In its latest announcement, the European Securities and Markets Authority (ESMA) issued a critical directive for crypto firms, specifically stablecoin issuers, operating within the European Union (EU).

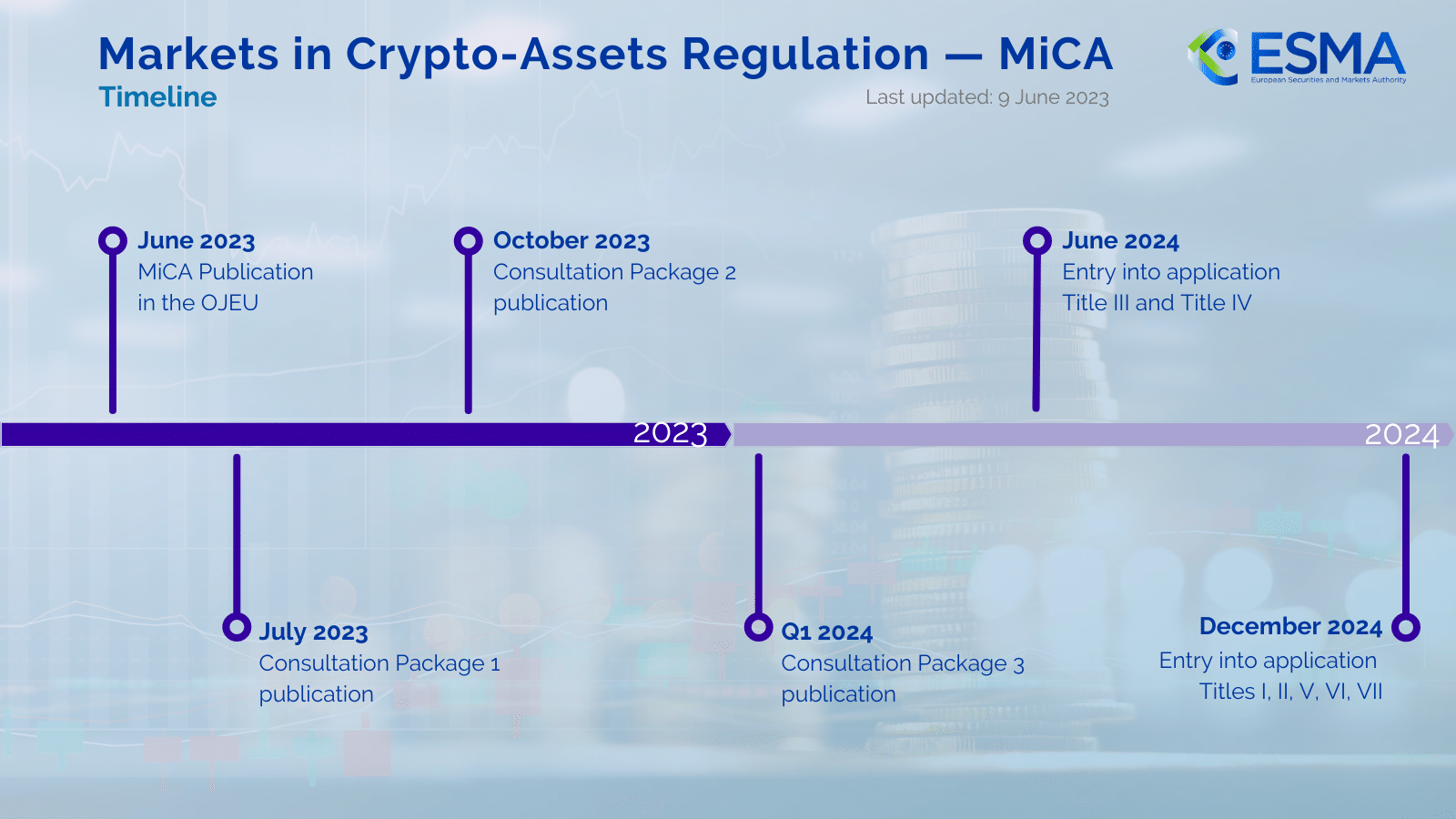

On January 17, 2025, ESMA mandated compliance with the new Markets in Crypto-Assets Regulation (MiCA). ESMA has set a January 31, 2025 deadline for crypto asset service providers (CASPs) to address non-compliant stablecoins.

ESMA’s directive will now compel CASPs to either restrict or delist non-compliant stablecoins by the end of January.

Major Players Like Tether’s USDT Can Suffer

While ESMA did not name specific stablecoins in its statement, industry insiders suggest that major players like Tether’s USDT could be affected due to their lack of MiCA authorization.

Tether’s USDT, the largest stablecoin by market capitalization, has become a focal point in the MiCA compliance debate. Reports indicate that USDT does not currently hold the necessary MiCA license.

For tokens already in circulation, firms are allowed to transition to a “sell-only” model. However, this provision comes with a hard deadline of March 31, 2025, after which further restrictions could be imposed. Hence, CASPs listing USDT must act swiftly to delist or transition it to “sell-only” conditions by March 31, 2025.

Tether reported experiencing a sharp decline in its market value, dropping by 1.2% to $137 billion, earlier this month. This marks its steepest weekly loss since November 2022, during the FTX collapse.

⚠️⏳ Just 20 more days until Tether becomes effectively illegal across the entire EU. Tether has refused to comply with MiCA requirements because it would mean they’d be forced to adhere to basic consumer protection and transparency standards

pic.twitter.com/Fxwsdqw4g2

CASPs Must Act Quickly: ESMA

The MiCA regulation requires that all stablecoins offered within the EU be issued by authorized entities. CASPs must ensure that their listed tokens meet MiCA’s stringent standards or face regulatory consequences.

With less than two weeks until the January 31 deadline, CASPs must act quickly to assess their portfolios and ensure compliance with MiCA’s standards.

ESMA’s enforcement strategy heavily relies on National Competent Authorities (NCAs), which serve as the primary regulators within individual EU member states. These NCAs are tasked with ensuring that CASPs align with MiCA’s requirements.

According to guidance from the European Commission, any CASP offering non-compliant stablecoins risks violating MiCA regulations, which could lead to severe penalties, including fines and potential bans from operating within the EU.

Recently, Crypto.com announced an in-principle approval for their MiCA license, making them the first major global crypto service provider to do so.