Trend Research Liquidates Over 400K ETH Amid Rising Liquidation Threats

Trend Research significantly downsizes its Ether holdings as market pressures mount and liquidation levels approach.

Trend Research has been actively decreasing its exposure to Ether as ETH approached critical liquidation thresholds below $1,700. The Ethereum investment firm offloaded a significant portion of its holdings in response to the latest market downturn, which has pressured it to liquidate assets to settle debts.

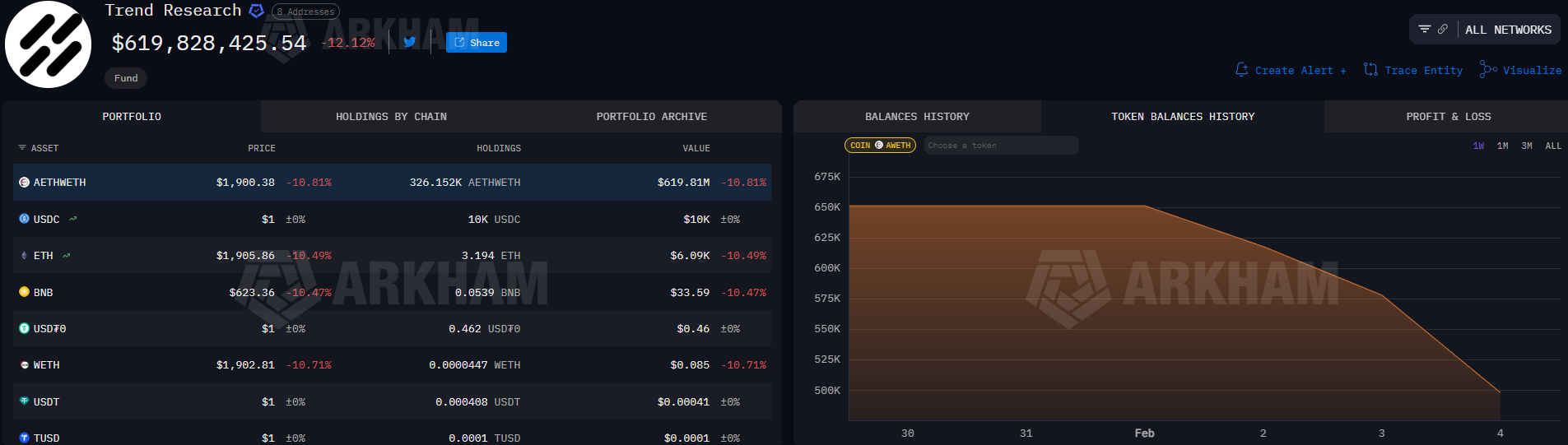

Initially holding approximately 651,170 Ether, which was represented as Aave Ethereum wrapped Ether (AETHWETH), the firm reduced its assets by 404,090, bringing it down to roughly 247,080 as of Friday.

The organization shifted 411,075 ETH to the Binance exchange since the start of the month, based on data from blockchain platform Arkham.

This series of transactions coincided with a nearly 30% drop in ETH’s price over the past week, which fell to $1,748 at one point, while it was trading at $1,967 at the time of this report.

Trend Research ETH Holdings

Trend Research, WETH token balance history, one-week chart. Source: Arkham

Trend Research ETH Holdings

Trend Research, WETH token balance history, one-week chart. Source: Arkham

Related: Sharplink pockets $33M from Ether staking, deploys another $170M ETH

Trend Research Enhances Risk Management as ETH Levels Approach Liquidation

Trend Research has been associated with Jack Yi, the founder of the Hong Kong-based crypto firm Liquid Capital. Yi accumulated Ethereum holdings by purchasing ETH on an exchange, utilizing them as collateral on Aave to secure stablecoin loans, which were subsequently used to buy more ETH.

Recent reports indicate Trend Research is facing multiple liquidation levels for ETH, specifically between $1,698 and $1,562, according to blockchain analytics service Lookonchain. Yi stated in a post that he remains optimistic about market conditions, despite acknowledging he had previously predicted the recovery too early, and intends to manage risks effectively moving forward.

Related: BitMine buys $105M Ether to kick off 2026, still holds $915M in cash

Trend Research gained attention shortly after the recent $19 billion liquidation event from October 2025, during which it began a robust accumulation of Ether. The firm would have ranked as the third-largest Ether holder in December; however, being an unlisted entity, it is not visible on many tracking platforms.

BitMine, known as the largest public corporate Ether holder, had approximately $8 billion in unrealized profits reported last Friday.