Weekly Crypto Market Digest: Market Fluctuations and Institutional Movements

This week saw significant fluctuations in the cryptocurrency market, driven by anticipation surrounding Federal Reserve announcements and notable market events. Key assets like Bitcoin and Ethereum exhibited volatility as traders navigated through profit-taking and institutional maneuvers.

This week in the cryptocurrency markets was characterized by notable volatility and institutional activities. Investors closely monitored Federal Reserve Chair Jerome Powell’s speech, which precipitated market reactions, particularly for Bitcoin and Ethereum, as prices fluctuated post-announcements. Additionally, various altcoins experienced shifts as traders reacted to profit-taking activities amidst broader market sentiments.

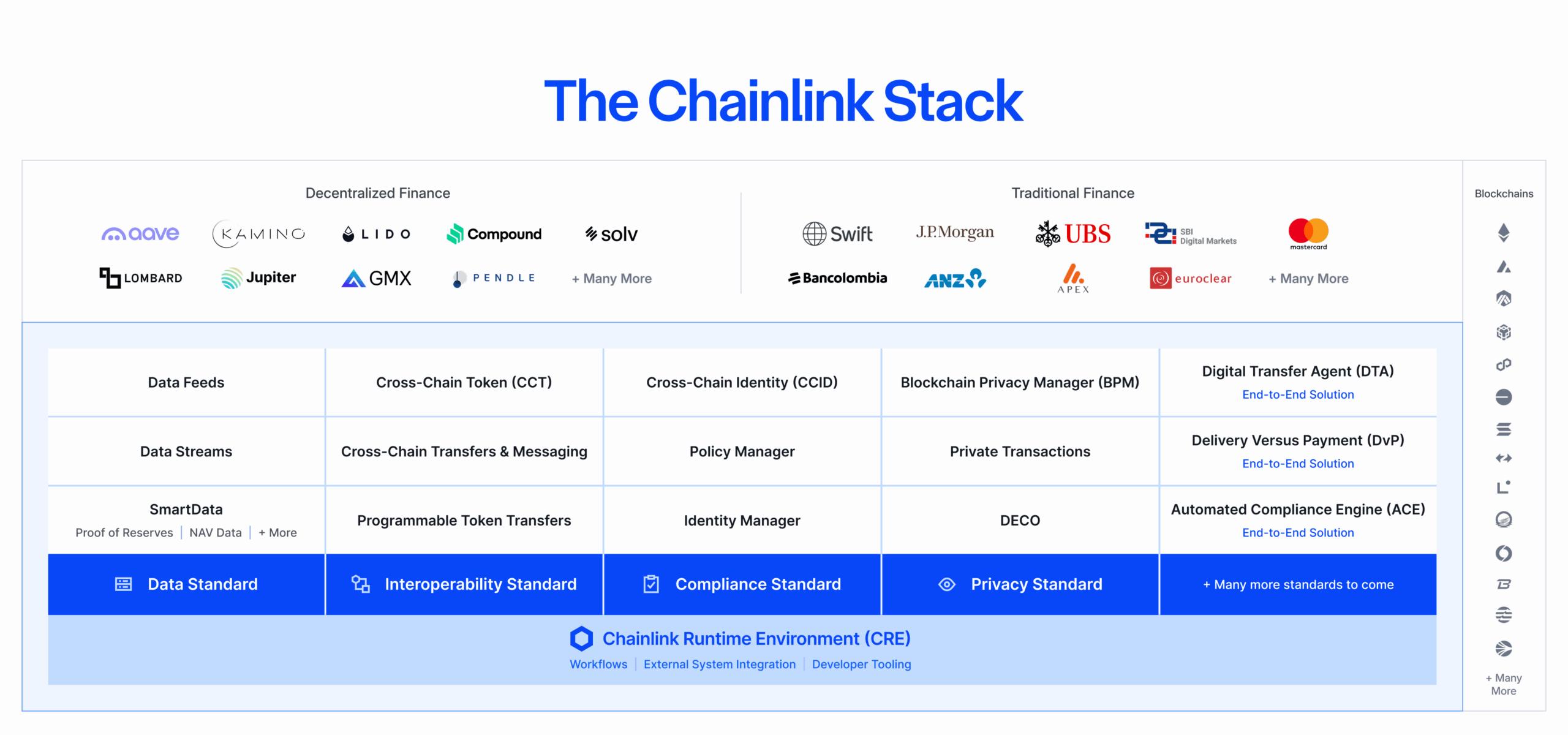

Chainlink’s LINK Token Surges Amid Market Rally

Chainlink's LINK Token Surges 12% to New Peak in 2025 Following Token Buyback and Market Rally

The LINK token from Chainlink bounces back significantly, reaching its highest price point since December after positive comments from the Federal Reserve.

Chainlink’s LINK token saw substantial gains, attributed to positive comments from Federal Reserve officials and strong fundamentals.

