Powell Declares No Digital Dollar as Central Bank Digital Currency Under His Leadership

Federal Reserve Chair Jerome Powell asserts that there will be no digital dollar or US central bank digital currency during his tenure, even amidst a global shift towards digital alternatives.

Jerome Powell clarifies there will be no digital dollar or US central bank digital currency (CBDC) while he leads the Federal Reserve.

Testifying before the Senate Banking Committee on February 11, Powell emphasized that no digital dollar is planned and that congressional approval is needed for such a development.

Senator Bernie Moreno pressed for a firm stance against a CBDC, to which Powell responded with a firm “Yes,” leaving no ambiguity on the subject.

We Already Have a Digital Dollar, What Is Powell Talking About?

Powell Photo

Powell Photo

Despite Powell’s statements, the shift to CBDCs is already in motion, with many individuals unaware of its implications.

The transition is occurring via stablecoins, which are increasingly backed by tangible assets.

Currently, stablecoins are backed by gold and other hard assets, demonstrating a growing trend toward a revamped currency system.

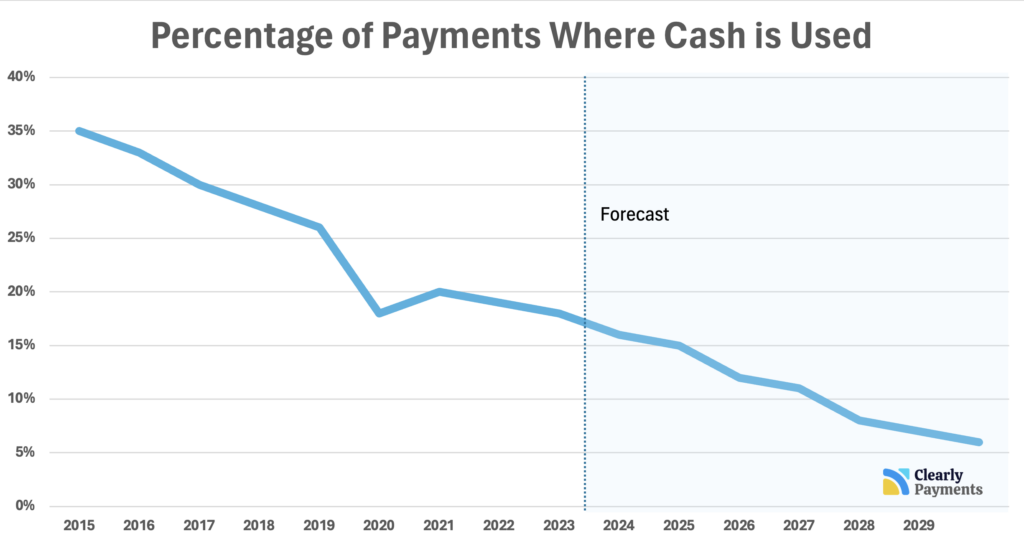

CBDC Statistics

CBDC Statistics

Online platforms are celebrating statements from government figures, proclaiming they will not endorse a CBDC, unaware that such a system already exists through stablecoins.

People often overlook the crucial issues surrounding financial management and governmental oversight.

Legislative Actions Against CBDCs

Fortunately, anti-CBDC legislation is gaining traction in Congress. The No CBDC Act is currently introduced in both the House and Senate, aiming to prevent the Federal Reserve from implementing a digital dollar without legislative input.

Proponents argue this currency could threaten financial privacy and empower the government to monitor citizens.

Congressman Tom Emmer warns, “A U.S. CBDC could allow the federal government to monitor and control individual Americans’ spending habits.” Critics refer to China’s digital yuan as a warning example of potential financial overreach and privacy erosion.

Global CBDC Developments: Can Stablecoins Prevail?

While the U.S. is cautious, the global community is rapidly adopting CBDCs. Reports indicate that 134 countries, accounting for 98% of the global economy, are exploring digital currencies. Many of these countries are well into pilot programs or have fully integrated CBDCs.

China’s digital yuan is making strides with expanded city trials, while Europe is enhancing efforts with its digital euro. Other nations like India, Brazil, and Russia are also deeply involved in the CBDC arena.

In conclusion, while the U.S. seems focused on blockchain technology, the possibility of a CBDC driven by stablecoins remains likely.