Weekly Crypto Market Overview Amid Rising Geopolitical Tensions

This week, significant events regarding geopolitical tensions and regulatory movements have influenced the cryptocurrency market, causing volatility and shifts in price dynamics across major assets.

This week in the cryptocurrency landscape was marked by heightened geopolitical tensions, particularly surrounding Iran and Israel, resulting in notable market fluctuations. Bitcoin experienced heavy pressure, dropping below $100,000 amidst escalating conflict and concerns over oil supply disruptions. Meanwhile, regulatory advancements, such as progress on stablecoin legislation, stirred optimism amongst investors.

Bitcoin Surges Past $102,000 Despite Market Turbulence Fueled by War Anxieties

Following a sharp decline to $101,000, Bitcoin rebounded to over $102,000 as trading volume surged, with hedge fund manager James Lavish criticizing the panic selling driven by fears of global conflict.

Bitcoin briefly rebounded to over $102,000 after a significant decline, demonstrating resilience in the face of market panic regarding geopolitical conflicts.

Bitcoin Dips Below $100,000 Amid Oil Supply Concerns

Bitcoin's price fell below $100,000, marking its lowest point since May, as concerns grow over potential disruptions in global oil supply due to Iran's actions.

Bitcoin experienced a significant decline as tensions mounted following a U.S. military strike in Iran, highlighting the cryptocurrency's sensitivity to geopolitical events.

With the rise in global oil supply concerns due to ongoing tensions in Iran, Bitcoin has faced tremendous selling pressure, dropping below $100,000 for the first time in weeks.

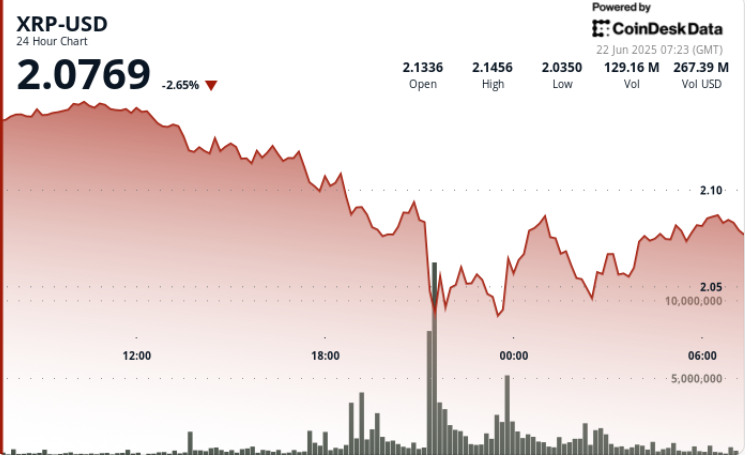

XRP Recovers Rapidly from Recent Lows, Creating a Positive Trend Above Critical Support

XRP has seen a significant recovery, climbing 6% after a recent decline, with indications of a potential positive trend as traders target key resistance.

XRP shows signs of recovery, climbing 6% after recent lows, suggesting a potentially bullish trend as the market stabilizes.

Ethereum Dips Below $2,500: A Record Outflow from Spot ETH ETFs on Friday

Ether stabilized after experiencing significant price fluctuations and recorded the highest outflows from ETH ETFs this month.

Ether faced significant outflows hitting its price as bearish sentiment rippled through the market following geopolitical developments.