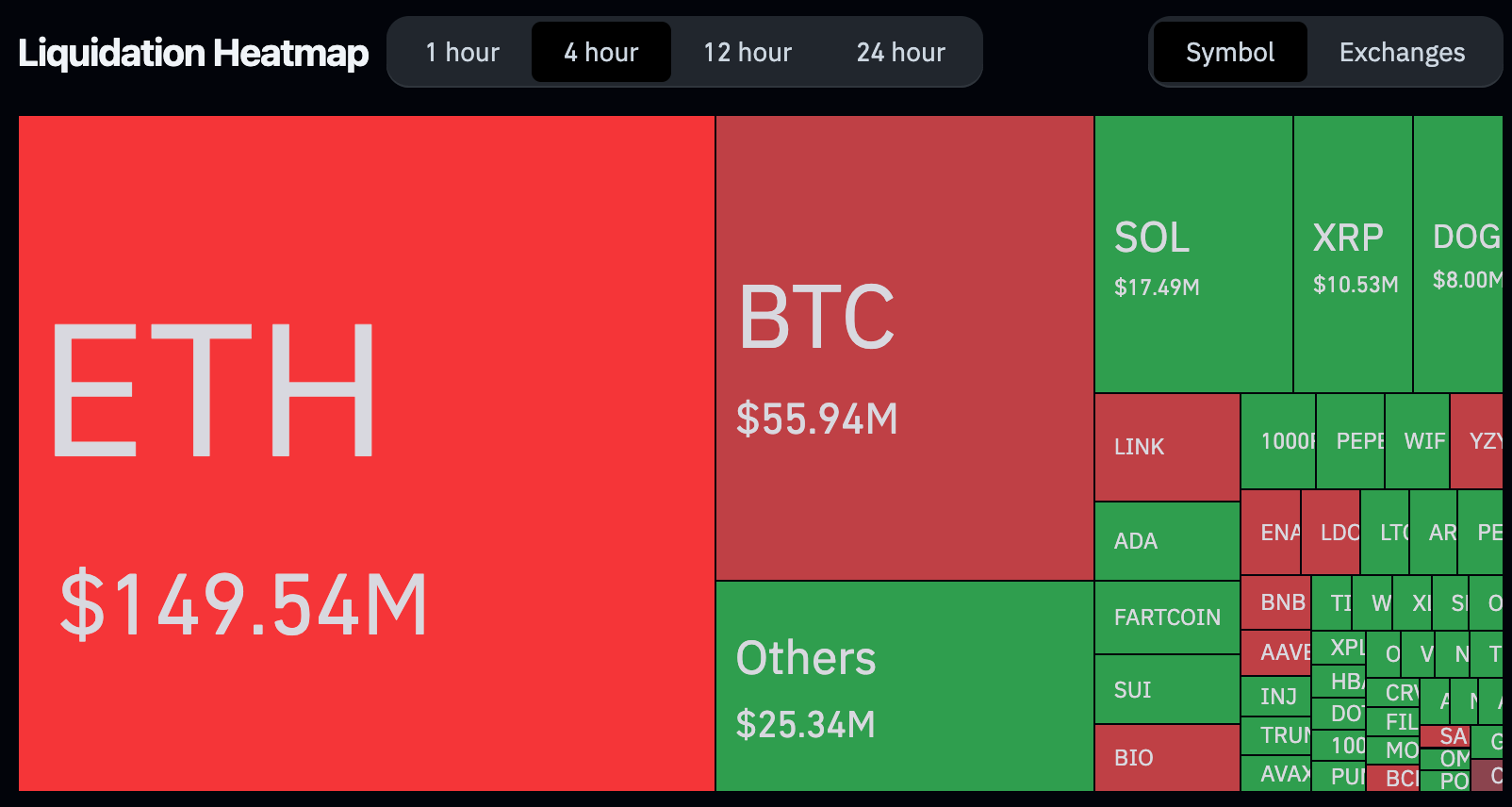

Surge in Crypto Liquidations as Bitcoin Benefits from Powell’s Remarks

Bitcoin's recent rise following predictions of potential rate cuts has resulted in significant liquidations in the crypto market, particularly affecting Ether.

Crypto-related stocks saw significant increases after indications from Federal Reserve Chair Jerome Powell regarding possible interest rate cuts in September.

The recent uptick in Bitcoin’s price led to significant liquidations in the market, prompting both excitement and caution among traders.

Dogecoin Surges 11% Following Positive News

Dogecoin experiences a significant increase in price following high trading volumes and positive developments in the crypto space.

Following a recent acquisition by a Trump-affiliated group, Dogecoin’s value surged, showcasing resilience amidst the volatility.

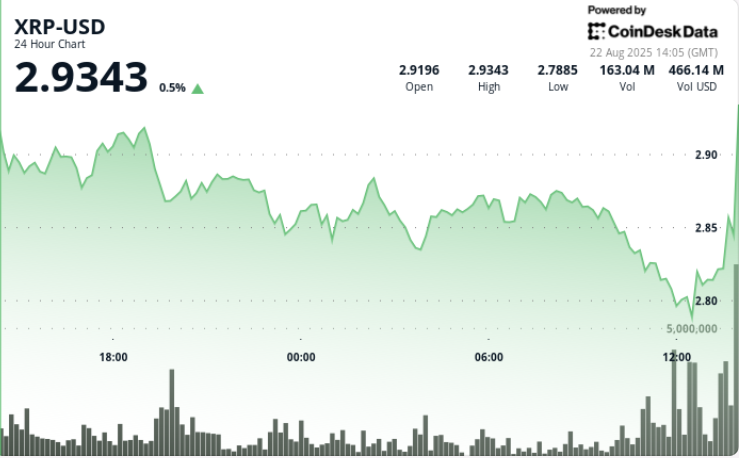

XRP Faces Pressure and Resilience as Institutional Interest Reemerges

Despite recent profit-taking by large investors, analysts maintain a bullish outlook on XRP and Solana due to potential upward trends in their prices.

Market dynamics shifted dramatically as institutional sell-offs of XRP occurred, amid broader trends influenced by Federal Reserve comments.

XRP has seen renewed institutional interest, leading to fluctuations near critical resistance levels, potentially signaling a breakout.

Ethereum Hits Record High Amid Rate Cut Expectations

Ethereum surged nearly 15%, reaching a new all-time high amid expectations of upcoming interest rate cuts.

Ethereum’s price surged significantly as speculation about interest rate cuts gained traction, pushing it to new heights.

Overall, the dynamics of this week’s cryptocurrency market reflected a blend of anticipation and reaction to macroeconomic influences and regulatory updates. The significant movements observed in Bitcoin and Ethereum display an evolving investor sentiment as they navigate predictions against a backdrop of institutional engagement and potential policy changes. Traders remain cautiously optimistic, focused on upcoming developments while managing risks associated with volatile markets.