April has witnessed significant volatility and uncertainty in the markets, primarily as a result of tariff announcements by President Trump. Investors are increasingly looking for refuge in assets that can withstand this turmoil.

While traditional safe havens like gold and the Swiss Franc have historically provided stability, bitcoin is now being recognized in the same light. A recent note from NYDIG Research suggests, “Historically, cash (the US dollar), bonds (US Treasuries), the Swiss Franc, and gold have fulfilled that role [safe haven], with bitcoin edging in on some of that territory.”

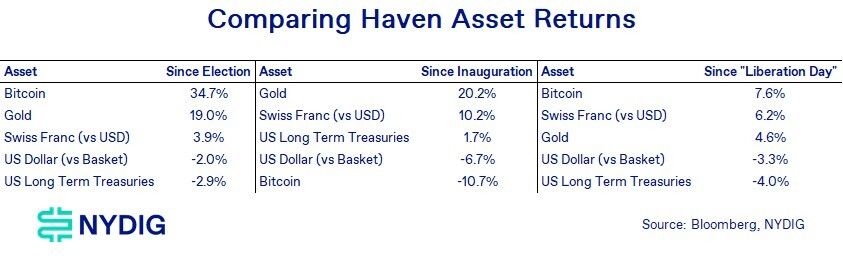

Safe haven asset performance (NYDIG Research)

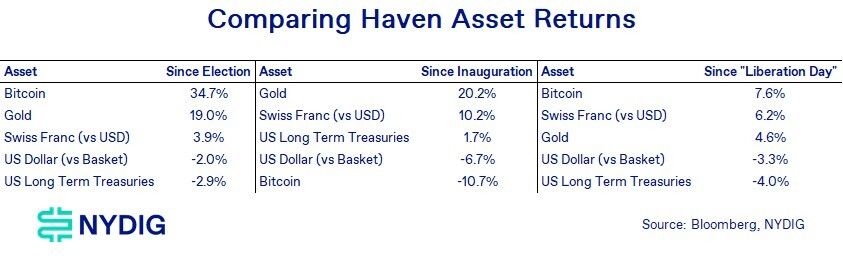

Safe haven asset performance (NYDIG Research)

NYDIG’s insights highlight that amidst the chaos following President Trump’s tariffs declared on April 2, bitcoin has behaved more like the store of value it was designed to be, rather than as just another leveraged asset. As market participants react to these shifts, bitcoin’s role as a non-sovereign store of value appears to be solidifying, fulfilling its original purpose and gaining traction among investors looking for stability in turbulent times.

Read more: Gold and Bonds’ Safe Haven Allure May be Fading With Bitcoin Emergence