Bitcoin’s price has hit remarkable highs, eclipsing $111,000, inciting optimism among investors. Nevertheless, market makers and dealers could introduce an invisible hand, potentially curtailing further increases.

Summary:

- Bitcoin’s price has reached record highs, exceeding $111,000.

- Experts forecast Bitcoin could rise to $180,000 by the end of the year due to spot ETF inflows and increasing institutional adoption.

- Hedging actions by market makers around certain price levels might impede Bitcoin’s upward momentum.

The leading cryptocurrency experienced this surge during the Asian trading hours, with analysts expecting heightened demand.

“The OTC supply might be dwindling, which could inflate prices. This might not be visible in exchange trading volumes or the derivatives market. If true, prepare for substantial fluctuations, as demand grows in a competitive Bitcoin treasury environment, possibly coupled with a tighter OTC spot market,” suggested Alexander Blume, CEO of Two Prime.

Ryan Lee, a chief analyst at Bitget, indicated that Bitcoin may reach $180,000 by year-end, primarily driven by ETF inflows, reduced supply growth post-halving, and increasing institutional adoption.

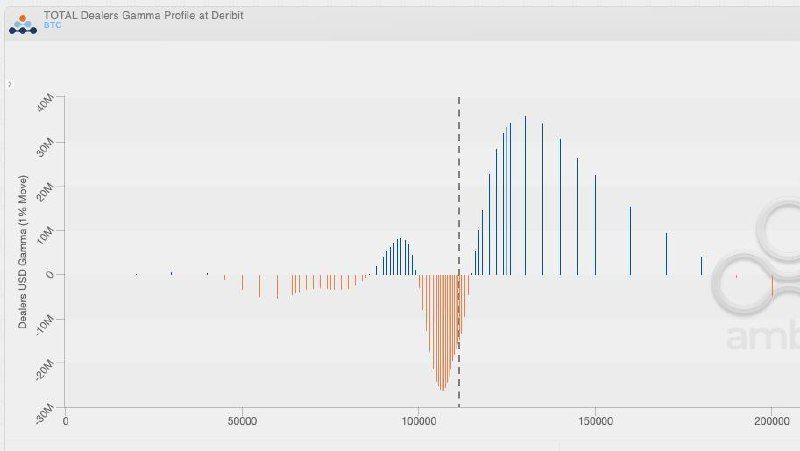

According to Jeff Anderson from STS Digital, while a bullish trajectory seems likely, hedging activities from options market dealers at $115,000 could challenge this optimism.

Market data illustrates significant positive gamma exposure for dealers above $115,000, indicating a potential negative pressure on prices as they hedge their positions.

Dealer Gamma Profile

Dealer Gamma Profile

The chart displays dealers’ gamma profile at Deribit. (Amberdata/Deribit)