Has the Market Lost Faith in Saylor’s Bitcoin Strategy?

MSTR shares are declining sharply, raising doubts about Strategy’s Bitcoin plans. The company holds more Bitcoin than any other publicly traded firm, but analysts believe it’s over-leveraged. Will the decline in MSTR shares continue?

Saylor’s Bitcoin Strategy

Saylor’s Bitcoin Strategy

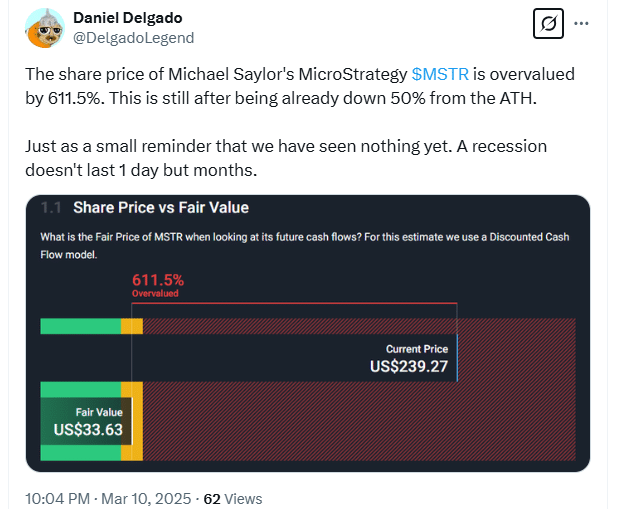

At $239.27, the price of MSTR shares is down nearly 22% from Friday highs and more than 50% off its peaks in 2024. In November 2024, shares were trading close to $550, peaking as Bitcoin surged past $100,000 for the first time.

Strategy Share Prices Falling Amid Worst US Stock Market Day Since 2022

After three months, investors are worried that cryptocurrency and stock prices are falling quicker than anticipated. The sell-off, particularly of MSTR, correlates with a significant drop in crypto prices, averaging over 30% from their all-time highs.

With more Bitcoin reserves than any public company globally, Strategy may face sustainability questions as its stock tanks. This was partly driven by institutional investors seeking indirect exposure to Bitcoin through MSTR shares in the last bull market.

The downturn has become more profound after President Donald Trump signed an executive order establishing the first Bitcoin and crypto reserve in the U.S. This change has prompted a re-evaluation of MSTR shares as part of a strategy of exiting some positions, while the market observes how federal policies and interest rates will evolve.

Strategy Has a Bitcoin Plan: Inside the Mind of Michael Saylor

If Bitcoin prices dip further, MSTR shares are likely to follow. The company’s immediate support level is around $230, and breaking this level may lead to a drop towards $200. Strategy continues leveraging its debt to build Bitcoin holdings, with total assets of 499,096 BTC valued at over $33 billion as of March 11, 2025.

Strategy seeks to raise $42 billion over the next three years to buy more Bitcoin. Their current approach involves issuing convertible senior notes, signifying that the stakes are increasing amid volatile market conditions.

Are Cracks Forming in Saylor Bitcoin Strategy?

Although Michael Saylor remains optimistic about Bitcoin, the rising costs and declining prices are causing alarm. The company is heavily reliant on debt for its acquisitions, making its shares sensitive to Bitcoin’s performance.

Market Insights

Market Insights

Should Bitcoin fall below an average of $66,000, it might trigger a crash in Strategy’s stock, further undermining confidence in its Bitcoin strategy. Investors now question whether Strategy’s extensive BTC holdings will offset the financial risks associated with its debt load.

In a turbulent market landscape, ongoing declines in prices could make it difficult for Saylor’s strategy to hold. As uncertainties mount, the path forward for Bitcoin may lead it to dip below 2021 highs, continuing a bear trend.