Aave has experienced a notable surge, rising nearly 19% to $355 in the past 24 hours. This spike comes as the top gainer among the 40 leading cryptocurrencies, driven by positive demand stemming from its recent Aptos expansion and the dovish comments from Federal Reserve Chair Jerome Powell.

What You Should Know:

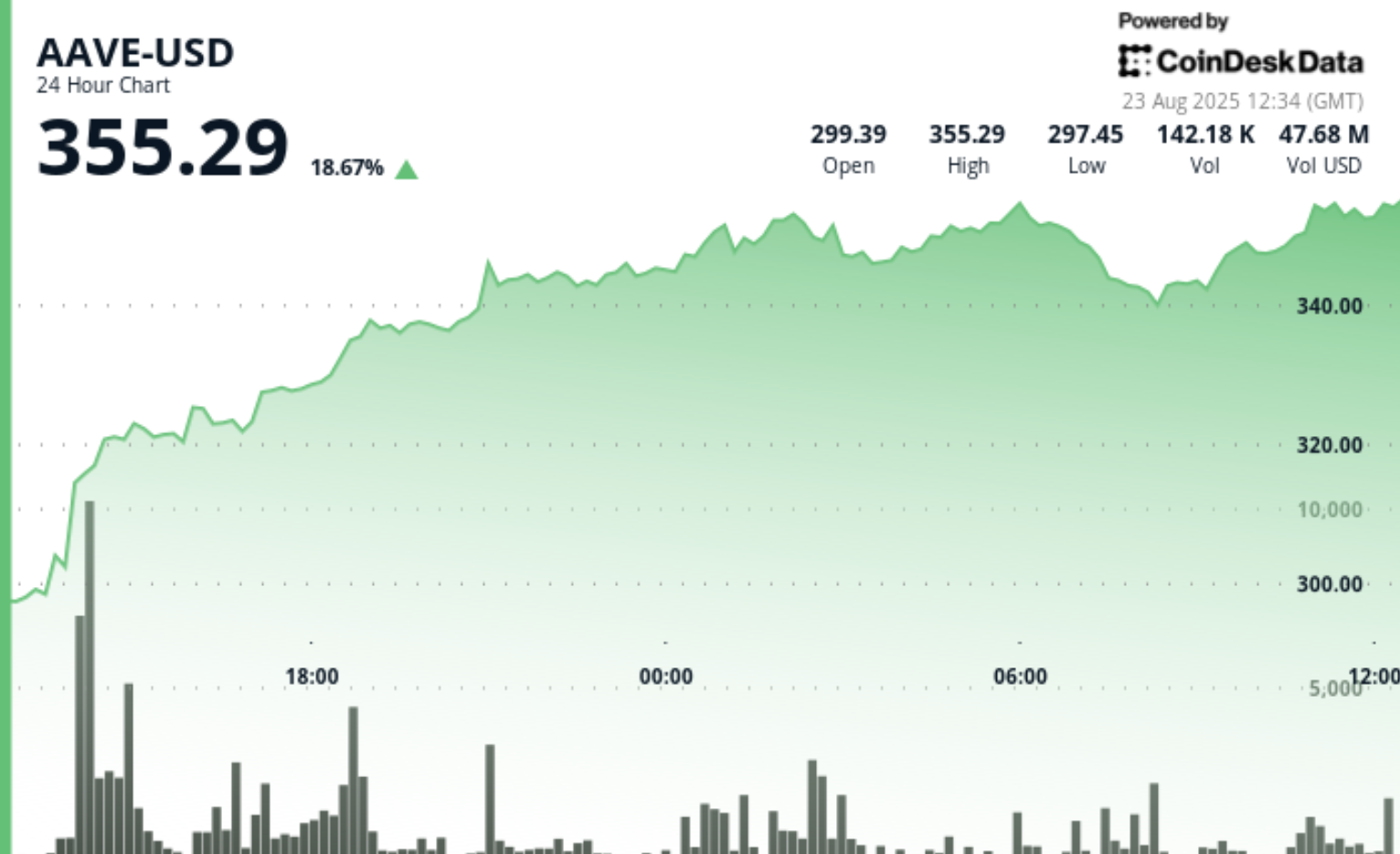

- AAVE, the governance token for Aave, has risen by 18.7% to reach $355.29.

- The surge is credited to the Aptos expansion and Powell’s recent comments suggesting potential interest rate cuts could begin as soon as September.

- Analyst Simon from Delphi Digital believes the market may be undervaluing Aave’s World Liberty Financial (WLFI) exposure, which could be contributing to AAVE’s rally.

Overview of Aave

Aave serves as a decentralized finance protocol enabling cryptocurrency lending and borrowing with no intermediaries. It operates via smart contracts requiring collateral from borrowers that exceeds the value of the loans.

Aave’s Growth and Future Plans

On August 21, Aave Labs announced its Aave V3 has launched on Aptos, marking a significant milestone as their first deployment outside of Ethereum-based blockchains. This transition involved reprogramming the code in the Move language while modifying the user interface to align with the Aptos virtual machine.

Economic Implications of Powell’s Remarks

During his speech at the Jackson Hole Economic Policy Symposium, Powell suggested a shift in the balance of risks regarding inflation and employment, indicating support for possible rate cuts, which further fueled market enthusiasm.

As markets reacted positively, the CME FedWatch data revealed an increase in expectations for a quarter-point cut from 75% to 83%.

Insights on WLFI Exposure

Aave’s interest in WLFI could hold significant implications for its market value. With projections showing WLFI’s token may begin trading at an estimated $27.3 billion valuation, Aave’s share could represent a value of approximately $1.9 billion. This substantial figure suggests that Aave’s market implications may not be fully recognized yet.

Technical Snapshot

From August 22 to August 23, AAVE experienced increased activity with notable trading volume changes and a price swing from $297.75 to $353.22. This reflects heightened confidence in Aave’s market strategy and expansion efforts.