Bitcoin Nears Historic Highs with OTC Desk Inflows at Yearly Lows: Insights from CryptoQuant

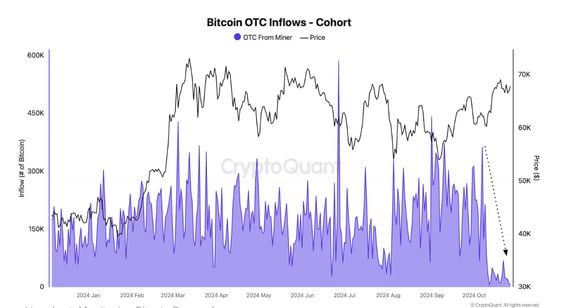

Recent trends show bitcoin approaching record highs while over-the-counter (OTC) desk inflows decline to their lowest rates this year.

As bitcoin (BTC) approaches a historic high, sophisticated investors are trading carefully to avoid affecting spot market prices. Currently priced at approximately $72,300, bitcoin stands under 2% from its all-time peak of $73,798 recorded in March, as per CoinDesk Indices data. In October, bitcoin has surged nearly 14%, marking a potential for the largest monthly uptick since March.

An interesting aspect observed in this current bitcoin surge is related to over-the-counter (OTC) desks where a significant amount of 416,000 BTC valued at around $30 billion is being held. This figure contrasts sharply with a previous average of less than 200,000 BTC observed earlier this year, according to data from CryptoQuant.

OTC desks are a preferred choice for institutions and affluent individuals aiming to make large trades discreetly, thus preventing market price disruptions. For the last several months, bitcoin prices have been moving sideways, largely attributed to the growing flow toward OTC transactions.

In summary, while demand for bitcoin is on the rise amid lower inflows to OTC desks, there is potential for further peaks if such dynamics continue.