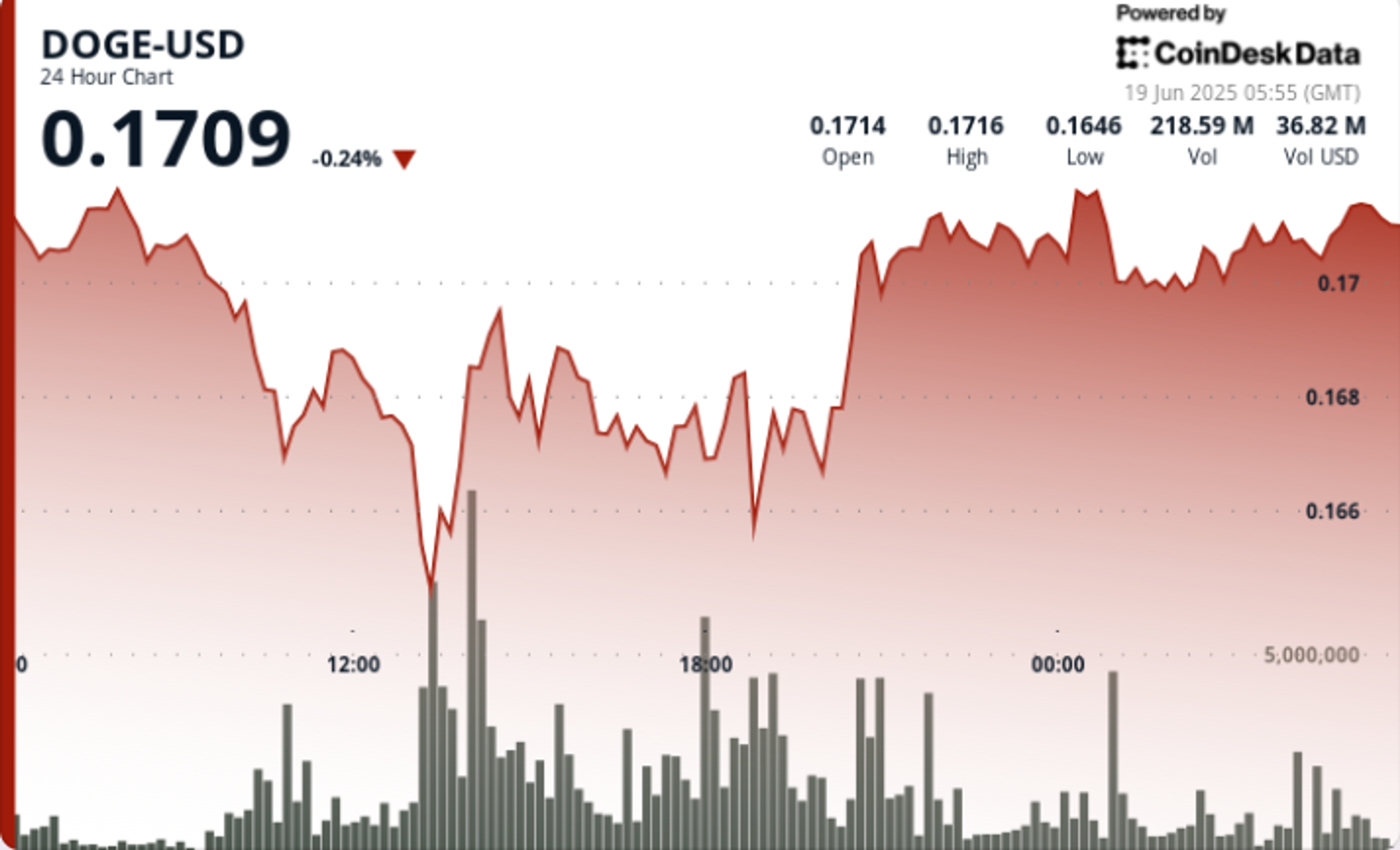

Dogecoin Stabilizes While Indicating Oversold Conditions: A Potential Bearish Signal

Technical indicators point to Dogecoin entering oversold territory, bolstered by strong social sentiment despite market fluctuations.

Despite current market instability, Dogecoin is showing signs of recovery as technical indicators suggest it may be oversold.

In summary, the ongoing geopolitical tensions, particularly related to Iran, have led not only to significant price swings in Bitcoin but also impacted the broader cryptocurrency market, capturing the attention of regulators and investors alike. As the market continues to react to these developments, traders are vigilant for potential upswings amidst the fluctuations.