On Monday, U.S. spot-listed Bitcoin ETFs witnessed their second-largest outflow of the year, totaling $516.4 million. As the cryptocurrency slipped towards $90,000, these withdrawals marked the ninth outflow in ten days. This trend showcases increasing apprehension regarding Bitcoin, which has remained within a narrow trading range of $94,000 to $100,000 throughout February.

Key Points:

- The recent $516.4 million outflow is the second-largest recorded this year.

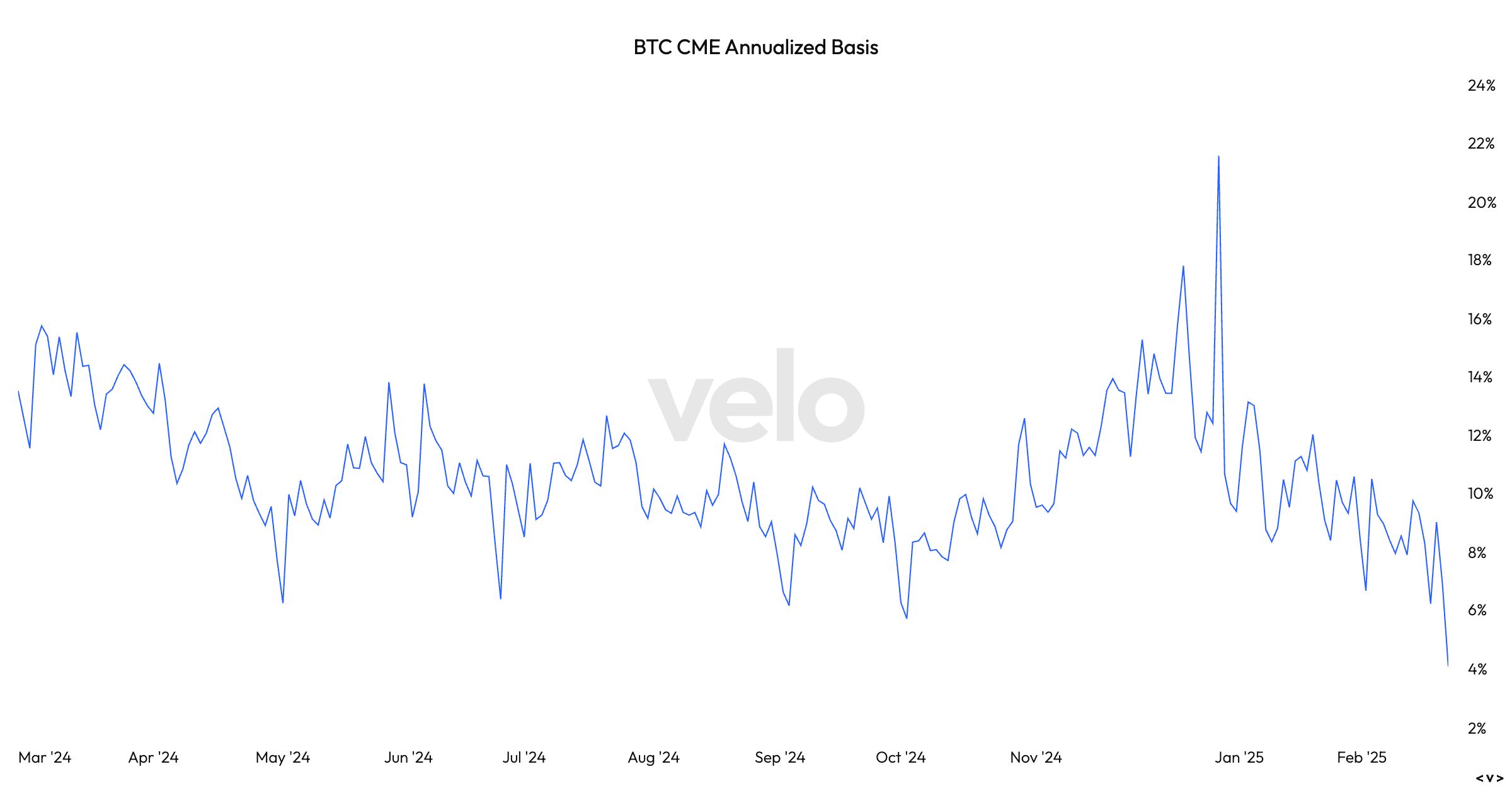

- The Bitcoin CME annualized basis has dropped beneath the 5% risk-free rate for the first time.

- Institutions typically employ CME for basis trading, simultaneously taking long positions in the underlying asset while shorting futures to capitalize on the price discrepancy.

Tuesday saw Bitcoin fall out of its three-month trading channel, dropping below $90,000 before hitting a low of $88,250. Velo data revealed that the annualized basis is currently at 4%, marking the lowest since Bitcoin ETFs commenced in January 2024.

This illustrates a neutral strategy employed by traders, who might reconsider their positions due to the diminishing returns compared to the U.S. treasury yields. In a recent post, Arthur Hayes elaborated on the shifts in trading strategies due to this basis trade, hinting at potential further outflows from ETFs.

“Many holders are hedge funds that have taken long ETF positions while shorting CME futures to gain more yield than U.S. treasuries. If the basis declines with Bitcoin falling, these funds will likely sell their ETF shares and re-enter the futures market, locking in profits. I’m eyeing $70,000 next!”