Ether-Bitcoin Ratio Indicates ETH's Significant Undervaluation, Despite Emerging Challenges

The ETH/BTC valuation ratio signals a potential outperformance for Ethereum. However, concerns over declining demand and increased supply clouds the outlook.

Key Insights:

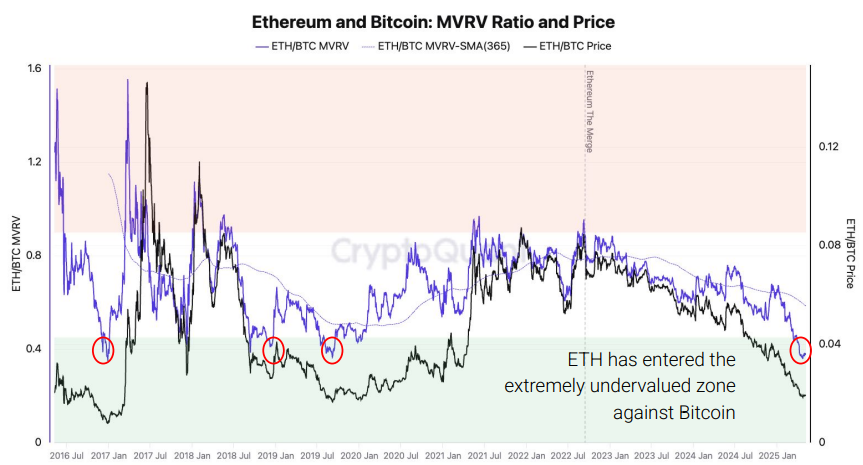

- The ETH/BTC valuation ratio has dipped to historic lows, suggesting a possible recovery for ETH against BTC.

- Ethereum’s network engagement has stalled, showing minimal growth since 2021.

- Institutional demand for ETH is diminishing, evidenced by decreasing staked ETH and lower investment product balances.

The ether-bitcoin (ETH/BTC) ratio has recently fallen to an “extremely undervalued” territory, which typically indicates a potential bullish trend. Yet, traders anticipating a swift recovery for ether at $2,185.16 might reconsider their positions.

Market Analysis

Credit: CryptoQuant

Market Analysis

Credit: CryptoQuant

According to CryptoQuant, the ETH/BTC market value to realized value (MVRV) ratio has plummeted to multiple-year lows, previously marking periods of ETH outperforming BTC. The high point for the ETH/BTC ratio was above 0.08 in late 2021; it currently sits at 0.019, a reduction of over 75% from its peak.

MVRV is an important metric, weighing a token’s market cap against its realized capitalization. This effectively showcases the average cost basis of all existing coins.

However, the situation might not be straightforward this time. The network’s activity is stagnant, with vital metrics like transaction counts showing minimal change since the previous bullish trend, as stated by CryptoQuant.

The increase in ether’s total supply correlates with a stark fall in burned fees. The Dencun upgrade, enacted in March 2024, notably lowered transaction fees across the network, which led to a decrease in burn activity towards almost zero.

Since 2021, ethereum’s network activity has largely plateaued with no significant usage growth observed across various vital metrics.

Layer 2 Growth

Credit: CryptoQuant

Layer 2 Growth

Credit: CryptoQuant

Furthermore, the advancement of Layer 2 solutions like Arbitrum and Base has negatively impacted mainnet engagement. This process decreases base layer fees and undermines the value accrual narrative for ETH.

Institutional interest is cooling off as well: “Investor appetite for ETH as a yield-bearing asset is waning, reflected in decreased staked ETH and fewer assets held by ETFs and similar investment avenues,” CryptoQuant noted.

The total ETH staked has dropped from an all-time record of 35.02 million ETH in November 2024 to approximately 34.4 million ETH, indicating investors may be reallocating their capital or moving to more liquid positions in a challenging market.

Additionally, ETH holdings in investment products have fallen by about 400,000 ETH since early February, marking a significant decline in institutional interest.

On another note, bitcoin continues to gain traction, reaching nearly $100,000 on Thursday, showcasing its increasing appeal as a safe-haven asset.