Key Highlights

- Indicators suggested a local bottom in Bitcoin pricing amid the recent decline.

- Funding rates dipped below zero while U.S.-listed ETFs witnessed their first withdrawals in months.

Market Overview

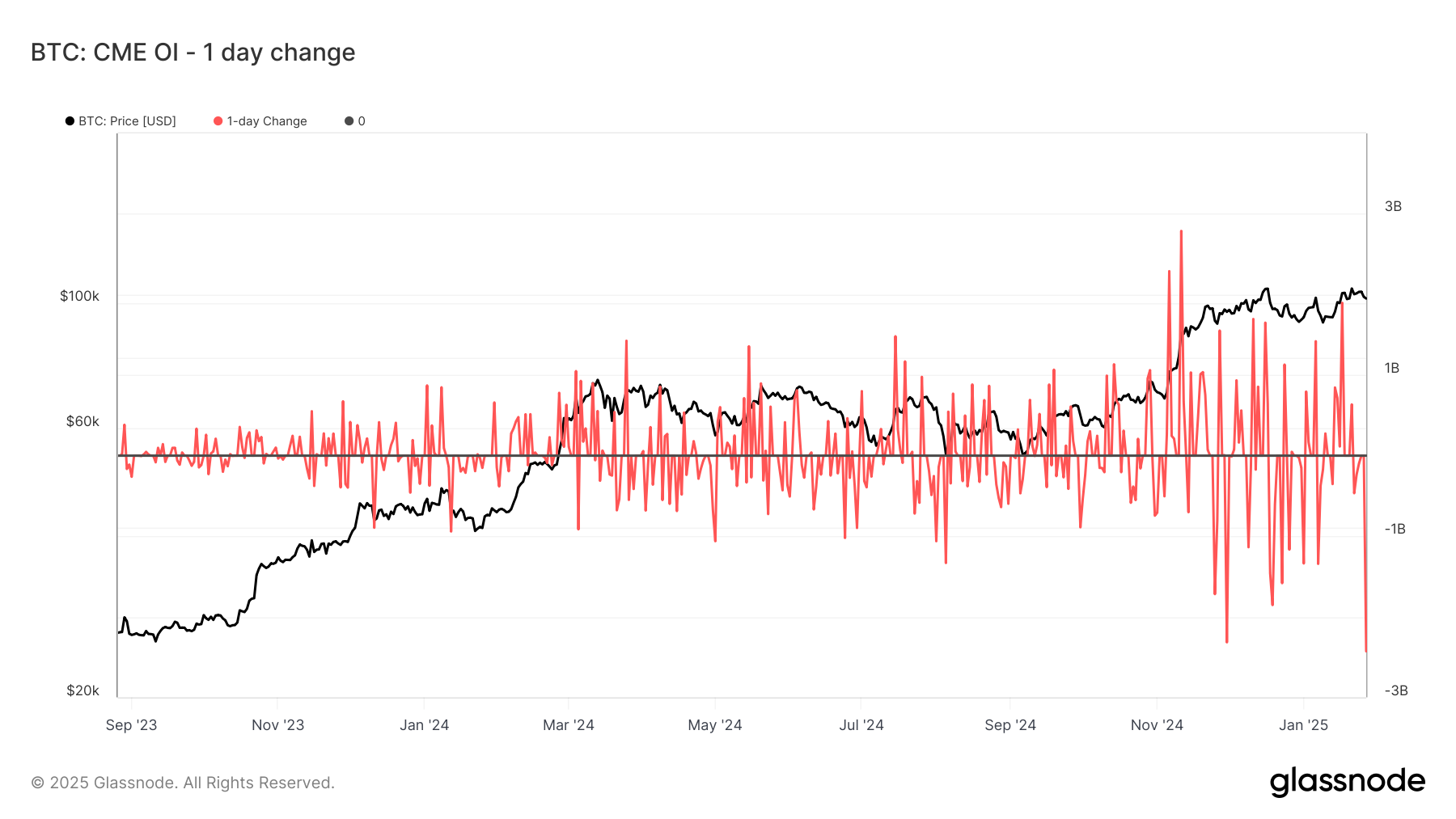

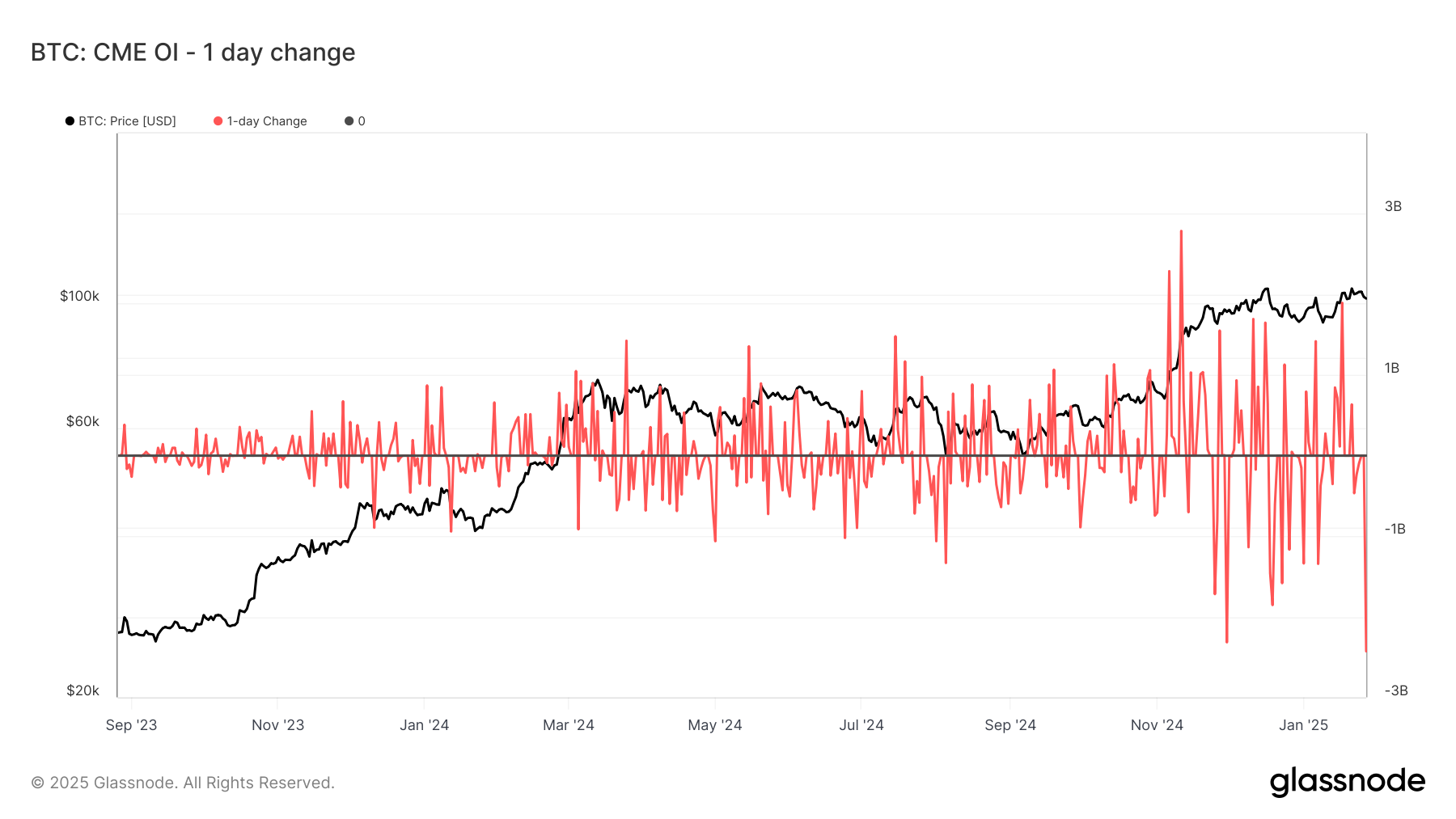

On Monday, a significant number of short-term Bitcoin (BTC) holders exited the market at a loss, coinciding with a sharp drop in prices which caused many derivative traders to resign from their positions. This resulted in a notable decrease in open futures contracts on the Chicago Mercantile Exchange.

Short-term holders, classified by Glassnode as accounts with less than 155 days of coin ownership, transferred over 21,000 BTC (approximately $2.2 billion) to exchanges as Bitcoin’s price plummeted by as much as 4.7%. This decline marks the steepest drop in two weeks, according to CoinDesk Index pricing.

These transfers to exchanges—often indicative of upcoming sales—were among the largest this month and may reflect the concerns of buyers who had acquired Bitcoin at nearly $108,000 at the year’s start, fearing the swift retreat back below $100,000.

Change in CME Bitcoin Open Interest

Change in CME Bitcoin Open Interest

General Sentiment

The addresses belonging to active traders and newcomers often react significantly to price changes and typically sell off when prices fall. BTC dipped below $98,000 in response to recent developments that challenged U.S. predominance in AI and technology.

