Bitcoin’s price remains stable as it navigates a challenging market environment following the US Supreme Court ruling on tariffs related to former President Trump’s administration. The ruling declared certain tariffs illegal, leading to discussions about potential refunds totaling around $150 billion.

Key Highlights:

- The Supreme Court’s verdict has initiated a minor response from risk assets.

- Inflation data has lowered market expectations for an interest-rate drop in March.

- Current Bitcoin trading shows bears maintaining control over price movements.

Supreme Court’s Decision on Tariffs

With the market reacting to the court’s announcement, Bitcoin has seen its price focus around $67,000. Although the ruling stated that some tariffs are illegal, it confirmed the legality of others, providing only a muted overall market response.

The court’s 170-page ruling emphasized that the International Emergency Economic Powers Act (IEEPA) does not empower the President to impose such tariffs. The Kobeissi Letter noted that this ruling would be significant for years ahead and could influence trading strategies regarding tariff refunds.

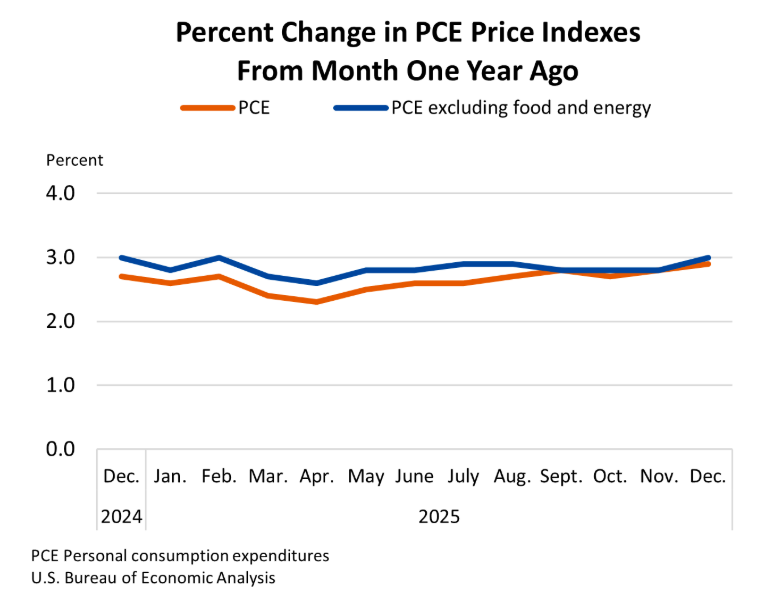

In recent inflation reports, the Personal Consumption Expenditures Index reached its highest level since late 2023, further dampening expectations for a near-term interest rate cut by the Federal Reserve.

BTC/USD

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC/USD

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

Bitcoin’s Market Position

Traders seem cautious about the current state of Bitcoin, with the predominant sentiment being bearish. Analysis highlights the significance of the 200-week exponential moving average as critical in determining future resistance levels.

“Markets are sensitive to changes, and Bitcoin’s price range currently indicates potential points of support and resistance,” noted another trader.

While the financial climate looks uncertain, some analysts remain hopeful about future market performance, suggesting that even amid bullishness in the economy, current trading conditions could benefit long-term strategies.