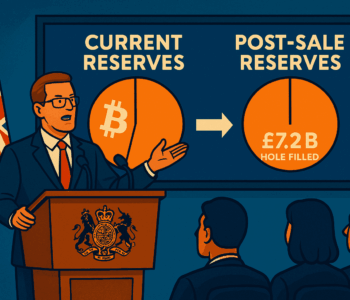

The UK government is contemplating utilizing its substantial Bitcoin reserve to alleviate increasing financial strain. Chancellor Rachel Reeves is assessing whether selling some or all of the government’s cryptocurrency assets could aid in addressing the expanding budget deficit.

From Criminal Seizure to National Asset

The Bitcoin reserve wasn’t acquired; rather, it was confiscated. In 2018, authorities seized approximately 61,000 BTC during an operation against a Chinese Ponzi scheme. At that time, this reserve was valued at a few hundred million pounds. Today, with Bitcoin trading at near-record highs, that same amount has escalated to a value exceeding $7 billion.

Pressure to Raise Funds Without Raising Taxes

Reeves faces a shortfall of about £20 billion, exacerbated by rising interest payments and sluggish economic growth. In this context, offloading Bitcoin might appear to be a swift and politically safe means of raising funds. However, there’s a significant downside; critics caution that acting hastily could result in missing even greater gains in the future.

Not Everyone Thinks It’s a Good Idea

Industry organizations such as CryptoUK are advocating for caution. They argue that selling Bitcoin at this time may undermine the UK’s long-term credibility within the digital asset sector. Nations like the United States, Bhutan, and Sweden have opted to retain their confiscated cryptocurrencies, viewing them as a form of digital reserve, though that strategy carries its own risks.

Selling Isn’t as Simple as It Sounds

The government cannot simply list the Bitcoin on an exchange and liquidate it immediately. Much of it is still entangled in legal matters, as victims of the initial fraud seek restitution. The National Crime Agency and the Home Office currently manage these assets; however, any residual funds remaining post-compensation could eventually be transferred to the Treasury.

Learning From Past Decisions

The United States has sold significant quantities of seized Bitcoin over the years, including over 185,000 BTC from the Silk Road operation. Some of these sales occurred when Bitcoin prices were low, and had they waited, the value could have been substantially higher. This history contributes to the argument for a more patient strategy this time.

So What Will Happen Now?

The Cabinet Office is developing a framework to regulate how the UK manages and potentially sells digital assets in the future. Any sales are expected to be gradual and conducted in a manner that minimizes market disruption and adequately addresses victims’ concerns.

The UK finds itself in possession of a rare asset that could either solve a budget crisis or serve as a long-term strategic reserve. The government’s choice will influence its standing in the digital asset realm and may set a precedent for how other nations address similar challenges.