Grayscale Pursues Approval for Spot BNB ETF, Expanding Beyond Bitcoin and Ether

Grayscale aims to provide US investors with regulated access to BNB through a new ETF filing with the SEC.

Grayscale has submitted an application to the US SEC for a spot exchange-traded fund that tracks BNB, expanding its portfolio beyond Bitcoin and Ether.

If the application is approved, it will allow US investors to gain regulated exposure to BNB without needing to hold the token directly.

The proposed Grayscale BNB ETF aims to hold BNB and issue shares reflecting the market value of the token, excluding any associated fees. It is expected to be listed on Nasdaq under the ticker GBNB, pending regulatory approval.

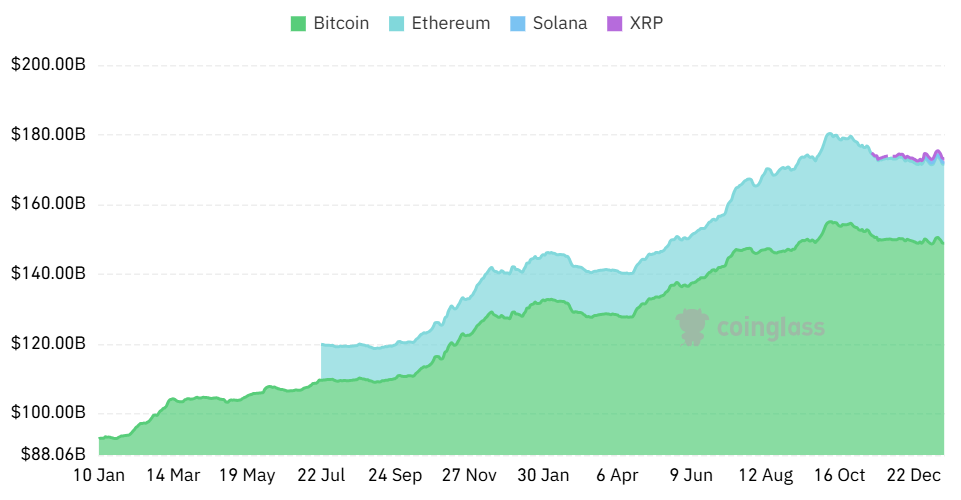

The interest in a BNB ETF is significant since it is currently the fourth-largest cryptocurrency, valued at $120.5 billion. BNB, the native token of the Binance platform, is utilized for transaction fees, governance participation, and offers trading discounts on Binance.

Grayscale’s application reflects its strategy to broaden its crypto investment offerings, following successful launches of Bitcoin and Ether ETFs in the US.

A BNB ETF would provide investors with access beyond the main layer of networks, particularly benefiting from the association with a major exchange ecosystem.