Bitcoin holder MicroStrategy’s (MSTR) soaring stock is driving up trading volumes compared to Nvidia (NVDA), one of the largest companies by market cap, reflecting increased investor interest.

MSTR has increased by over 240% this year, with prices doubling to $236 in just the past five weeks, according to TradingView. This marks the highest the stock has reached since the dotcom bubble 25 years ago. MicroStrategy is nearing a market cap of $50 billion, which is only 1.5% of NVDA’s $3.44 trillion.

Interestingly, MSTR’s trading volume, as a percentage of NVDA, has consistently risen this year, peaking at 17.65% in October. Data from Investing.com indicated that on October 11, MicroStrategy recorded 30 million in trading volume, while NVIDIA had 170 million.

This is a marked improvement compared to the bull market of 2021 when MSTR traded at over $130 per share on February 9 with a volume of 23.2 million, amounting to just 8% of NVDA. An uptick in trading volume along with a price rally often signals a sustained uptrend, however, ongoing increases in volume relative to NVDA could indicate a buildup of speculative activity in the market.

MicroStrategy Outperforms Nvidia

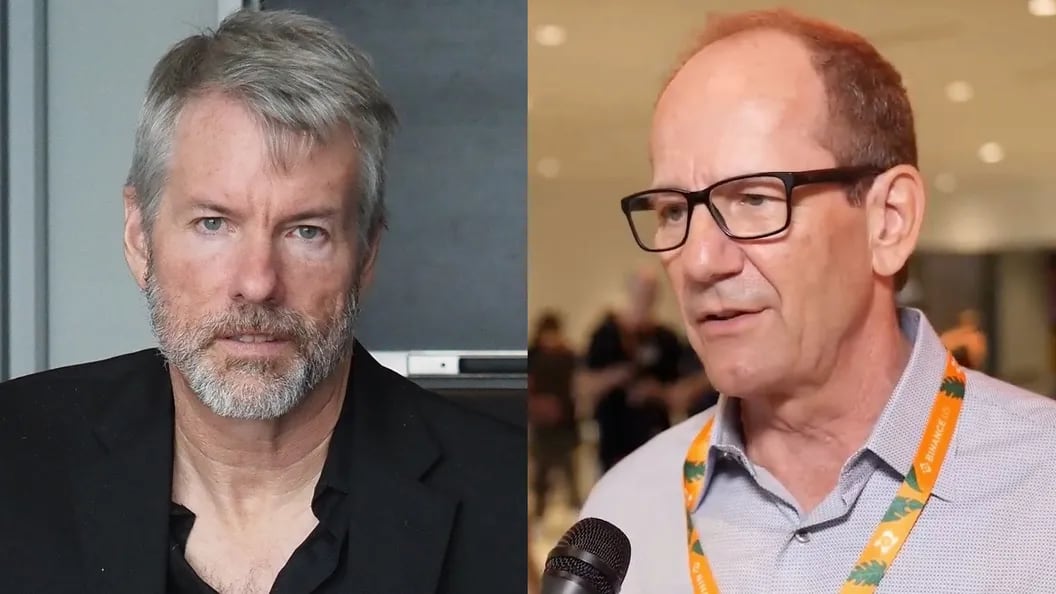

With a gain exceeding 240% this year, MSTR has greatly surpassed NVDA’s 192% rise. Since MicroStrategy adopted Bitcoin as a treasury asset in August 2020, the gap has widened noticeably, with MSTR gaining 1,800% compared to NVDA’s 1,150%, a testament to MicroStrategy and CEO Michael Saylor’s strategy.

MicroStrategy’s net asset value (NAV) is once again on the rise, as Bitcoin remains in the mid-$60,000 range; the MSTR tracker reports that the NAV premium has reached nearly 3, marking its highest point since early 2021.