Cardano's ADA Faces Uncertain Future as 190 Million Tokens Are Sold

Recent sell-offs from Cardano whales raise questions about ADA's potential decline or reversal in price.

Cardano’s ADA has been facing challenges recently, with its price dropping to a five-year low early in February. A resurgence seems uncertain as major investors’ recent actions indicate a further decline may be imminent.

Are the Whales Aware of Hidden Insights?

Renowned analyst Ali Martinez highlighted that Cardano’s affluent investors have dumped around 190 million ADA in just a week, equating to roughly $50 million at the current price of $0.26 each. Previously, these whales possessed 13.57 billion ADA but now hold roughly 13.38 billion, which is about 36.3% of the total circulating supply.

There’s a prevailing view in the cryptocurrency community that whales generally have insightful knowledge regarding significant impending changes that may affect their decisions to buy or sell assets. Hence, their latest sell-off may instigate unease among smaller investors, prompting them to exit as well.

The economic ramifications are noteworthy: large-scale sell-offs heighten the available quantity of ADA on the market; coupled with stagnant demand, this should exert downward pressure on prices.

Investors should also consider ADA’s Relative Strength Index (RSI), an important indicator for assessing whether an asset is overbought or oversold. This ranges from 0 to 100 and aids traders in determining potential trend shifts.

Readings above 70 suggest ADA is overbought and may be poised for a pullback, while figures below 30 hint at bullish scenarios. Currently, the RSI is about 74.

Will History Repeat Itself?

ADA is distinguished by its large supporter base, composed of advocates and optimistic analysts. Just days ago, user Aman mentioned that ADA’s price has dipped to the $0.26 demand zone, a level historically linked to notable recoveries. Mentor echoed this sentiment in a recent post arguing that the last time ADA approached these figures, it surged to nearly $1.40 within a month. They foresee a similar course unfolding shortly.

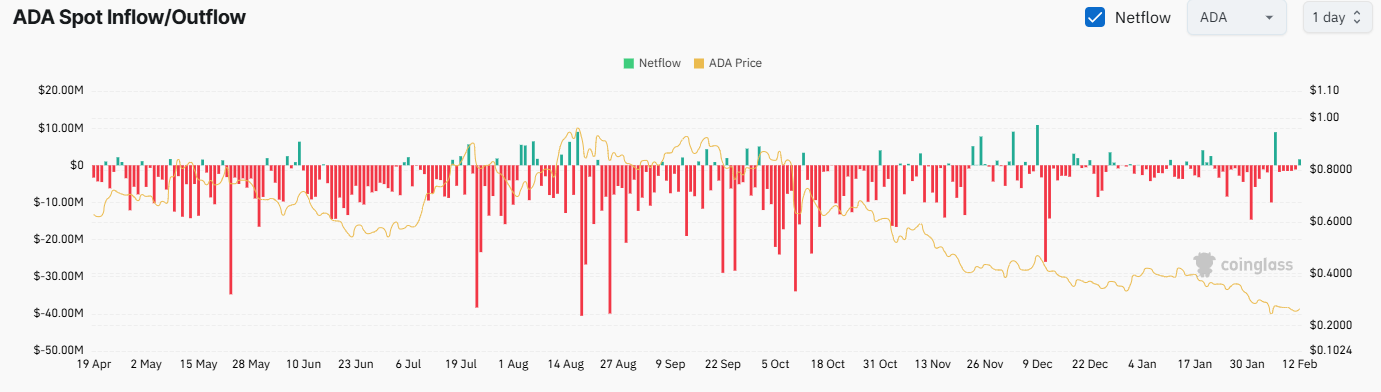

In recent months, negative exchange netflows for ADA have become a common trend, strengthening these optimistic forecasts as it reflects a movement of tokens from exchanges to self-custody. This trend decreases the likelihood of prompt selling.

You may also like:

- Crypto Trading Activity Hits Yearly Lows as Holiday Lull Freezes Markets

- Bitcoin (BTC) Stops at $90K After the FOMC Meeting, Cardano (ADA) Plunges by 10%: Market Watch

- Whales Are Leaning Into Ethereum (ETH) and Cardano (ADA): Retail Is Lagging Behind

ADA RSI

ADA RSI

ADA RSI, Source: RSI Hunter

ADA Exchange Netflow

ADA Exchange Netflow

ADA Exchange Netflow, Source: CoinGlass