Overview

You are reading Crypto Daybook Americas, a revised morning briefing that delivers insights into overnight happenings in the cryptocurrency markets and provides expectations for the day ahead. In the near future, this daily update will substitute for the First Mover Americas newsletter, arriving in your inbox each morning at 7 a.m. ET. If you’re not yet subscribed, click here for essential market details.

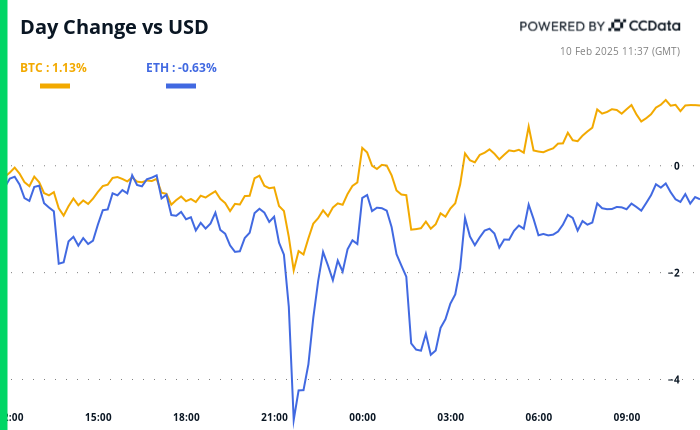

Market Sentiment

Despite escalating discussions about tariff measures by former President Donald Trump, Bitcoin (BTC) remains resilient, bolstered by positive trends in foreign exchange metrics like AUD/JPY. Trump is expected to announce 25% tariffs on steel and aluminum, alongside additional duties on other metals today.

This unexpected stability contrasts sharply with the risk aversion felt just a week ago, when Trump first initiated tariff actions. Market observers are cautiously speculating whether Trump is utilizing tough rhetoric to negotiate favorable trade agreements rather than locking in prolonged tariffs. This speculation intensified following last Monday’s suspension of tariffs on Mexico and Canada for a period of 30 days, suggesting a more calculated strategy to trade discussions.

According to QCP Capital, such market steadiness might encourage Trump to adopt a firmer position. “A feedback loop is forming — Trump is acutely aware of market volatility, and the market appears increasingly skeptical of his bluffs. This could provoke more volatility,” they remarked in a Telegram broadcast.

Noteworthy Developments

A social media highlight depicted record short positions on CME-listed cash-settled ether futures. Some of these shorts might not be overtly bearish; they could be part of strategic trades where investors maintain long positions in ETFs while also shorting futures on CME. Notably, the inflow into the ETH ETF surged last week, indicating that some shorts may serve as hedges against prospective losses tied to altcoin investments due to apprehensions about coin unlocks.

Over the weekend, Base member Kabir.Base.eth refuted claims indicating that Coinbase had sold off ETH garnered as fees, enhancing operational transparency around their practices.

In an exciting turn of events, Archange Touadéra, the president of the Central African Republic, launched a new memecoin that enabled one trader to transform a $5,000 investment into nearly $12 million within under three hours, realizing an extraordinary return of 2,450x. Meanwhile, Litecoin (LTC) remained the star performer among cryptocurrencies, witnessing a 9% rise in the past day.

Market Watch

Keep an eye on the upcoming macroeconomic indicators and cryptocurrency events scheduled for the coming days.

Stay tuned for more updates in the Crypto Daybook Americas!