Key Points

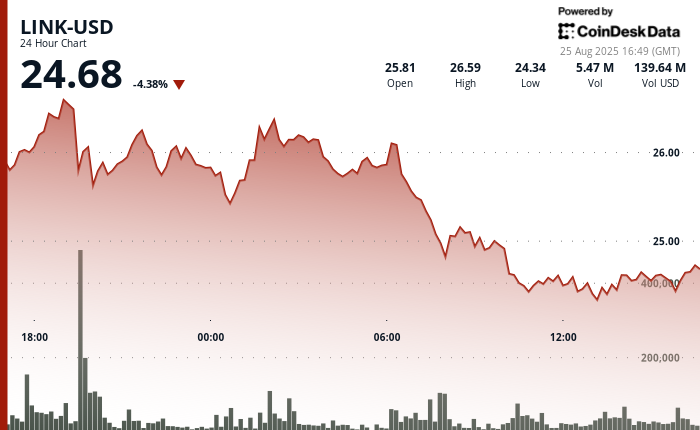

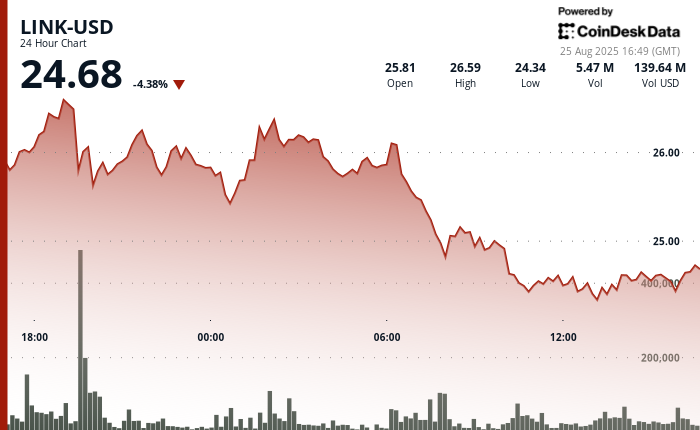

- The price of Chainlink’s native token, LINK, dropped more than 6% to $24.4 despite a new alliance with SBI Group.

- This collaboration aims to create solutions for tokenized assets and stablecoins within Japan.

- Technical evaluations suggest resistance at $26.61 and support at $24.37, indicating a bearish trend.

Chainlink Discussion

Chainlink Discussion

“Chainlink reaches an all-time high of $24.65 before experiencing a 5% decline due to intense selling pressure.”

In light of recent market activity, LINK’s price fell concurrently with a general downturn in the crypto space, even following a significant partnership announcement with SBI Group. The decline marks a reversal from previous gains, indicating the current volatility in the cryptocurrency sector.

Market Overview: SBI Group, recognized as a major player among Japanese financial institutions, has engaged Chainlink to collaboratively explore the development of tokenized assets and stablecoin infrastructures, with the potential of extending these solutions to other regions in Asia-Pacific. This integration will utilize Chainlink’s Cross-Chain Interoperability Protocol, which supports secure transactions while adhering to compliance standards.