The House of Representatives in the Netherlands has made progress on a significant legislative proposal aimed at implementing a 36% capital gains tax targeting savings and most liquid investments, including cryptocurrencies.

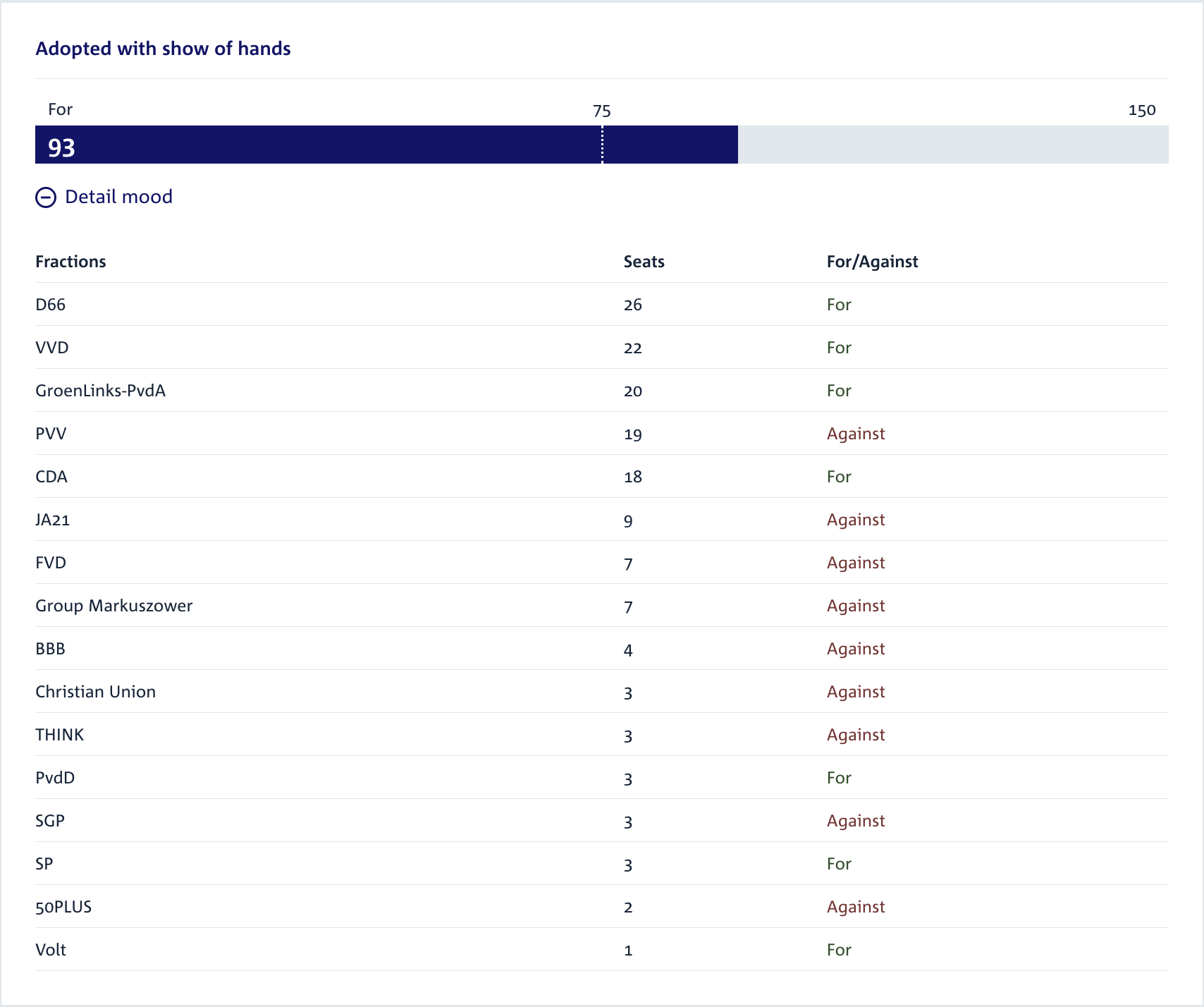

On Thursday, the vote reached the 75-vote threshold necessary for advancement, with 93 lawmakers in support of the bill, as per the House’s tally.

This new tax will apply to savings accounts, cryptocurrencies, various equity investments, and profits from interest-earning financial instruments, regardless of whether the assets are sold.

Vote Tally

The vote tally for the 36% capital gains tax bill. Source: Dutch House of Representatives

Vote Tally

The vote tally for the 36% capital gains tax bill. Source: Dutch House of Representatives

Critics argue this legislation could prompt investors to move assets out of the Netherlands and into areas with more favorable taxation laws. Concerns are particularly high among those in the cryptocurrency sector, who fear capital flight in response to high tax rates.

The bill will require Senate approval before officially becoming law, set to take effect in the 2028 tax year if passed. However, many in the crypto community are already warning of the potential ramifications.

Investors believe the tax could be counterproductive

Denis Payre, co-founder of Kiala, remarked, “France enacted a similar policy in 1997 and experienced a significant outflow of entrepreneurs from the country.”

