Bitcoin ETFs Face $410 Million Outflow as Standard Chartered Lowers BTC Price Projection

US Bitcoin ETFs experience continued losses as Standard Chartered adjusts its price predictions for Bitcoin in 2026.

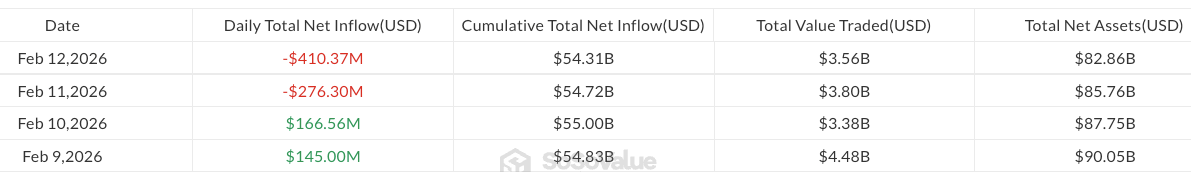

US spot Bitcoin exchange-traded funds (ETFs) continued to see significant outflows, totaling $410.4 million on Thursday as Standard Chartered revised its Bitcoin forecast for 2026 down from $150,000 to $100,000.

The recent selling spree has pushed cumulative losses to $375.1 million for the week. If substantial inflows do not occur, these funds are positioned for a fourth consecutive week of losses, with their assets under management plummeting from nearly $170 billion in October 2025 to just under $80 billion now.

Daily flows in US spot Bitcoin ETFs since Monday. Source: SoSoValue

Daily flows in US spot Bitcoin ETFs since Monday. Source: SoSoValue

This wave of selling aligns with Standard Chartered’s announcement regarding their lowered predictions for Bitcoin, citing potential declines to $50,000 before a possible recovery. In a Thursday report, the bank warned, “We expect further price capitulation over the next few months,” suggesting Bitcoin could eventually rebound towards $100,000 by year-end.

Solana ETFs Gain Amidst Bitcoin ETF Outflows

Contrary to the negative trend observed in Bitcoin ETFs, Solana ETFs recorded modest inflows of $2.7 million, while other products like BlackRock’s iShares Bitcoin Trust ETF faced the heaviest outflows.

Market Overview

Bitcoin was trading around $66,000, but had briefly dipped to $65,250 according to CoinGecko. Despite this ongoing selling trend, the behavior of long-term holders indicates that widescale panic sell-offs are not yet in play.