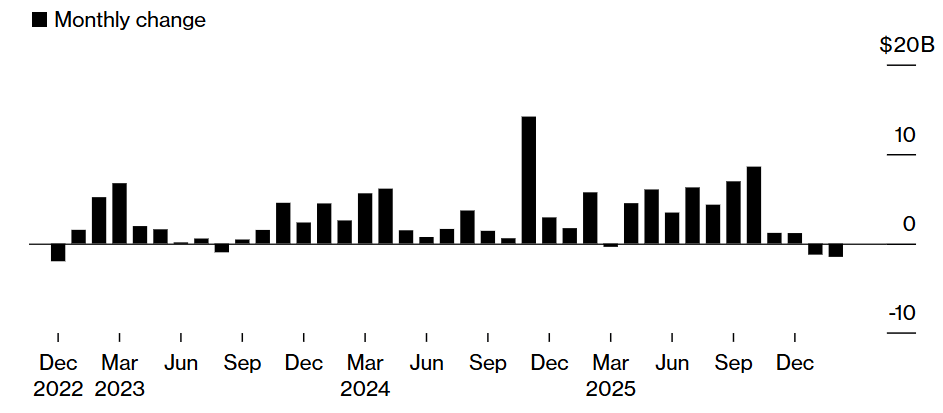

Tether’s USDT, recognized as the largest stablecoin tied to the US dollar, is facing its sharpest monthly supply reduction since the notable FTX collapse in 2022. Current data indicates that the circulating supply of USDT has already decreased by approximately $1.5 billion in February, building on a $1.2 billion loss recorded in January.

This trend follows a significant downturn in December 2022, when a $2 billion drop occurred after the FTX incident reverberated throughout the crypto space.

Although the USDT supply is retracting, it suggests a potential reduction in liquidity within the cryptocurrency market. Notably, Tether’s USDT carries a market capitalization of $183 billion, making up about 71% of the total stablecoin market as reported by CoinMarketCap.

Tether USDT Supply Analysis

Source: Artemis Analytics, Bloomberg

Tether USDT Supply Analysis

Source: Artemis Analytics, Bloomberg

Cointelegraph has reached out to Tether for comments regarding this supply drop but has yet to receive a response by the time of publication.

Related Article: BlackRock Enters DeFi as Institutional Crypto Push Accelerates

Overview of Stablecoin Market Performance in February

Despite the downward trend of USDT, the total market capitalization of stablecoins across various exchanges has notably increased by 2.33% this February, climbing from $300 billion to $307 billion according to data from DeFiLlama.

While both leading stablecoins—USDT and USDC—have decreased by 1.7% and 0.9% respectively, the USD1 stablecoin, associated with the Trump family, has remarkably gained 50% in market cap this month, reaching a valuation of $5.1 billion as of recent reports.

Market Activity Insights

Recent data reveals that major cryptocurrency traders, also termed ‘whales’, have been significantly offloading their USDT positions. In the past week, whale accounts sold approximately $69.9 million USDT through 22 wallets, which indicates a 1.6-fold increase in the selling rate from this segment.

Conversely, fresh wallet addresses created within the last 15 days have purchased about $591 million worth of USDT over the week, illustrating a split market dynamic where substantial holders are redeeming or reallocating while new participants are actively acquiring the stablecoin.

USDT Transaction Insights

Source: Nansen

USDT Transaction Insights

Source: Nansen