Kraken’s Tokenized Stocks Surpass $25 Billion in Trade Volume

The xStocks platform by Kraken has exceeded $25 billion in trading activity, reflecting rapid growth in tokenized stock ownership.

Kraken’s tokenized stocks division, known as xStocks, has remarkably exceeded $25 billion in total transaction volume just under eight months post-launch, highlighting a surge in adoption as tokenization becomes increasingly popular among traditional investors.

Recently, Kraken announced that this $25 billion volume encompasses trades on both centralized and decentralized exchanges, in addition to minting and redemption actions. This new figure signifies a 150% growth since November when xStocks achieved $10 billion in cumulative volume.

The xStocks tokens are managed by Backed Finance, a licensed asset provider that offers tokenized versions of publicly traded stocks and ETFs at a 1:1 ratio. Kraken acts as a primary marketplace and exchange, while Backed handles the structure and issuance of these tokenized assets.

Upon its launch in 2025, xStocks featured over 60 tokenized equities, including shares from leading US tech giants such as Amazon, Meta Platforms, Nvidia, and Tesla.

Image

Source: xStocks

Image

Source: xStocks

Kraken indicated that on-chain trading has been a significant factor in its growth trajectory, with xStocks accumulating $3.5 billion in on-chain trading volume and exceeding 80,000 unique on-chain accounts.

Unlike transactions confined to the internal order books of centralized exchanges, on-chain actions are executed directly on public blockchains, providing transparency and enabling users to retain control of their assets.

Increased participation on-chain signifies that users are not just trading tokenized stocks but are also assimilating them into broader decentralized finance (DeFi) markets.

Kraken noted that eight of the 11 largest tokenized stocks, based on unique holder count, are now part of the xStocks ecosystem, pointing to a surge in market share within the evolving field of tokenized equities.

Tokenized Stocks Reflecting Rapid Growth

Tokenization of real-world assets (RWAs) is one of the fastest-expanding regions of the digital asset market, despite a general downturn in cryptocurrency values since the turn of the year.

According to industry reports, tokenized RWAs have surged by 13.5% in overall value over the last month, contrasting sharply with the broader crypto market, which has seen a drop of about $1 trillion in market capitalization during the same timeframe.

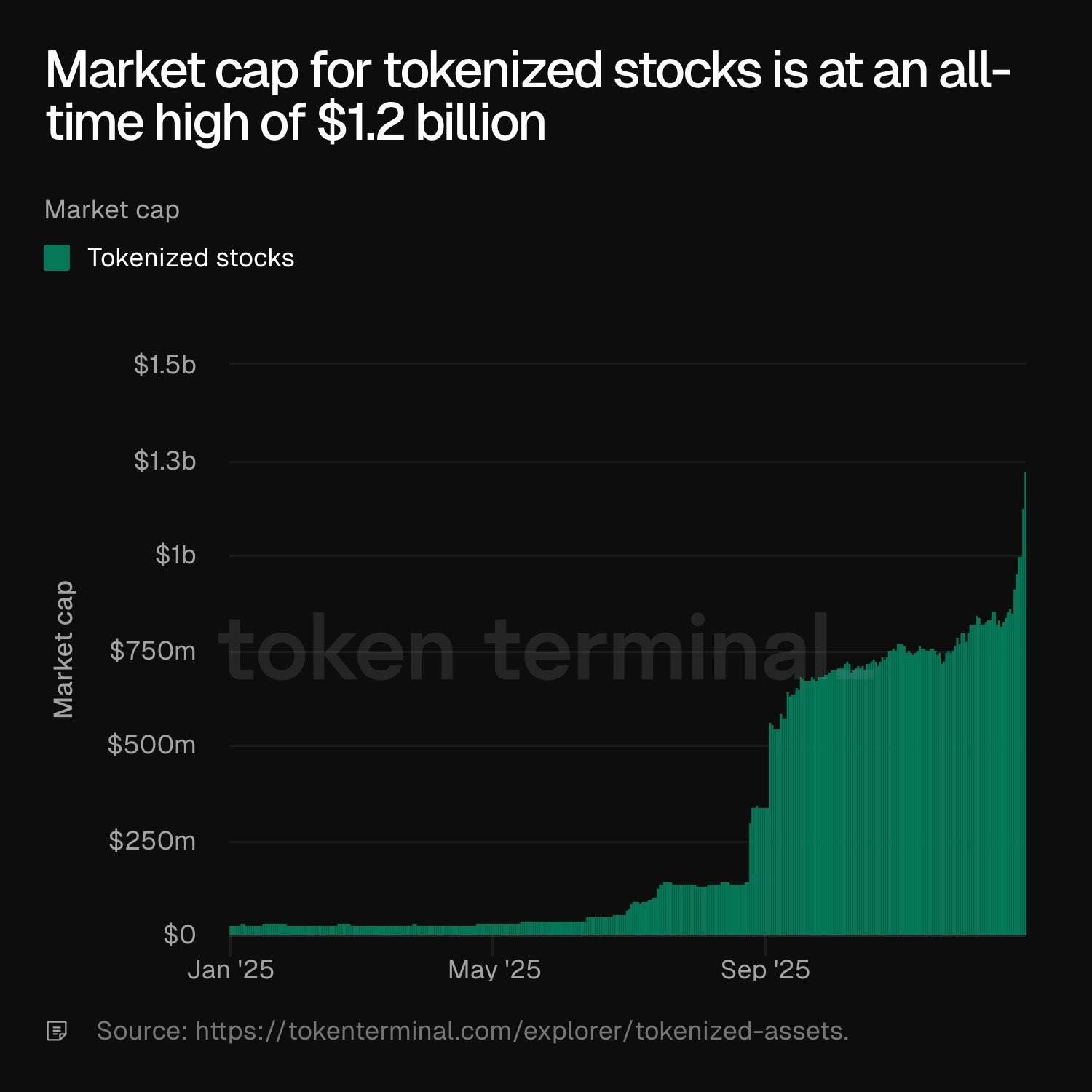

Observers of the market suggest that tokenized stocks might be encountering their own “stablecoin moment,” akin to the swift early uptake that led dollar-pegged digital currencies to mainstream acceptance.

Data from Token Terminal demonstrates that tokenized stocks reached a market cap of $1.2 billion in December, compared to virtually zero just six months prior.

Market Cap Growth

Source: Token Terminal

Market Cap Growth

Source: Token Terminal

By noting the rapid market evolution, Kraken solidifies its standing in the financial landscape propelled by innovative tokenization.