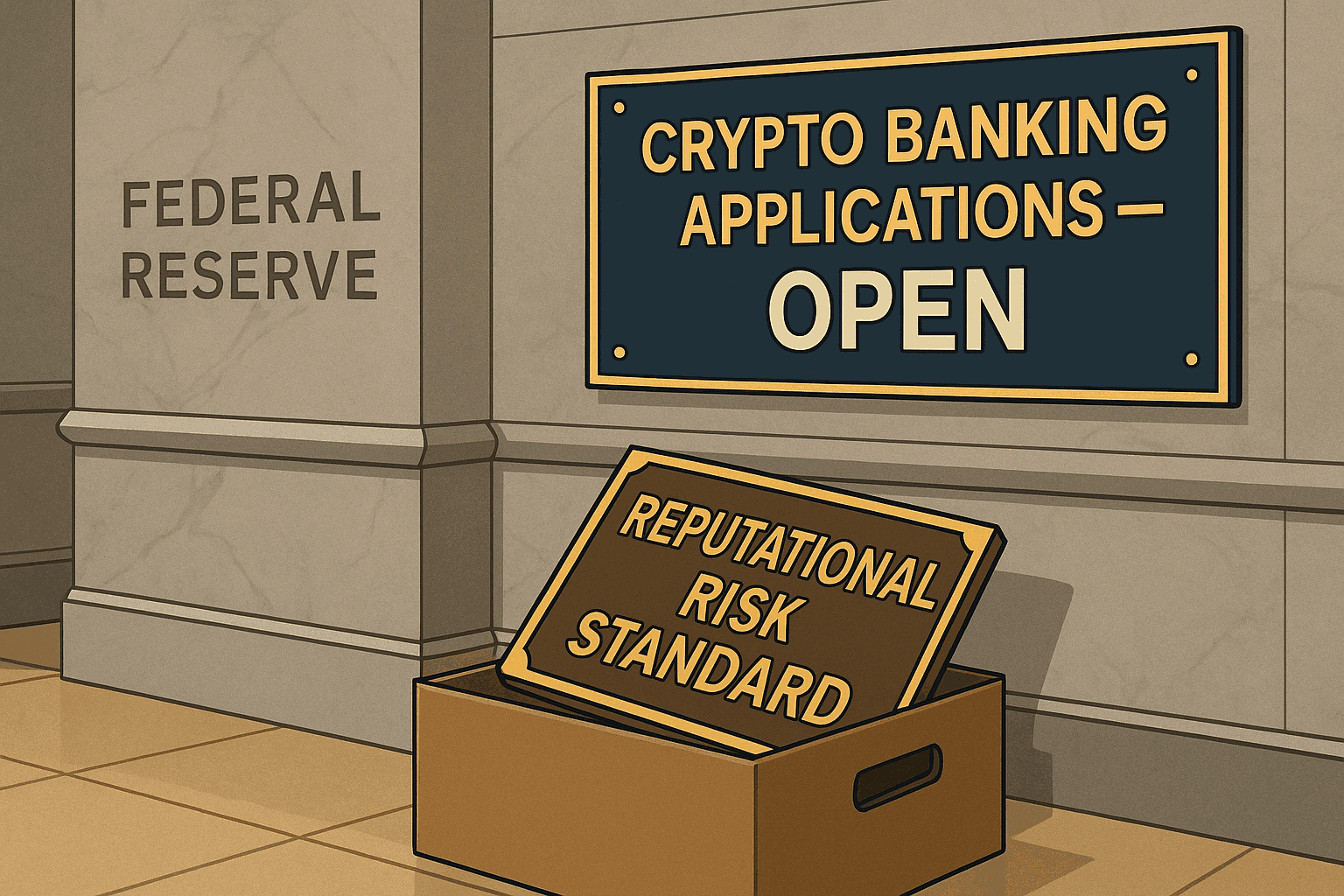

Federal Reserve Eases Path for Crypto Banking by Removing 'Reputational Risk' Standard

The Federal Reserve has eliminated the 'reputational risk' stipulation, simplifying banking for cryptocurrency firms and promoting better access to traditional financial services.

The Federal Reserve has officially aligned with the FDIC and the OCC by removing ‘reputational risk’ from the criteria for banks engaging with certain industries, significantly shifting how banks approach the cryptocurrency sector.

Why This Decision Matters Now

The undefined nature of reputational risk gave regulators considerable power to penalize banks for collaborating with legal yet unpopular companies. This led many crypto firms to face banking difficulties without clear reasons.

🇺🇸 FED JUST OFFICIALLY REMOVED “REPUTATIONAL RISK” FOR BITCOIN AND CRYPTO BANKING. BULLISH FOR CRYPTO 🚀 Ash Crypto

This change frees banks from worrying about public perception, allowing them to prioritize assessments based on financial stability and compliance.

A Break for Crypto’s Banking Problem

With the reputational barrier removed, banks can now better evaluate potential clients based on actual risks instead of speculative fears. This advancement could lead to more reliable, long-term relationships between banks and cryptocurrency entities.

Setting the Tone Across Agencies

The Fed’s actions contribute to a unified stance among U.S. financial regulators, ensuring a consistent approach towards lawful businesses within the financial sector.

A More Practical Approach to Risk

Overall, this modification allows regulators to focus on tangible threats to safety and stability in the rapidly changing financial landscape. While cryptocurrencies still involve various risks, the elimination of reputational risk marks a substantial milestone for accessing traditional banking services.

Key Takeaways

- The Federal Reserve has abolished reputational risk from its oversight criteria, aligning with the FDIC and OCC.

- Banks no longer need to weigh public image against working with cryptocurrency companies.

- This regulatory change facilitates access to banking services for compliant crypto firms in the U.S.

- The decision could enhance partnerships between banks and cryptocurrency organizations, focusing on measurable risks rather than fears of controversy.