The investment discourse in the crypto landscape has seamlessly shifted. It now emphasizes strategic allocation rather than merely pondering the viability of cryptocurrencies. Particularly, institutional investors are progressing beyond an exclusive focus on bitcoin toward achieving a diversified outlook across the expansive crypto ecosystem.

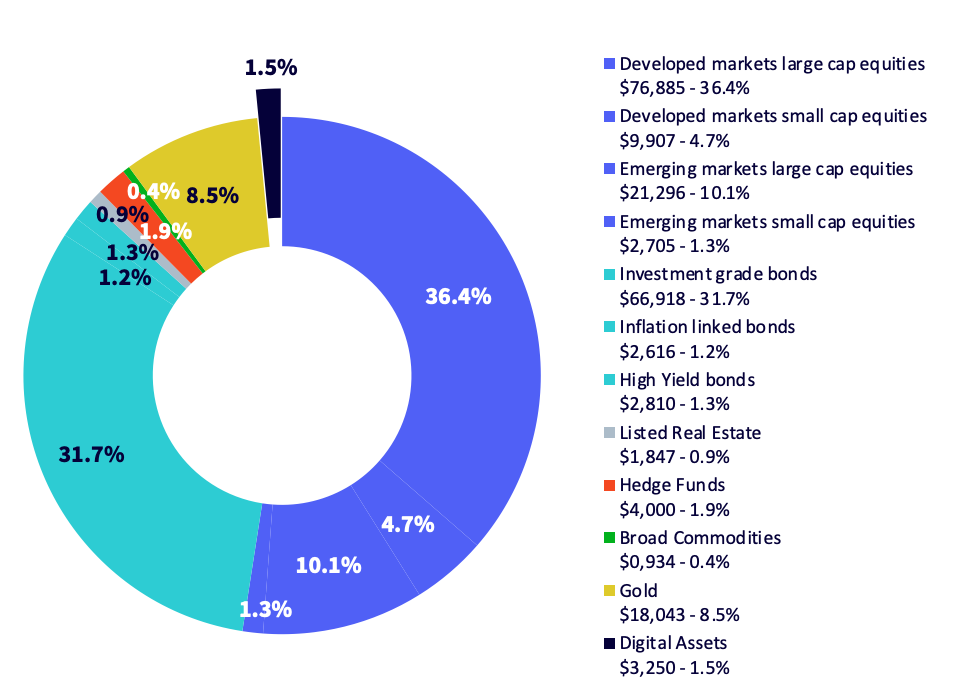

With a total market capitalization exceeding $3 trillion, cryptocurrencies account for roughly 1.5% of the accessible investment portfolio for all listed assets (as reported by Bloomberg and WisdomTree on January 31, 2025).

You’re reading Crypto Long & Short, our weekly newsletter providing insights and news for professional investors. Sign up here to receive it every Wednesday.

The market portfolio

The market portfolio

Source: Bloomberg, WisdomTree. Data as of December 31, 2024. Historical performance is not a reliable indicator of future performance.

The market portfolio

Source: Bloomberg, WisdomTree. Data as of December 31, 2024. Historical performance is not a reliable indicator of future performance.

In 2024, it became apparent that institutional investors view a market-neutral stance in multi-asset portfolios as entailing about 1.5% exposure to cryptocurrencies. This understanding can potentially enhance their risk/return ratio.

As a norm, this allocation has led to debates over whether to channel the entire 1.5% into bitcoin or distribute it across various cryptocurrencies.

Cryptocurrency market caps

Cryptocurrency market caps

Source: Artemis Terminal, WisdomTree. As of January 31, 2025, using USD market caps. Direct investment in an index is not available.

Cryptocurrency market caps

Source: Artemis Terminal, WisdomTree. As of January 31, 2025, using USD market caps. Direct investment in an index is not available.

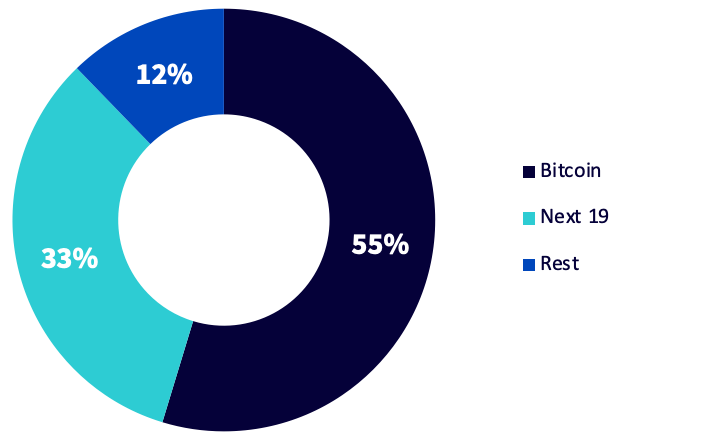

Bitcoin maintains dominance over the cryptocurrency landscape, representing 55% of the total market cap, while the next 19 largest cryptocurrencies together account for about 33% and the remaining 12% is shared among others.

This market structure fuels discussions among institutional investors on the best investment strategies for crypto assets. Opponents of diversification advocate for concentrated investments in bitcoin, citing its performance akin to gold. This viewpoint stems from bitcoin’s solid history and status as a digital safe haven.

Conversely, proponents of diversification argue that spreading investments across multiple cryptocurrencies can allow for harnessing growth from emerging digital ventures, effectively cushioning against market volatility. This approach enables absorption of developments across the rapidly evolving digital economy.

Ultimately, the choice between a singular investment in bitcoin or a diversified portfolio rests on individual investor preferences, risk appetites, and market perspectives. Investors with a balanced view may benefit from a cap-weighted diversification strategy that aligns with the broader crypto market’s growth.