What to Know

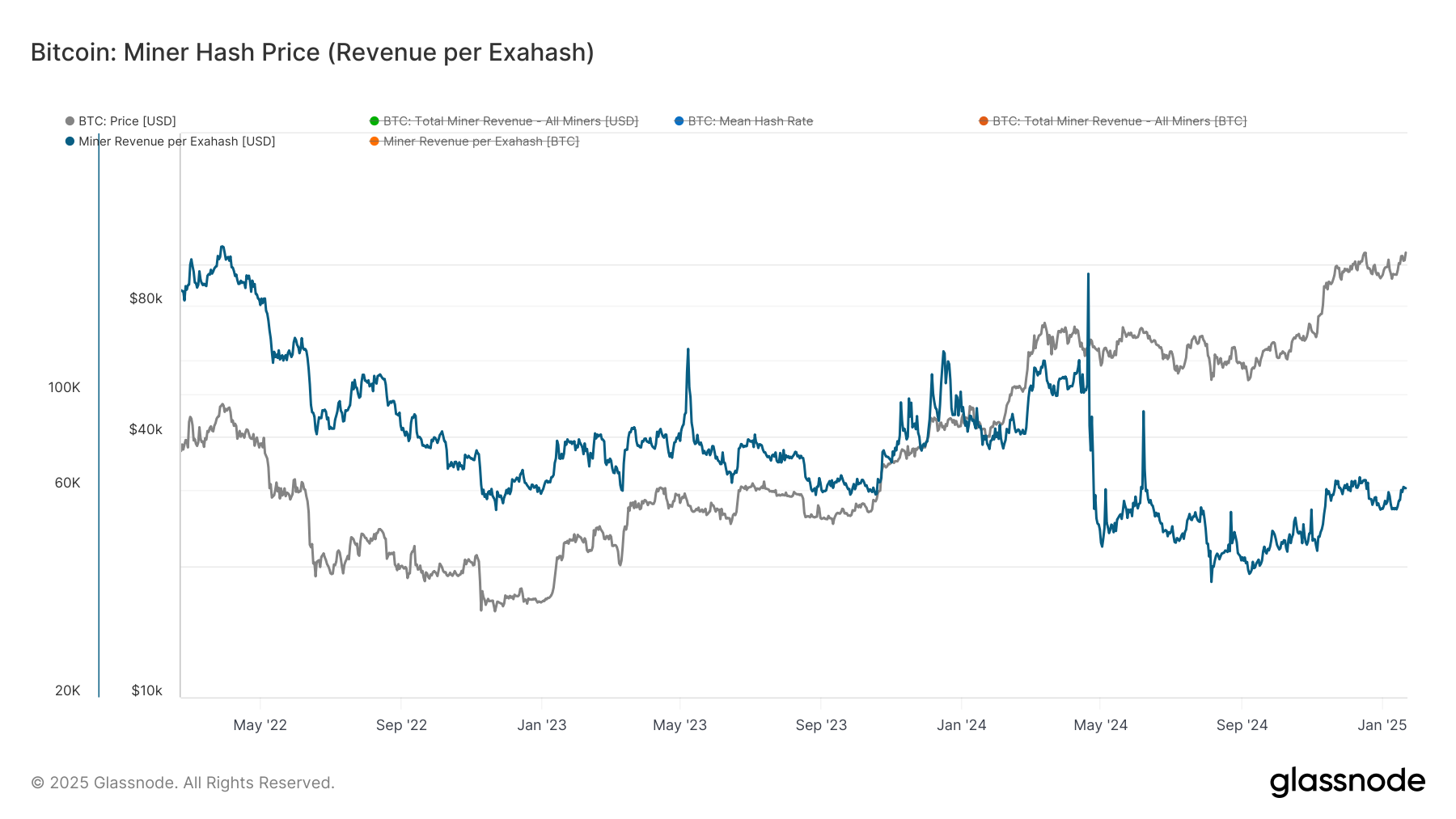

- Miners’ hashprice has reached $62 PH/s, marking the highest monthly level.

- Mining revenue has consistently surpassed the 365-day moving average since November, which is a historically bullish sign.

Understanding Hashprice

Hashprice, a term created by Luxor, measures mining profitability by estimating miners’ daily income against their hash power contribution to the Bitcoin network. It signifies the expected returns from 1 TH/s of hashing power.

According to Glassnode, the current hashprice is above $62 PH/s, nearing the peak for the past month.

Factors Behind the Surge

The recent surge in hashprice can be attributed to Bitcoin (BTC) climbing above $100,000, representing a 56% increase in the past three months, which offers miners much-needed relief. Additionally, miner fees have also risen, averaging about 12 BTC daily, driven by increased network activity.

Due to the anticipated halving in April 2024, when mining rewards will be halved, hashprice previously dropped from around $115 PH/s.

Despite the halving, miners faced difficulties in share price appreciation last year. However, since November, the 365-day moving average has been reclaimed, often seen as a positive indicator.

Emerging Challenges

Recently, the Bitcoin network’s total hash rate surged to an all-time high, leading to increased network difficulty, which negatively impacts mining profitability as it becomes more challenging for miners to earn rewards.

Expert Insights

Andre Dragosch, Head of Research at Bitwise, noted, “We have recently seen a decline in network hash rate since the all-time highs in early January. Meanwhile, the price of Bitcoin has risen, and overall transaction volume has increased again. This has caused a recovery in hash price, which should motivate miners to enhance their hash rate.”

Dragosch further mentioned, “Overall, Bitcoin miners seem to be financially solid, as indicated by their increasing Bitcoin holdings since the year’s outset, suggesting they are retaining more than they mine daily.”