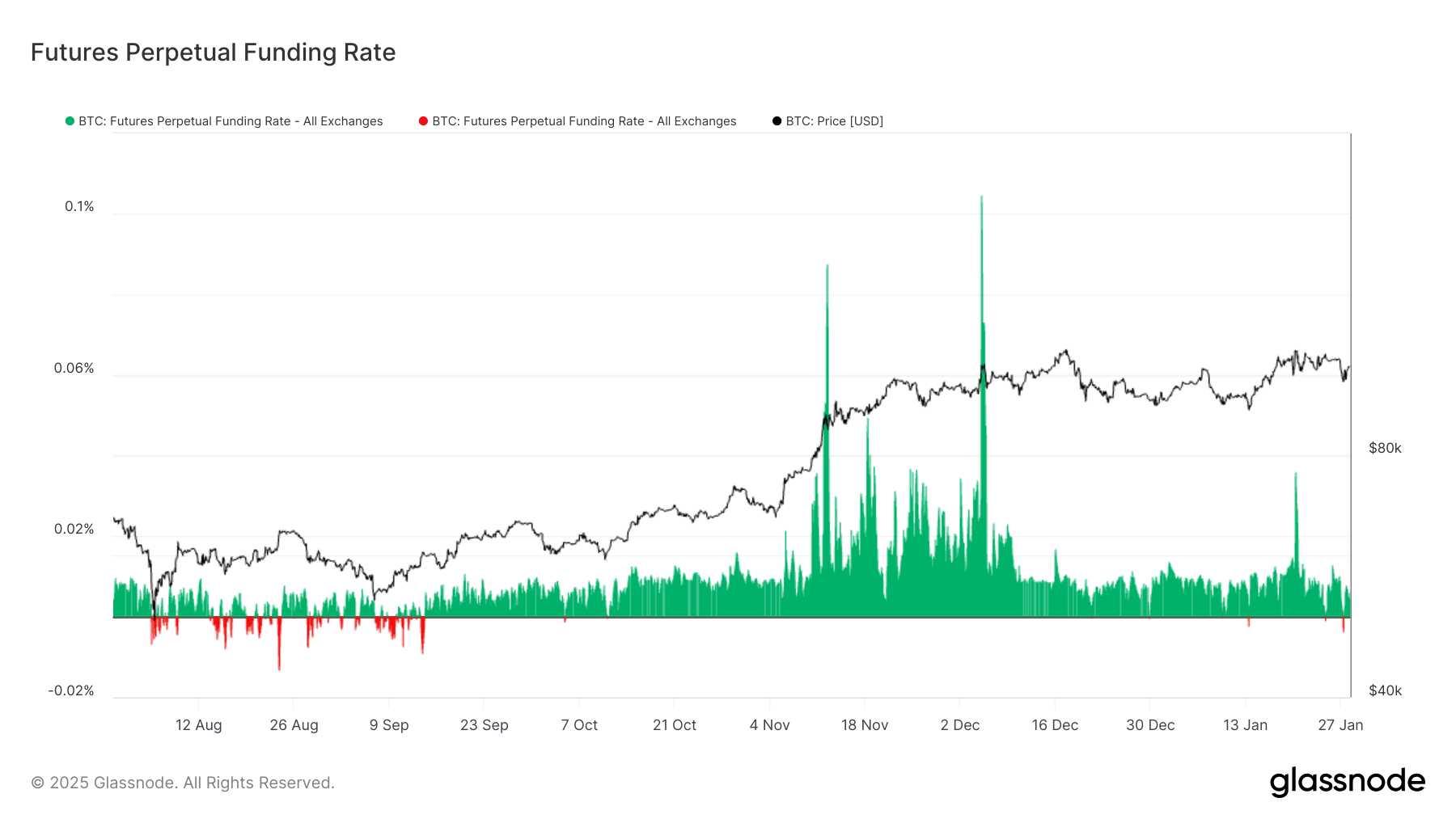

Further indicators of capitulation appeared elsewhere in the market, often seen at local price lows. For example, the perpetual funding rates for Bitcoin turned negative, suggesting a greater inclination for bearish bets, similar to conditions observed on Jan. 13, when Bitcoin’s price fell below $90,000.

Perpetual Funding Rate

Perpetual Funding Rate

Additionally, the Chicago Mercantile Exchange recorded the largest decrease in open interest, reflecting institutional activity and a record drop of $2.4 billion. U.S.-listed Bitcoin ETFs also reported massive outflows totaling $457.6 million.