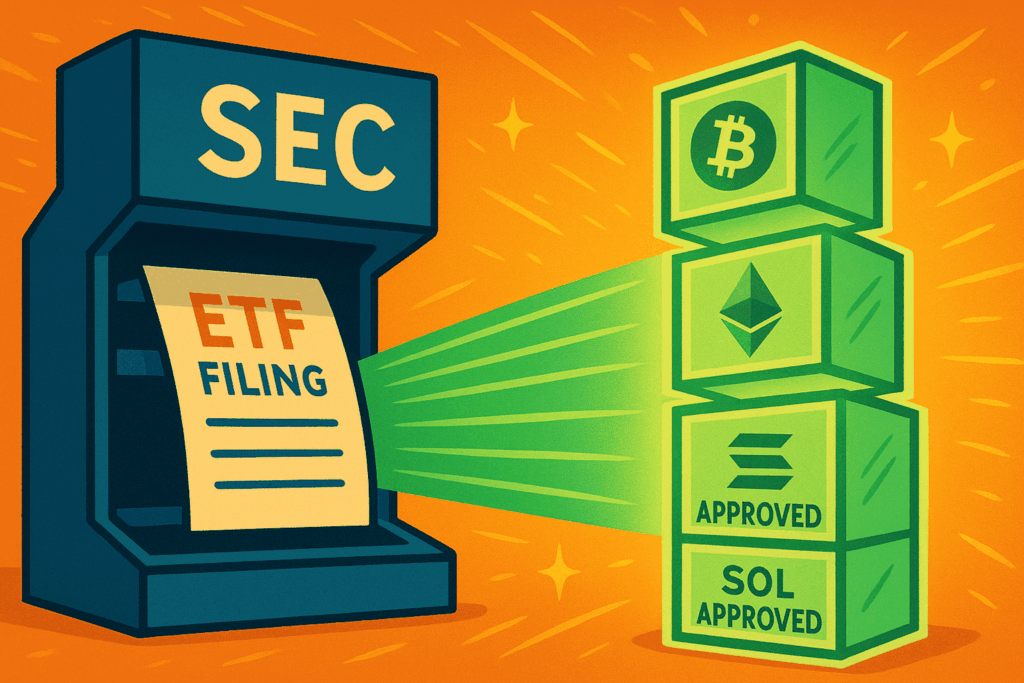

The U.S. Securities and Exchange Commission (SEC) has finally provided crypto ETF issuers with clarity. On July 1, the SEC released a comprehensive guide detailing what is required in applications for cryptocurrency ETF approvals, particularly in response to the rising interest in Ethereum-based products.

The Fine Print

The new guidelines demand complete transparency from issuers. They need to elucidate how net asset values are determined, where pricing data originates, and the mechanisms for securing crypto assets. If fund sponsors occupy multiple roles, such as fund management and asset protection, they must clarify their approach to avoid conflicts of interest.

Another crucial requirement is how funds will manage substantial capital movements. Issuers must demonstrate how they will address liquidity issues that arise from increased trading activity. The SEC also mandates strong surveillance systems to detect fraudulent activities.

Why It’s Getting Attention Now

These new guidelines come amid a surge in demand for ETF products linked to Ethereum, following the SEC’s approval of Bitcoin ETFs. As firms push to file new applications, clarity on requirements is paramount to ensure they understand expectations fully, especially given the continued concerns surrounding volatility and custody risks in digital assets.

How the Industry Is Responding

Companies are meticulously reviewing the guidelines relative to their own applications. Many see the clarity as a positive step forward, though some smaller entities express concerns about meeting the high standards due to resource constraints.

What Comes Next

It is anticipated that applications will soon align with these fresh requirements, which promise to enhance the structure and safety of ETF products. The SEC’s approach aims not just for approval of new applications but to ensure the broader integrity of the market.

In conclusion, it may lead to fewer but more robust crypto ETFs, ultimately benefiting the market with enhanced protection and clear operational frameworks, all while maintaining a pace of innovation.