Is XRP Set to Surge? Three Indicators Point to a Return of the Ripple Bulls

Key factors suggest that XRP's bears may be stepping back, indicating a potential surge for Ripple's token.

The latest market downtrend has not been kind to Ripple’s XRP, whose price slipped by nearly 25% over the past two weeks. However, several factors point to a possible resurgence for the bulls.

Signs of a Potential Rally

Last week, Ripple’s cross-border token fell to around $1.10—its lowest since November 2024. It has since recovered to approximately $1.40.

Factors like XRP’s exchange reserves indicate a potential revival. According to CryptoQuant, the amount of coins on Binance fell to approximately 2.55 billion—the lowest since early 2024. Current reserves are around 2.57 billion XRP, close to the local bottom.

XRP Exchange Reserves

XRP Exchange Reserves on Binance, Source: CryptoQuant

XRP Exchange Reserves

XRP Exchange Reserves on Binance, Source: CryptoQuant

This shift suggests that many investors are moving from centralized exchanges to self-custody methods, reducing immediate selling pressure.

The introduction of spot XRP ETFs is another bullish sign. The first such offering in the USA debuted in November 2025 and was introduced by Canary Capital, with subsequent products launched by Bitwise, Franklin Templeton, 21Shares, and Grayscale. These funds have attracted strong demand, with total net inflows exceeding $1.23 billion.

Technical Indicators Signal Potential Upsurge

Technical patterns are also indicating a decisive move upward for XRP. An analyst named Niels noted an “inverse head and shoulder pattern” forming in XRP’s price chart—three bottoms with the middle being the lowest. Breaking above the neckline of this pattern could trigger a significant price pump, with the $1.44 level being a crucial target.

Caution for the Bears

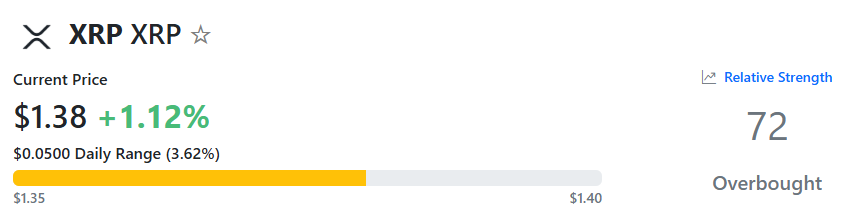

Despite these signals, the wider crypto market remains bearish, and a potential downturn for major digital assets, including XRP, can’t be ruled out. Moreover, XRP’s Relative Strength Index (RSI) currently stands around 72, suggesting overbought conditions that could lead to a pullback.

XRP RSI

XRP RSI, Source: RSI Hunter

XRP RSI

XRP RSI, Source: RSI Hunter

In summary, while several indicators are lining up for a bullish outlook, traders should remain vigilant given the current overall market conditions.