What You Need to Know:

- The demand for borrowing in decentralized finance (DeFi) has notably declined due to recent turmoil in the crypto markets, signaling a large-scale deleveraging.

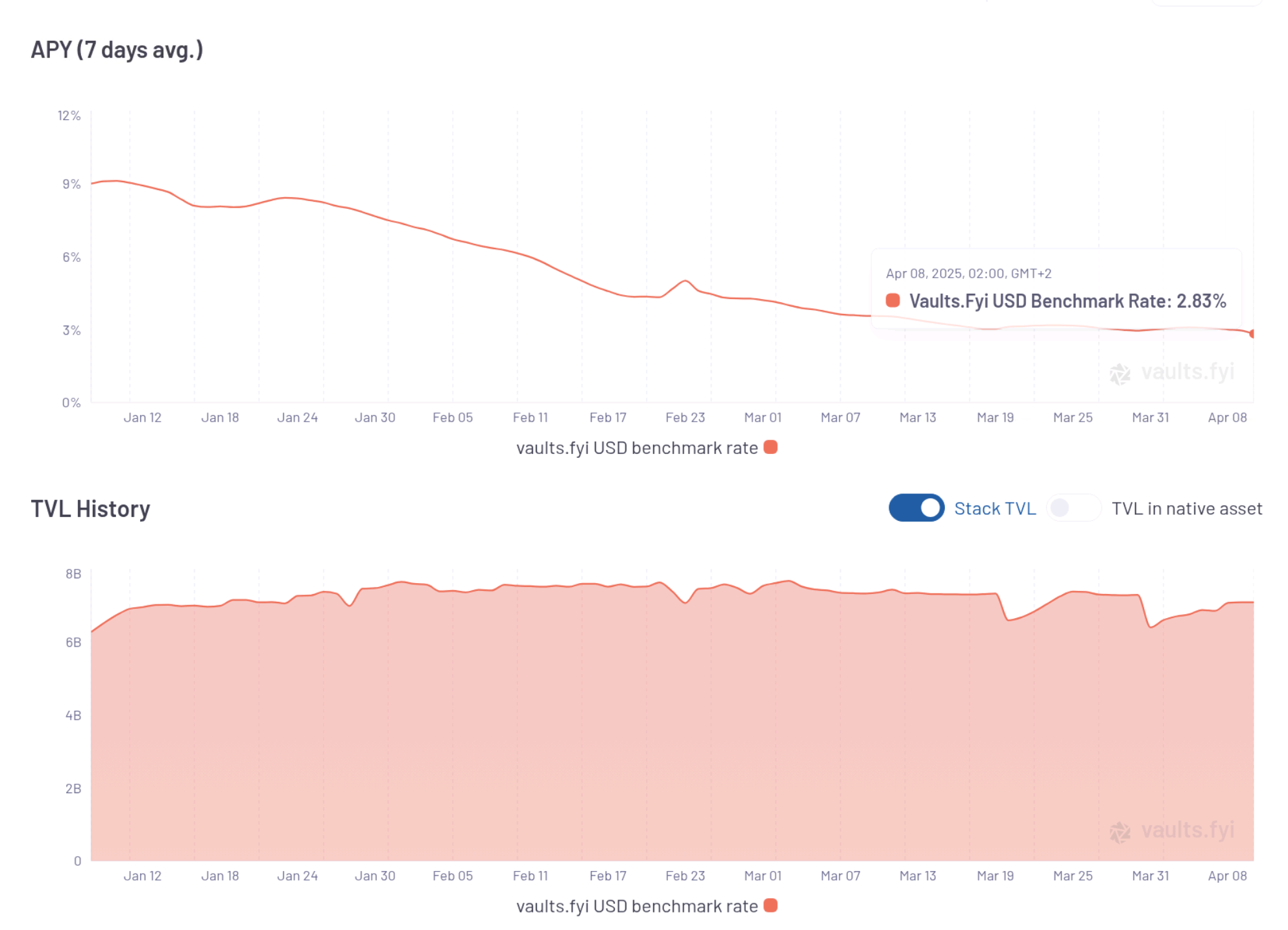

- The average yield on U.S. dollar stablecoins offered by DeFi lenders fell to 2.8%, its lowest point in a year.

- Key DeFi platforms, such as Aave and Morpho, have seen a significant drop in the value of borrowed assets recently as investors reassess risk, noted Ryan Rodenbaugh from Wallfacer Labs.

Borrowing demand across DeFi protocols has seen a significant downturn following turbulence in the crypto markets, reflecting a broader trend of deleveraging as investors unwind riskier positions. The average yield on U.S. dollar stablecoins—which indicates what lenders earn—has plummeted to 2.8%, a stark contrast to the mid-December highs over 18%.

“This shift is predominantly due to a market transition toward a risk-averse stance, leading to a marked decline in borrowing activity,” Ryan Rodenbaugh, the CEO of Wallfacer Labs stated.

The decrease in borrowing occurs in the context of ongoing volatility. While loan repayments and liquidations reduce under-collateralized positions, the availability of deposits remains unchanged, spreading declining revenues among the same number of lenders, resulting in further downward pressure on yields.

Recent Developments:

The dramatic yield drop was intensified by the recent crash in the crypto space, where large DeFi protocols recorded numerous liquidations due to rapidly falling asset prices. Bitcoin and Ethereum, pivotal assets for securing loans, fell by 10%-15% below the $75,000 and $1,500 marks respectively.

Aave reported over $110 million in forced liquidations throughout the recent market decline, as pointed out by Omer Goldberg, CEO of DeFi analytics company Chaos Labs. Meanwhile, Sky, formerly MakerDAO, liquidated collateral belonging to an ether whale, worth $74 million at the time, indicating the high stakes within the DeFi lending market.

The total combined borrowing on Aave has sharply declined from over $15 billion in mid-December to around $10 billion now, with Morpho showing a decrease from $2.4 billion to $1.7 billion in the same timeframe.