Crypto market analyst Michaël van de Poppe criticized the proposal, calling it “the dumbest thing I’ve seen in a long time.”

He expressed concerns about the number of investors considering leaving the nation, stating, “The number of individuals ready to flee the country will be astonishing.”

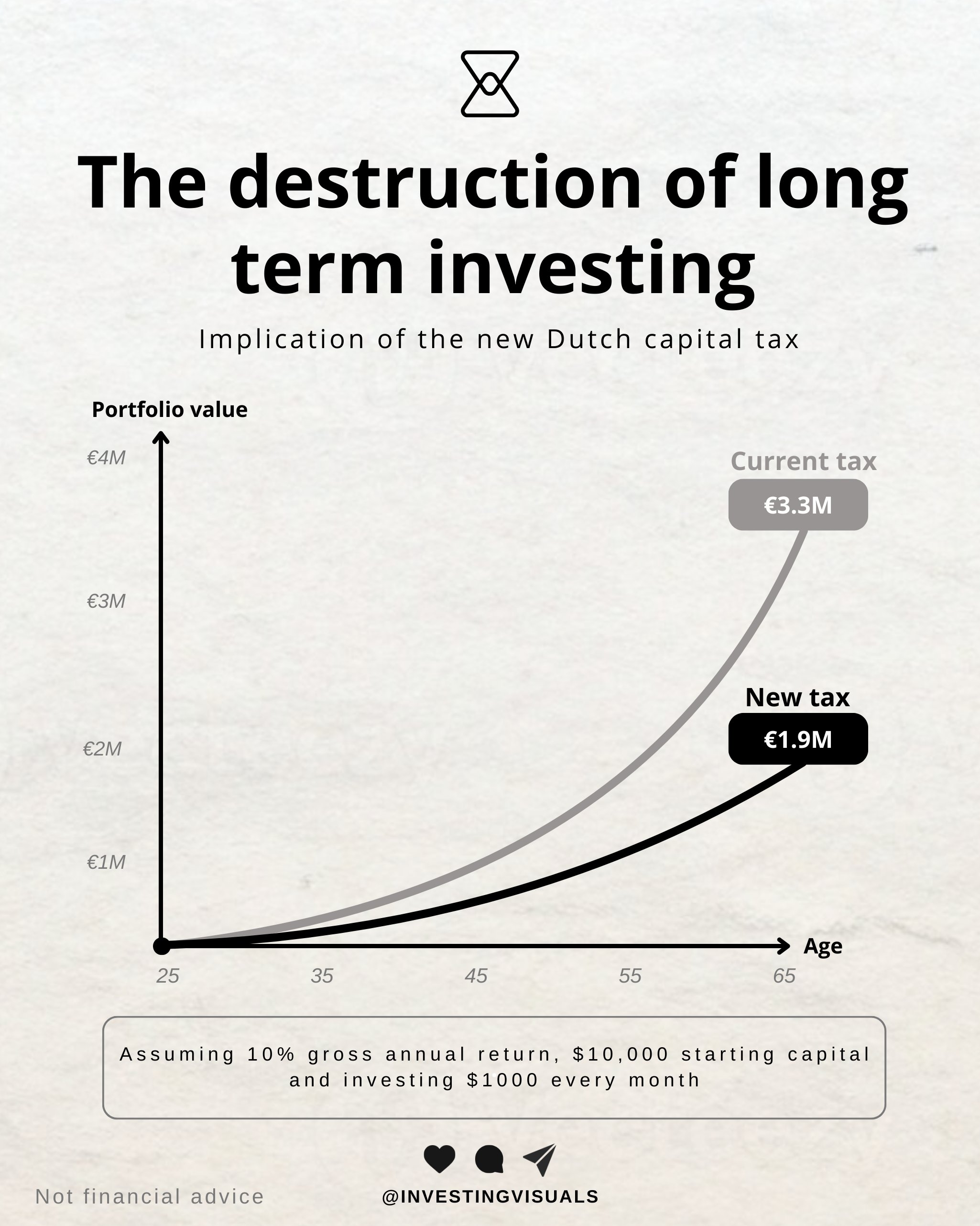

An analysis from Investing Visuals indicates that an investor beginning with €10,000 who adds €1,000 monthly over 40 years would accumulate approximately €3,320,000. However, under the new 36% tax, that total would drop to about €1,885,000 after four decades—an astonishing loss of €1,435,000.

Investment Comparison

Comparison of an investment’s growth over 40 years with and without the 36% unrealized gains tax. Source: Investing Visuals

Investment Comparison

Comparison of an investment’s growth over 40 years with and without the 36% unrealized gains tax. Source: Investing Visuals

Similar sentiments have been echoed by crypto and tech executives in the United States regarding California’s proposed wealth tax on billionaires, which has spurred numerous entrepreneurs to leave the state.

Update: This article reinforces Cointelegraph’s commitment to independent journalism, striving to provide timely and accurate information. Verification of sources independently is encouraged.