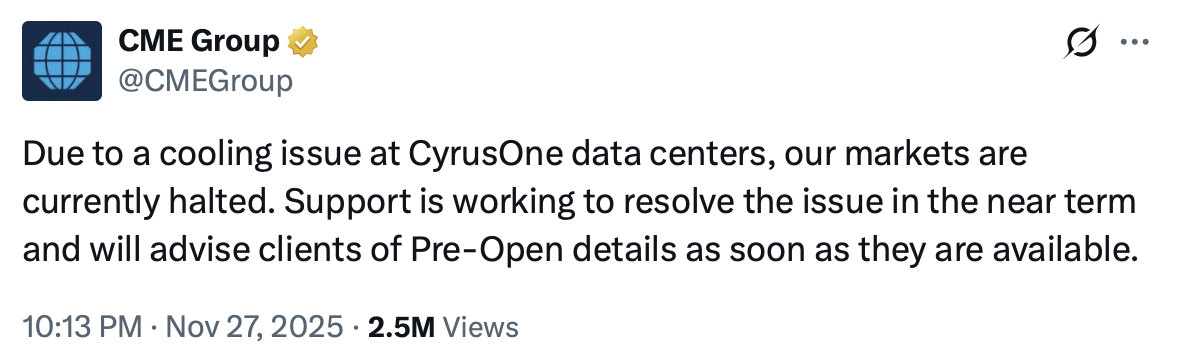

Technical disruptions have also permeated conventional derivatives markets. In November, the Chicago Mercantile Exchange (CME) suspended trading for roughly 10 hours after a cooling failure at a data center in Illinois disrupted operations, sparking traders’ complaints.

CME Group

Source: CME Group

CME Group

Source: CME Group

In November, Cloudflare reported an “internal service degradation” affecting numerous significant cryptocurrency platforms, temporarily obstructing access to exchanges, wallets, and data dashboards.