Bitcoin Sees Significant Drop to 6-Week Low Following Iran Conflict Concerns

Bitcoin's value has fallen drastically to a six-week low as fears of military action against Iran escalate, leading to significant liquidations in the crypto market.

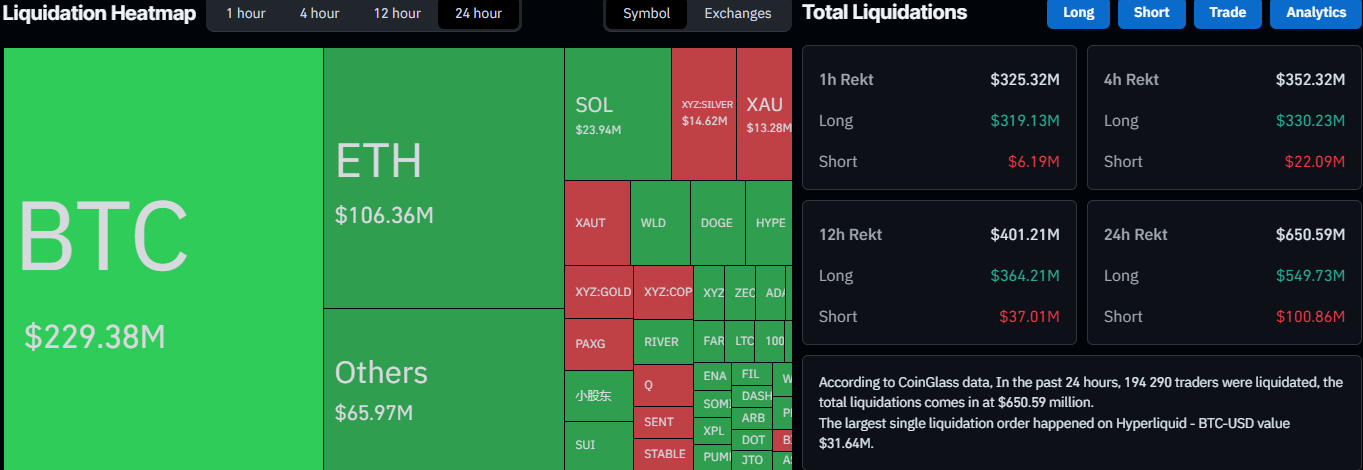

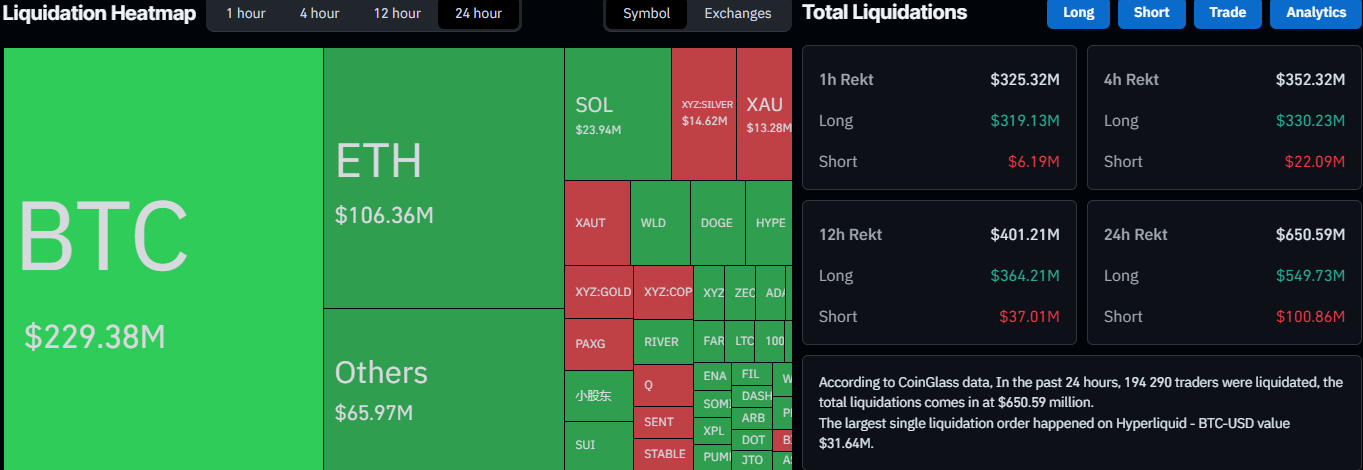

Bitcoin’s value has taken a significant hit recently, falling to a new six-week low of slightly above $85,000. This decline has pushed the crypto market into turmoil, especially among altcoins, resulting in over $650 million in leveraged positions being liquidated, with about half occurring in just the last hour.

As per CoinGlass data, over 190,000 trades have been liquidated, with the largest single liquefaction reported on the Hyperliquid platform, valued at more than $31 million.

Liquidation Data on CoinGlass

Liquidation Data from CoinGlass

Liquidation Data on CoinGlass

Liquidation Data from CoinGlass

The sharp downturn is largely attributed to rising concerns about a potential military strike against Iran by the United States. Reports indicate that the U.S. has dispatched the Abraham Lincoln Carrier Strike Group to the Middle East, warning Iran about its negotiations running out of time. Consequently, U.S. crude oil prices surged over 2.5%, further destabilizing the crypto and precious metal markets, with gold dropping sharply from a recent high of over $5,500/oz to approximately $5,300.

Bitcoin is presently down approximately 3% per hour, with altcoins experiencing even sharper declines; Ethereum (ETH) has dropped to $2,800, rejected at the $3,000 mark, and XRP has seen a reduction of 3.5%, while Solana (SOL) has plunged by 3.7%.

BTCUSD Jan 29

BTCUSD Chart from TradingView

BTCUSD Jan 29

BTCUSD Chart from TradingView