Binance’s Market Share Hits Lowest Point in Four Years

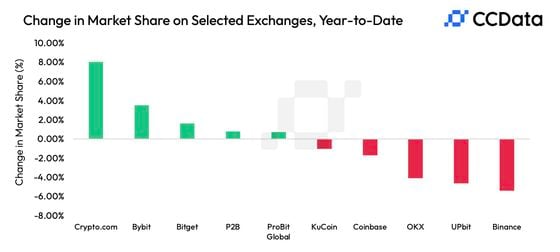

Last month, Binance’s overall market share in spot and derivatives trading volume fell to its lowest since September 2020, as reported by CCData. This decline comes as the exchange experienced a more than 20% drop in trading volumes in September compared to August. Meanwhile, competitors like Crypto.com saw a surge greater than 40% in their trading volumes.

According to the report, Binance now handles only 36.6% of total trading volume in centralized crypto exchanges, marking a substantial drop from previous levels. Spot trading has significantly declined by nearly 23%, bringing its market share down to 27%, the worst since January 2021.

The decrease in Binance’s dominance is partly attributed to rising regulatory scrutiny. For instance, the U.S. Securities and Exchange Commission (SEC) has filed a proposed complaint against Binance, questioning its token listing practices. Additionally, the founder of Binance, Changpeng “CZ” Zhao, recently pleaded guilty to charges related to inadequate compliance systems.

Overall, the crypto trading landscape appears to be shifting, with historical trends indicating that the last quarter often brings increased trading activity, especially given upcoming catalysts such as the U.S. elections and changes in Federal Reserve policy.