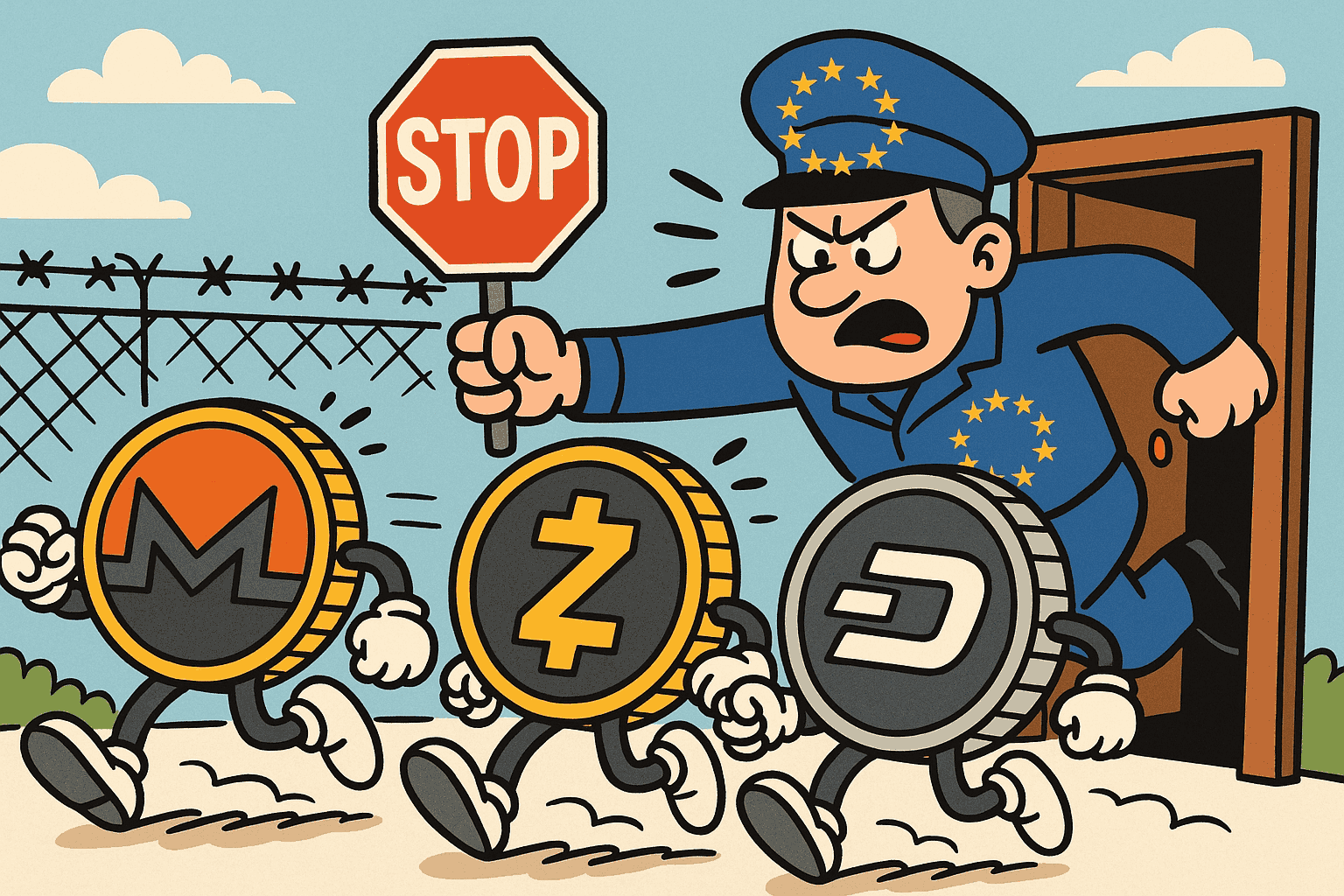

EU Set to Enforce Ban on Privacy Coins by 2027

Privacy coins and anonymous cryptocurrency wallets may lose their place in the European Union as regulators tighten anti-money laundering (AML) measures. The EU has announced its intention to implement a complete ban on these services by July 1, 2027.

The initiative comes under an updated AML framework. The EU clarifies that while cryptocurrencies can remain, they must adhere to the same regulatory standards as traditional financial systems. This move signals a significant shift in how digital currencies will be monitored and controlled in Europe.

What the Ban Actually Covers

The ban targets anonymous crypto accounts, which would be fully prohibited across the EU. Consequently, crypto service providers, including exchanges and financial institutions, cannot offer services unless they verify customer identities.

“The EU will ban anonymous crypto accounts and privacy coins by 2027.”

— Mr. Man (@MrManXRP) May 2, 2025

For enthusiasts of privacy-centric coins like Monero (XMR), Zcash (ZEC), or Dash, this announcement is pivotal as these cryptocurrencies are often scrutinized for their potential to facilitate concealed transactions and the movement of illicit funds.

The new regulations will also require identity verification for crypto transfers exceeding 1,000 euros, aligning crypto operations more closely with conventional banking practices.

Privacy Coins EU Ban: Who Will Be Watching?

To enforce these regulations, the EU will set up a specialized entity known as the Anti-Money Laundering Authority (AMLA) to supervise leading crypto asset service providers within at least six EU member states. Companies will need to have over 20,000 users or manage more than 50 million euros in transactions annually to attract AMLA’s attention.

This effort aims to provide a cohesive regulatory landscape across member nations, preventing individuals from exploiting countries with lax oversight for illicit activities.

Why It Matters

Critics of the ban argue that restricting privacy coins could hinder innovation and compromise individuals’ financial privacy, noting that these technologies are not solely used for illegal purposes. Many advocates, journalists, and regular citizens leverage these tools to maintain privacy in an increasingly digitized financial environment.

Conversely, regulators contend this prohibition is a crucial countermeasure against money laundering risks associated with cryptocurrency, positioning the EU at the forefront of global regulatory efforts.

What This Means for the Future of Privacy Coins in the UK

The impending EU deadline mandates substantial operational changes for crypto entities within its jurisdiction. This will involve developing comprehensive know-your-customer systems and reassessing the use of privacy tools.

Although it remains uncertain if other regions will adopt similar measures, it is clear that the EU is signaling an end to the age of anonymous cryptocurrency transactions.